Even companies like Calumet Specialty Products (NASDAQ:CLMT) with its brilliant future can experience the dreaded chart pattern labeled falling knife. Investopedia defines one, “[f]alling knife refers to a sharp drop, but there is no specific magnitude or duration….” Investors generally consider an unhindered drop without relief, a falling knife. This pattern is more prevalent with illiquid entities. Someone with a large enough position decides to exit regardless. Sometimes it is forced, sometimes not. We continue our coverage of Calumet with an update and a strategy suggestion. Dodging market falling knifes might require clever evasive action. Put on the athletic shoes and let’s go dodging.

The Company & 4th Quarter

Calumet is comprised of three unique businesses: Performance Brands, high margin branded low volume specialty products, Specialty, higher volume, but slightly lower margin plus traditional fuels, and Montana Resources (MRL), the high margin, best in class renewable, fuels business. MRL products includes a very high margin jet fuel alternative labeled Sustainable Aviation Fuel (‘SAF’). Also, MRL products are manufactured at the company’s Great Falls’ facility of which half continues as a traditional fossil fuel operation. Each business has had a level of challenges and high points in the past few years. It appears that all are now firing at full power.

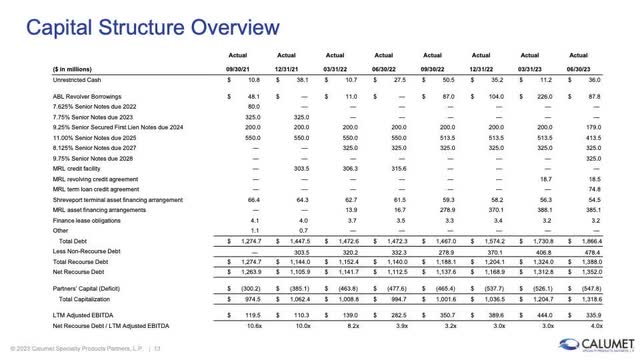

Before we continue, it is important to mention capital and debt. The company spent focused capital creating this vision. A slide from the last conference shows this issue. Debt climbed from $1.3B few years ago to today’s $1.8B plus.

3rd Quarter Conference

In addition, the company still must spend $60M above long-term capex in the older Specialty and $200 for creating a new version of MRL. In the past, management clearly stated that it seeks to lower debt associated with Specialty from $1.3B to $800M. The company possesses several paths to pay the $1B and the future $250M. The paths include a possible DOE loan at extremely low interest, cash from operations and a partial equity sale of MRL.

Next, in the past, we provided estimates for the last quarter. A soft continuation of this practice follows for December which included a major shutdown at Great Falls, the MRL facility.

Beginning with Specialty, a table for our estimate follows. The units in this business seem to have operated admirably for the entire quarter, but with slightly lower cracks.

| Specialty | 2nd | 3rd | 4th |

| EBITDA | $60M/$80M * | $40/$70M ** | $65M Est. *** |

| Cracks GC 2-1-1 | $30 | $32 **** | $26 ***** |

* Weather related issues equaling $20M in lost EBITDA.

** Unplanned outage loss of EBITDA equaled $20M plus. Crude pricing variability also negatively impacted specialty margins. The actual was rounded upward.

*** This estimate includes a negative factor from lower cracks and a positive influence from higher margins through trailing price hikes.

**** Cracks calculation for Specialty, 3rd quarter averaged $36 softened by a $29 hedge at half equals $32.

***** Cracks calculation for Specialty, 4th quarter averaged $22 improved by the $29 hedge at half equals $26.

From the table, Specialty generates between $70 – $80 in EBITDA with stable crude oil prices at cracks near $30. For December, the lower crack spreads in the $5 region suggest a $10 – $15M lower performance quarter over quarter.

Performance Brands continue to improve results with last quarter at $13M. The 4th quarter can be dicey with big box businesses correcting year-end inventory. An estimate of $10 might be in order.

Estimating MRL is the crap shoot. The unit operated at 8,000/12,000 barrels per day in October for the renewable and older business, shutdown for the repair outage during most of November followed with December being full rates with an unknown but higher cost renewable feed. Again, a table shows our calculations.

| 4th (Millions) | Oct. | Nov. | Dec. | Quarter |

| Fuels | $17.5 * | OFF | $16 *** | $33.5 |

| Renewables | $20M ** | OFF | $34M **** | $55 |

| Fixed Costs | $70 | |||

| Estimate for Dec. | $20 |

* Calculation equals 12,000 bpd times 31 days times (GC 2-1-1 of $24 plus WCS crack of $23) or $17.5M.

** Calculation equals 8,000 bpd times 31 time $2 (margin without fixed costs) pg times 42 gpb or $20M.

*** Calculation equals 12,000 bpd times 31 days times (GC 2-1-1 of $21 plus WCS crack of $21) or $16M.

**** Calculation equals 13,000 bpd times 31 time $2 (margin without fixed costs) pg times 42 gpb or $20M.

An MRL estimate including the long outage might equal $20M. The loss from the outage is in the $50M range.

In total, the company might generate approximately $100M in EBITDA netting, after fixed costs, $80M.

Falling Knifes & Markets

Next, some commentary and a Calumet chart follow. Falling knifes happen with markets. For example, the Chinese market is now experiencing a major falling knife event. What was once the 2nd largest by market capitalization now equals the 4th. Its value is at 5-year lows and for valid reasons.

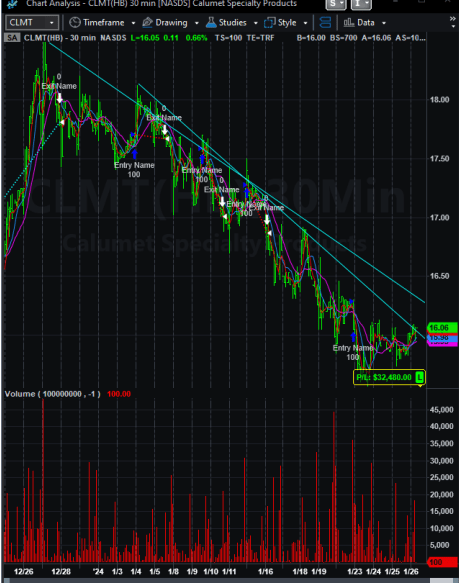

A 30-minute bar chart created using TradeStation Securities for Calumet shows that for the last several weeks, it is also experiencing that bearish pattern.

TradeStation Securities

Contrary to China, in our view, this falling knife action is irrational for several reasons. Someone with a significant holding when compared with the level of liquidity relentlessly sold. In general, the rule of thumb for falling knifes, stay away until the price breaks above the downtrend line.

An Irrational Action

Again, in our view, the action created from this dumping is both short sided and irrational. We offer several compelling reasons why:

- DOE Loan.

- Stellar financial performance from MRL

- MaxSAF Expansion.

- Stable Specialty/Fuels Business.

- Small Equity Sale of MRL for Debt Management.

- Future Organic Specialty Growth.

- Conversion from MLP to C-Corp.

A level of depth for each comes next.

A DOE Loan

Noted above, the company added a level of measured debt from the low a few years ago. MRL, the renewable business, is a perfect fit for an ultra-low interest Department of Energy renewable energy loan. Although, we don’t know the exact size, it appears to be at least $200M enough to complete the expansion toward the higher SAF production. Management has stated that future capital projects will be self-funded or from a DOE loan.

Coming Stellar Results from MRL/Great Falls

MRL still experienced a level of start-up issues last year not ever fully demonstrating the full results. In our view, the shutdown plus lower feed-rate during October resulted in at least a $50M EBITDA hit. Going forward, at expected full operation, this combined business could generate approximately $300 million per year in EBITDA, the game changer.

MaxSAF

Management constantly communicates its forward view on MRL with a MaxSAF option likely coming. From the 2nd quarter conference, management noted, “we can more than double our current EBITDA run rate in 2025.” It adds $200M plus once operational. Calumet also stated that this change must either be funded from a DOE loan or self-generated cash.

Stable Specialty/Fuels Business

At a recent conference, management noted that the older fuels and specialty businesses are slated to generate $250-$300M per year in EBITDA with significant low hanging fruit for growth. At the approximate 75 million units and future yearly costs for interest and capital equaling approximately $120M, investors could envision the surplus EBITDA of $2 per share/unit with more coming generating a value of at least $20.

Small Equity Sale of MRL for Debt Management

Investors and management have spent great efforts in trying to nail down the actual worth of the renewable business (MRL). Is it worth $3B or $5B or $10B, is immaterial for this approach to matter. A sale that generates $300M – $400M immediately fixes the needed debt reduction with Specialty. (Remember cash flows going forward will likely generate excesses in the $400M per year range.)

Future Organic Specialty Growth

Management continues to beat the low hanging fruit drum within the older Specialty business. Though of undeclared value, in aggregate, these aren’t small.

Conversion of the Business Structure

Management announced a major restructuring for its business converting from an MLP to a C-Corp. This change will help immensely with the illiquid circumstance now facing investors. The primary reason for this falling knife, non-existent liquidity, likely disappears.

Risk & Investment

It is clear that risk from over-extended debt exists. But, in our view, at least three solutions exist which will more than cover the needs. In the past few years, the company experienced several weather or other issue related outages costing significantly more than a $100M. Will those events continue? Thus far this year, Calumet has dodged that bullet. Lastly, macro-market risks continue with recession uncertainty. Our view is that this is the biggest risk. Cash flows could be significantly lower delaying debt payments or forcing non-optimal approaches in doing so. In-spite of the risk, we continue with our strong buy rating once prices break above the steep downtrend line shown above. In the meantime, get those tennis shoes on, be limber and dodge the knife.

Read the full article here