Introduction

As explained in a previous article, Cargojet (OTCPK:CGJTF) (TSX:CJT:CA) is Canada’s largest freight airliner. With several widebody cargo planes and long-term agreements with UPS, DHL, Amazon and Canada Post which include minimum revenue guarantees and cost pass-through provisions, the business model is robust as long as its long-term partners remain solvent.

In my previous few articles, I predominantly focused on the company’s debentures, which are all publicly trading on the Toronto Stock Exchange. Cargojet repaid one of the debentures on the final trading day of 2023, four months ahead of the maturity date of the debt security, so I wanted to check up on the company’s financial health to see if I should immediately reinvest the proceeds into one of its other debentures or if I perhaps should give the common equity a closer look.

The company’s cash flows remain robust from a creditor’s perspective

Cargojet has obviously been hit by the slowdown in the world economy, and this was covered by fellow author Dhierin Bechai in his August article.

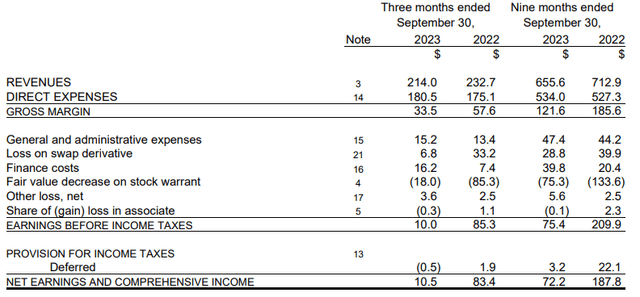

The total revenue in the third quarter was approximately C$214M resulting in a gross margin of almost C$34M. The income statement below shows that the revenue decrease had an almost 1:1 impact on the gross margin, as a lot of Cargojet’s operating expenses are fixed in nature.

Cargojet Investor Relations

Cargojet also saw its G&A expenses increase, while the total interest expenses almost doubled compared to a year ago. The company remained profitable as it reported a pre-tax income of C$10M, but this was entirely caused by the C$18M gain on the value of the stock warrants it has issued to its largest customers. A lower share price results in a lower fair value of the warrant, and vice versa.

In the first nine months of the year, Cargojet reported a net income of C$72.2M for an EPS of C$4.20, but as you can see in the image above, pretty much the entire pre-tax profit was caused by the decreasing value of the stock warrant. Which means that from an earnings perspective, the company was breaking even.

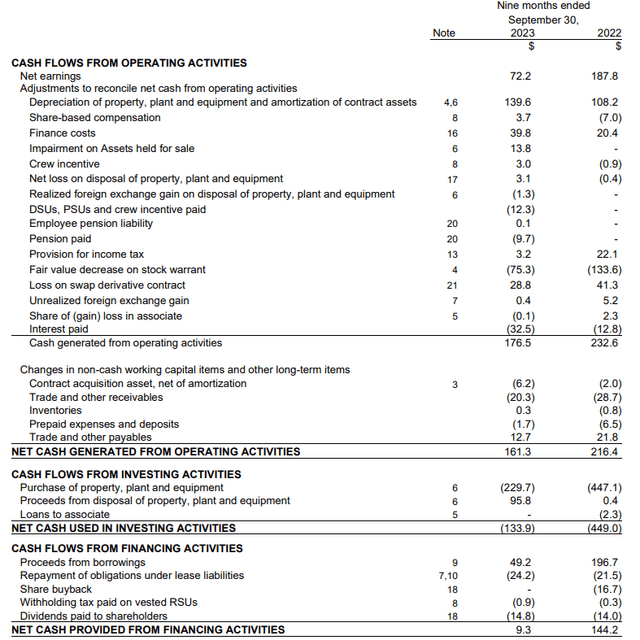

That’s slightly annoying, especially considering Cargojet is investing in its expansion. The company reported an operating cash flow of C$176.5M before changes in the working capital position, which was reduced to just C$152M after taking the C$24.2M in lease payments into account.

Cargojet Investor Relations

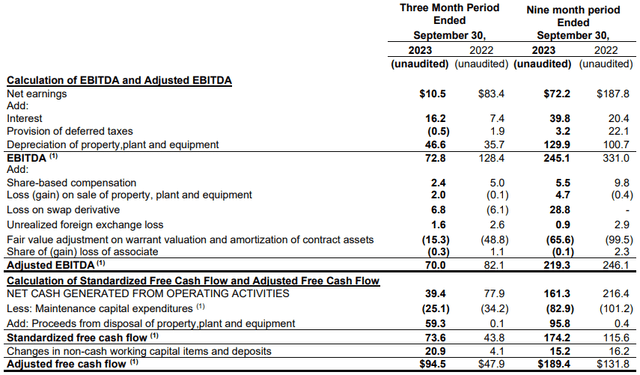

This wasn’t even close to sufficient to cover the C$230M in capex and even after selling C$96M worth of assets (including a Boeing 777-300 for C$36M resulting in a small loss and four GE90 engines for total proceeds of C$59M), the company barely broke even on the cash flow front. Fortunately, the company also provided a breakdown of the sustaining capex and as you can see below, the total sustaining capex was just C$83M. This means that on an underlying basis, Cargojet’s sustaining free cash flow result in the first nine months of the year was approximately C$70M. You can ignore the ‘adjusted free cash flow’ mentioned below, as it includes the proceeds from asset sales.

Cargojet Investor Relations

While the positive free cash flow is good news, let’s not forget Cargojet will need cash to cover its growth plans. The company expects 2024 to be another capex-heavy year as it has earmarked a net amount of C$200M to invest in growth before the investment pace will drop off to just C$50M in FY 2025.

This potential cash shortfall will likely be funded by the sale of 4 Boeing 757s, which are currently a surplus in the fleet. Cargojet mentioned on its Q3 earnings call it hopes to fetch C$120M for these four planes and the anticipated proceeds are already included in the C$200M net growth investment in 2024. The sustaining capex will likely trend around C$150M per year from next year on.

At the end of September, Cargojet hat C$43M in cash, C$86M in short-term debt maturities (these have already been paid) as well as C$584M in long-term debt net of lease liabilities, resulting in a net debt of approximately C$625M. This will likely increase towards C$800M by year-end 2024 before decreasing in 2025 as the growth capex will drop substantially while new aircraft will

The recent increase of the debenture prices makes them unappealing

I was quite happy when Cargojet announced it was planning to retire its 2024 debentures early, as I expected this would allow me to use the proceeds to purchase the June 2026 debentures (‘Series F Debentures’). Those debentures were trading at just 90–91 cents on the dollar as recent as October and November, but as the Fed Pivot has been underway, the price of the debenture has almost entirely closed the gap to its par value of 100.00 in the past month. The most recent closing price was 99.75 cents on the dollar, resulting in a yield to maturity of just 5.35%.

TMXMoney.com

That’s pretty unfortunate as this represents a markup of just 120 bp over the risk-free interest rate (I am using the 2 year Canada government bond which is currently yielding 4.13% as a reference here). The April 2025 bonds have a higher yield to maturity of approximately 6.5% right now, and from an economic perspective, it would make more sense to add to my position of the Series E debentures at that share price.

However, I won’t do anything right now. I think the price of the Series F debentures has gotten a little bit ahead of itself as the mark-up to the risk-free interest rates is just about 120 bp while the Series E debentures are trading at a mark-up of approximately 200bp (based on the 1Y and 2Y government bond rates of 4.79% and 4.13% respectively). In order for the Series F to reach the same mark-up to the risk-free interest rate, I would have to see a bond price closer to the 97-97.5% range.

Investment thesis

I have always been more interested in Cargojet’s debentures but at the current share price and debenture prices, I have no interest in adding any of the company’s securities to my portfolio. As the company has repaid the Series D debentures four months ahead of the maturity date, I currently only have a long position in the Series E debentures which I intend to hold for the time being (but I would sell them if the debentures reach 100-100.5% of par value). I would definitely consider adding to my Series E debentures and/or initiating a long position in the Series F debentures at a slightly lower debenture price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here