Investing Environment

US equities posted solid gains in Q4, capping off a robust year. After Donald Trump’s presidential election victory, investors cheered the prospect of deregulation, corporate tax cuts and the reshoring of manufacturing benefiting the economy and, ultimately, the stock market. This optimism faded in December as concerns about potential inflationary pressures from proposed tariffs and strict immigration policies led to hawkish Fed speak and reintroduced downside volatility to the market. Still, markets finished 2024 with solid gains, capping off one of the best two-year performance stretches in decades.

The Republican sweep in November, while causing a positive shift in sentiment for risk assets, also provoked concerns about inflation. These concerns led to a US Treasury market selloff, with yields up across the curve. The 2-year, 10-year and 30-year Treasurys were up 63bps, 83bps and 70bps, respectively. Amid the selloff, the Fed held meetings in November and December, cutting the fed funds rate by 25bps at each meeting. Despite these cuts coming on the heels of a 50bps cut in September, the expectation of future rate cuts shifted dramatically.

Outside the US, eurozone equities retreated in Q4 as recession fears and political instability in France and Germany weighed on sentiment. Concerns over potential trade wars following Trump’s electoral win further dampened investor confidence. The European Central Bank (ECB) responded to weak growth by cutting interest rates by 25bps in both October and December. ECB President Christine Lagarde signaled further cuts in 2025, emphasizing a more accommodative monetary policy to counter sluggish economic growth. Emerging markets equities also faced headwinds in Q4, driven by Trump’s electoral win and the prospect of new tariffs, particularly targeting China.

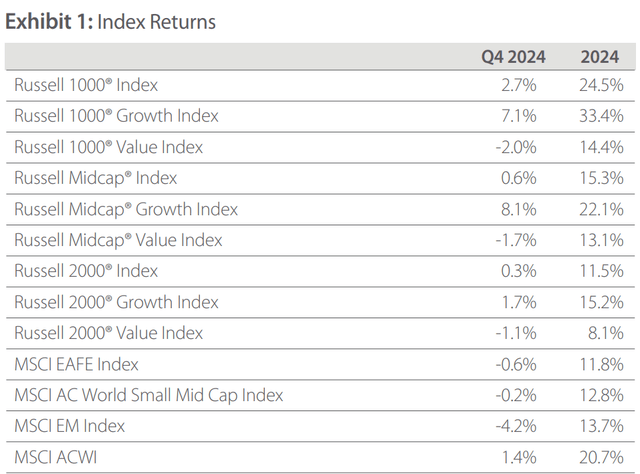

Following the trend from much of 2023 and 2024, markets in Q4 were led by US mega cap and more growth-oriented equities. Looking at the MSCI ACWI Index, sector performance was led by consumer discretionary, communication services and information technology, with several Magnificent Seven stocks contributing to the rally. In contrast, the materials and health care sectors lagged.

Source: Artisan Partners/FactSet/MSCI/Russell. As of 31 Dec 2024. Past performance does not guarantee and is not a reliable indicator of future results. An investment cannot be made directly in an index.

Performance Discussion

The portfolio delivered a strong absolute return of over 5% in Q4. This performance was supported by rallies in several Internet and media holdings, including Shopify (SHOP), Spotify (SPOT), GoDaddy (GDDY) and Live Nation (LYV), driven by robust earnings and positive forward outlooks. Additionally, our software investments showed significant improvement, as easing macroeconomic pressures and early adoption of artificial intelligence (AI)-enhanced features bolstered earnings performance. However, the industrials sector was the weakest contributor, with Xylem (XYL), Ingersoll Rand (IR), Hubbell (HUBB) and Fortive (FTV) retreating on in-line earnings results.

Despite strong absolute returns, our portfolio lagged the Russell Midcap® Growth Index, which emerged as the best-performing segment of US markets in the quarter—outpacing both its large-cap and small-cap counterparts. The index’s strength was propelled by extraordinary momentum of a few large constituents, notably Palantir Technologies and AppLovin (APP), which each surged over 100% in Q4. These two names accounted for more than 90% of the index’s IT return and over 50% of its overall Q4 return. For the full year, Palantir and AppLovin accounted for more than 80% of the index’s IT return and nearly 30% of the entire index’s total return. Our lack of exposure to these two securities detracted 400bps in Q4 and 600bps in 2024 relative to the index.

This outsized impact is striking, especially in mid-cap markets, where such dominance is rare. Palantir Technologies (PLTR) stands out with a 2024 return exceeding 300%, which was propelled by a retail audience that owns about 50% of the outstanding shares. This performance has been largely driven by multiple expansion. Its forward price-to-sales ratio ballooned from 14X at the start of the year to 49X by year-end. While the company’s projected revenue growth of 26% in 2024 and 25% in 2025 is healthy, we believe its valuation is difficult to justify. By comparison, high-quality software names within our portfolio—such as Atlassian, HubSpot and Zscaler (ZS)—are growing at comparable rates and trade at elevated, but more reasonable, 10X–20X forward sales multiples.

Among our top detractors were Monolithic Power Systems (MPWR), Xylem and Exact Sciences (EXAS). Monolithic Power Systems designs analog power-management chips for a wide variety of industrial and consumer devices. Shares declined after the company reported strong growth in its data center segment that trailed investors’ lofty expectations, which had driven the stock up YTD. Also, while the segment is expected to grow in 2025, the company will face some temporary headwinds as additional power semiconductor suppliers are expected to be qualified to supply NVIDIA’s (NVDA) GPU needs. While we’re cognizant of this headwind in 2025, we expect it to be manageable, and the company has other meaningful growth drivers in store for the year (particularly in autos). Our valuation discipline had led us to reduce the position earlier in the year, but given a more reasonable starting point in Q4, we decided to add to the position.

Xylem is a global leader in water technology across pumps, smart meters and treatment services. More than 80% of the company’s sales come from markets where it maintains the No. 1 or No. 2 market position. Xylem’s pumps business (sold primarily to utilities) is sticky and profitable, providing capital to invest in innovative solutions, such as smart meters. In mid-2023, Xylem completed the acquisition of Evoqua, giving it a leading position in the US water treatment business. Unfortunately, the company reported its first earning miss during the quarter after a series of beats due to pockets of geographic weakness and some project delays. Despite the short-term setback, we believe the company is at the start of a compelling profit cycle as smart meter sales recover from supply chain issues, cost and revenue synergies are realized from its acquisition, and the newly hired and well-respected CFO helps catalyze long-awaited margin expansion.

Exact Sciences is a leading provider of diagnostic testing and a maker of the noninvasive colorectal cancer screening test Cologuard®. Shares struggled in the first half of the year due to investor concerns around competing blood-based tests. However, we remained invested because blood tests, while potentially more convenient, have historically been unable to match the accuracy of stool testing (especially when it comes to detecting early cancers). Furthermore, we had expected growth to improve in the second half of the year as Exact Sciences partnered with hospital networks and payors to meet colon cancer screening targets before year-end. Unfortunately, Cologuard® revenues failed to accelerate, which was attributed to sales execution issues. Given the large addressable market, we have been disappointed that the company has required flawless sales execution to drive significant growth. Given these challenges and the competitive noise, we reduced the position.

Among our top Q4 contributors were Atlassian (TEAM), Spotify and Marvell Technology (MRVL). Atlassian provides collaboration and productivity software tools—a large, structurally growing addressable market that is expanding from the core software developer market to a much larger “knowledge worker” market. Along with much of the software industry, the company went through a period of weakness as small and medium-sized businesses pulled back spending due to macroeconomic concerns, and enterprise IT spending shifted toward AI projects at the expense of traditional cloud software offerings. However, shares rallied after earnings results beat expectations and showed signs of a turnaround, including higher-than-expected paid seat expansion.

Spotify is a leading global audio streaming franchise with over 600 million monthly active users. We believe its position in the supply chain is solid given a secular trend of fragmentation in the music industry and its internal product and pricing initiatives. Shares continued their year-to-date ascent after reporting strong earnings results, including strong growth in active users, premium subscribership and revenue. Importantly, the company’s profit margin is expanding nicely, and we believe it can rise further if the company increases prices, negotiates potentially better terms with labels and maintains cost discipline.

Marvell Technology is a semiconductor company offering networking, secure data processing and storage solutions to customers worldwide. We believe Marvell has among the broadest range of intellectual property in technological areas (e.g., high-bandwidth data switching and storage applications) that position it well for the growing requirements of data centers, wireless networks and autos. The company delivered strong earnings results, driven by the company’s product lines (e.g., custom silicon, optical connectivity and switching) leveraged to AI data center growth. We believe this could be a significant opportunity for the company as it helps design and manufacture cost-effective custom data center chips that would help reduce cloud providers’ reliance on expensive GPUs. Furthermore, like many other semiconductor companies, a portion of its business may be poised for a cyclical recovery after the industry’s recent inventory correction.

Portfolio Activity

During the quarter, we initiated new Garden SM positions in US Foods (USFD), Pure Storage (PSTG) and Robinhood (HOOD). US Foods stands as the second-largest food distribution company in the US, catering to independent restaurants, national chains, health care providers and hospitality venues. Historically fragmented, the food distribution industry has consolidated into three dominant players, driven by strategic M&A, procurement efficiencies, private label expansion and technological advancements. US Foods leads the industry with best-in-class asset and inventory turnover metrics, reflecting exceptional productivity. We believe the company is well positioned to achieve continued margin growth through several self-improvement initiatives, including a new warehousing operating and management system, advanced routing, flexible scheduling, small truck service expansion, warehouse automation and enhanced vendor rebate programs. By leveraging these operational enhancements, we believe US Foods is poised to strengthen its competitive edge, drive higher profitability and reinforce its standing as a leader in the food distribution landscape.

Pure Storage is redefining enterprise data storage by bypassing traditional approaches used by competitors. Instead of purchasing costly enterprise-grade solid-state drives (SSDs) and layering software on top, Pure Storage sources raw NAND flash memory and designs custom all-flash storage systems, providing a cost advantage. The company has been gaining share of the core enterprise data storage market due to this offering, but we believe its recent announcement of securing a large hyperscaler data center contract potentially opens the company up to a much larger addressable market and gives us confidence that the company can accelerate its growth trajectory over the next two to three years.

Robinhood has emerged as the go-to trading platform for millennials, boasting approximately 25 million accounts (versus Charles Schwab’s 34 million). The company’s user base skews younger, with deposits growing significantly faster than the broader industry due to several drivers, including the rise of self-directed trading, the generational wealth transfer to millennials and increasing market share. As Robinhood’s customer base matures and accumulates wealth, we believe the company is well positioned to expand its product offerings to meet evolving financial needs. Furthermore, management’s focus on profitable growth and a 90% fixed cost structure suggests meaningful margin expansion potential.

Along with Monolithic Power Systems, notable adds in the quarter included Onto Innovation and Gitlab. Onto Innovation provides process control solutions and inspection systems needed for advanced semiconductor packaging inspection and optical metrology. Wafer-level packaging inspection is a small yet rapidly growing segment within process control tied to increasing chip sales from AI, edge computing and wearable technology advancements. Optical metrology growth is driven by a transition to 3D chip architecture, which requires greater numbers of sensitive layers to be measured and tracked. This growth is further supported by gross margin and operating margin expansion, as increasing complexity drives pricing power. Shares declined in the quarter due to cyclical pressures that we believe are largely short-term issues. We used it as an opportunity to build our position.

Gitlab (GTLB) offers a one-stop shop for software development projects. The company provides developers with tools to manage code, collaborate with teammates and track the entire development workflow. It has a strong brand with more than 30 million registered users across its free and paid subscription tiers. Customers adopt Gitlab to deploy code faster, more consistently and more securely. We believe the company is early in its lifecycle given the large addressable market of global software developers and a general trend toward companies looking to digitize aspects of their business and deploy code quickly. Recent earnings results were thesis affirming, and we added to the position.

We ended our investment campaigns in ON Semiconductor (ON), Monday.com (MNDY) and CoStar Group (CSGP) during the quarter. ON Semiconductor is a leading designer and manufacturer of chips for power management and image sensing. From a battery-electric vehicle standpoint, ON is a leading producer of silicon carbide chips. Shares have been under pressure as the company grapples with multiple quarters of inventory right-sizing across the entire auto supply chain and slower-than-expected EV sales growth. While ON is seeing smaller sales declines than peers due to its market share gains, we are concerned that moderating US and European EV growth trends will weigh on the company’s 2025 performance. We exited the position.

Monday.com is a software provider specializing in project management offerings for businesses of all sizes. Our thesis was based on the company’s core project management product being differentiated due to its ease of implementation and wide use cases, driving attractive payback periods of two years. Meanwhile, the company was introducing new products for new and existing customers, and the management team was pivoting toward a more disciplined expense structure. The stock was a strong performer, but in the recent quarterly results, which were solid overall, it displayed signs of slowing growth. Given the stock’s elevated valuation, we no longer see the risk-reward as attractive relative to other opportunities.

CoStar Group is a leading provider of information services to the global real estate industry, with a dominant position in commercial real estate through platforms such as Apartments.com. Recently, the company expanded into the residential market with the launch of Homes.com, aiming to capture market share by offering a business model more aligned with listing agents than other existing portals. Despite significant investment in sales and marketing, Homes.com has struggled to gain traction. Coupled with headwinds in CoStar’s core business driven by a weak commercial real estate cycle, the anticipated growth has not materialized, and we decided to exit the position.

Along with Exact Sciences, notable trims in the quarter included Ingersoll Rand (IR) and NVR (NVR). Ingersoll Rand is a global market leader in several mission-critical flow creation technologies for industrial and medical applications, including pumps and compressors. Recent earnings results displayed slowing organic growth due to cyclical industrial pressures causing customers to delay orders and weakness in China. We continue to be impressed by management’s handling of acquisition integration, marketing lead generation and new product development. We also believe Ingersoll’s compressed air technologies will remain in demand in the long term as customers seek to reduce energy and water usage and generate fewer emissions. However, given the slowing organic growth and the stock’s elevated valuation, we reduced the position.

NVR is a highly productive, build-to-order homebuilder with a land-light strategy that operates in the mid-Atlantic, Northeast, Southeast and Midwest regions. The company uses land options rather than land purchases in its lot development. Land options allow it to focus on building homes and walk away from lots should the market environment change, which has proven to be an effective risk management approach over time. While the housing cycle continues to be favorable for homebuilders from both a supply and demand perspective due to demographic tailwinds (rising household formation), a low rate of housing starts and depressed existing home sales (since many existing homes are financed with below-market interest rates), we believe rising mortgage rates and permitting bottlenecks will prevent short-term volume growth from accelerating. We decreased our position.

Stewardship Update

The growth in data centers has played a significant role in increasing demand for reliable, large-scale and carbon-free energy sources. Data centers are energy-intensive, requiring vast amounts of electricity to power servers, cooling systems and infrastructure. With the expansion of AI, energy consumption by data centers is projected to grow exponentially. By some estimates, data centers could account for up to 8%–10% of global electricity consumption by 2030, prompting the need for sustainable and continuous energy sources.

Meanwhile, technology giants like Google (GOOG), Microsoft (MSFT) and Amazon (AMZN) have committed to reducing their carbon footprints and achieving net-zero emissions. While wind and solar are crucial for clean energy transitions, their intermittent nature creates challenges for data centers, which require 24/7 power. Given this conflict of accelerating power needs versus carbon reduction commitments, our team has focused on the implications.

One option for these hyperscalers may be to pursue nuclear power sources, a low-carbon energy source that provides a stable energy supply that ensures uninterrupted operations. For example, Constellation Energy (CEG) announced it inked a 20-year deal with Microsoft to supply power to an AI data center from the shuttered Three Mile Island nuclear plant in Pennsylvania. There is also increased interest in the prospect of small modular reactors (SMRs). Advocates for SMRs believe their smaller size and faster deployment timelines make them an attractive solution. However, our optimism in this area is somewhat tempered based on the relatively immature state of the technology and the stated hesitancy of regulated utilities to invest in anything nuclear.

Based on our research today, we believe that hyperscalers will pursue clean energy power sources wherever possible to satisfy their power needs. However, the evidence is mounting that they may need to push their emissions goals if they are going to satisfy energy demand. This will likely have investment implications for the energy industry, particularly for companies exposed to natural gas, which may become the go-to fuel source, especially in areas where renewable energy infrastructure is not yet robust or reliable enough to ensure consistent power delivery.

Perspective

US mid-cap growth equities, as reflected by the Russell Midcap® Growth Index, have delivered a very strong two-year performance run. We are cognizant of the expansion in valuation multiples that has accompanied this rally, as well as the extreme momentum experienced by several “hot” growth stocks at the top of the index (which is further evidence of robust animal spirits in the market today, and we believe has distorted the index performance as discussed earlier). This aggressive investor behavior can be seen elsewhere in some large-cap equities and cryptocurrency trading and has been elevated by post-election optimism about future policy changes in the US.

Looking past these momentum leaders, we find valuations in the portfolio to be more reasonable, albeit not cheap, and have been trimming some highly valued securities in favor of more opportunistic investments. Fundamentally, recent earnings reports for portfolio holdings have generally been quite solid, and our conviction in the profit cycles driving the portfolio seems well-supported entering 2025.

In particular, our team’s Q4 research and travel strengthened our confidence in many of the profit cycles driving our information technology holdings. We own multiple category leaders within technology that are gaining market share partly due to how well positioned they are to help enable AI advances. Examples include Marvell (custom AI chips), MACOM (MTSI)(networking chips), Arista Networks (ANET)(high-speed networking solutions), Pure Storage (data storage) and Onto Innovation (ONTO) (inspection systems for advanced chips). In addition, our cloud software franchises are making steady progress in introducing AI functionality into their leading solution suites. Meanwhile, strong profit cycle momentum from our Internet and media holdings (such as Spotify, Shopify and Liberty Media Formula One) looks poised to continue in 2025 as these franchises benefit from strong competitive positions and a solid mix of revenue and profitability growth.

Health care, by contrast, has been largely left behind in this bull market and now presents some of our portfolio’s most attractive valuation opportunities. For example, we anticipate profit acceleration for all three of our biotech holdings (Ascendis (ASND), Argenx (ARGX) and Insmed (INSM)) this year as they each launch new medicines with blockbuster sales potential. Inventory headwinds in the biologic drug packaging sector should also clear, enabling West Pharmaceuticals (WST) to resume its compelling long-term growth trajectory.

In addition to valuations, we enter the new year with an increased focus on domestic and international political uncertainty. Most significantly, the incoming Trump administration is expected to propose specific (and likely aggressive) policy changes across trade, labor, government spending, regulation and health care. We’re paying close attention to how these changes do and don’t get enacted and are integrating them into our assessments of investment risks and rewards. The signal-to-noise ratio is expected to be high, and we’ll lean on our team of sector experts to help us tell the difference. Of course, these policy changes will likely also impact interest rates, which could continue to be a source of market volatility ahead.

As previously communicated, Jason White, a longstanding portfolio manager on the team, was named co-lead portfolio manager (alongside Matt Kamm) on the mid-cap strategy effective January 1. Matt and Jason look forward to deepening their collaborative efforts and leveraging Jason’s proven record of capital allocation, expertise in technology investing and deep familiarity with franchises emerging from small cap to mid cap. We believe our team has never been stronger and are confident in our process as we enter 2025.

Read the full article here