Growing stacks of coins representing investment compounding.

My investing philosophy is all about repeatable results. As an investor, it isn’t just my goal to become wealthy. I want to stay that way, too.

In my view, wealth that can be made overnight can also be lost just as quickly. In other words, what speculation giveth, it can taketh right away.

This is why my focus was, is, and always will be on businesses with winning business models. If a prospective company doesn’t fit within my parameters, I won’t own it in my portfolio. I also won’t spend time covering it here on Seeking Alpha.

One business that, I believe, is the textbook definition of consistency is American States Water (NYSE:AWR). When I last covered AWR with a buy rating in May, I thought its growth prospects were intact. I was also amazed by the nearly seven-decade dividend growth streak. That’s the longest-known track record of dividend growth of any publicly traded company. The utility also enjoyed an A-rated balance sheet from S&P on a stable outlook. Finally, shares appeared to be undervalued by a double-digit percentage.

Today, I’m reiterating my buy rating. In August, the company declared an 8.3% hike in its quarterly dividend per share – – its 70th consecutive year of dividend growth. A couple of weeks earlier, the utility reached a constructive settlement agreement with the California Public Utilities Commission’s Public Advocates Office (Cal Advocates). Additionally, AWR’s balance sheet is well-capitalized. Topping off the buy case, shares are a decent value here.

A Positive Rate Case Outcome

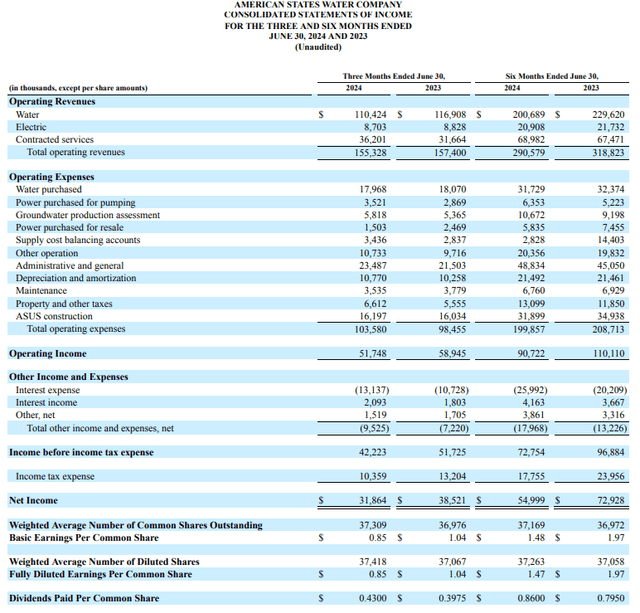

AWR Q2 2024 Earnings Press Release

On Aug. 6th, AWR released its second-quarter results for the period ended June 30. The utility’s operating revenue decreased by 1.3% over the year-ago period to $155.3 million in the quarter. This was $17.3 million more than the Seeking Alpha analyst consensus during the quarter.

The Water segment’s operating revenue fell by 5.5% year-over-year to $110.4 million for the second quarter. This was due to a $9.3 million regulatory liability reversal in the segment in Q2 2023 to account for the final cost of capital decision. That explains why segment operating revenue declined in the quarter.

Electric segment operating revenue decreased by 1.4% over the year-ago period to $8.7 million during the second quarter. This was the result of awaiting a decision on the electric rate case per CFO Eva Tang’s opening remarks during the Q2 2024 Earnings Call.

These headwinds were largely offset by a 14.3% surge in contracted services segment operating revenue to $36.2 million for the second quarter. That was because of higher management fee revenue from the commencement of operations at Naval Air Station Patuxent River in Maryland and Joint Base Cape Cod in Massachusetts.

AWR’s adjusted diluted EPS fell by 1.2% year-over-year to $0.85 in the second quarter. That was $0.02 less than the Seeking Alpha analyst consensus during the quarter. Higher operating expenses and interest expenses were responsible for this marginal contraction in the bottom line for the quarter.

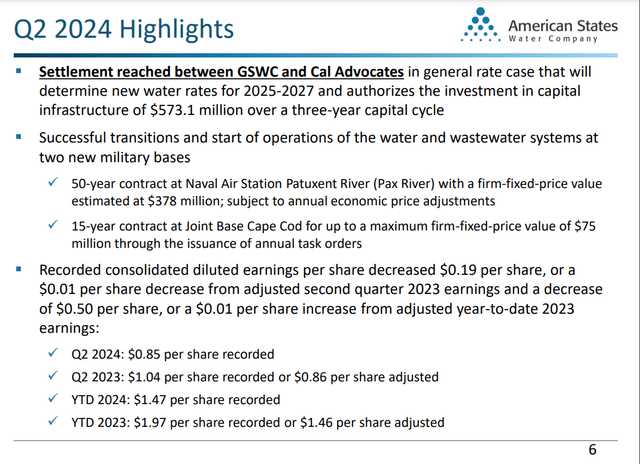

AWR Q2 2024 Earnings Presentation

Moving forward, the future is encouraging for AWR. On July 18th, the company announced that on July 12th, it reached a settlement agreement with Cal Advocates for its water utility general rate case.

This agreement stipulated that $573.1 million could be invested by the utility from 2025 through 2027 in its infrastructure. This was most of the $611.4 million that the utility sought for the three-year capital cycle.

The rate case agreement is expected to contribute another $23 million to AWR’s operating revenue less water supply costs for 2025 versus 2024. The company also has potential additional revenue increases of $20 million in 2026 and 2027, respectively. These are subject to the results of the earnings test and changes to forecasted inflationary index values per AWR.

Additionally, a decision on the electric utility subsidiary general rate case filed in 2022 is expected by the end of this year. That could be a more modest lift to AWR’s operating revenue in the years to come.

For these reasons, the FAST Graphs analyst consensus is that adjusted diluted EPS will rise by 6.3% in 2024 to $3.03. Another 9.7% growth in adjusted diluted EPS to $3.33 is being projected for 2025. In 2026, an additional 5.2% growth in adjusted diluted EPS to $3.50 is currently being predicted.

AWR’s financial health is also robust. The company’s interest coverage ratio through the first six months of 2024 was 4.2. This is very high for a regulated utility.

AWR’s debt-to-capital ratio as of June 30 was 43.4%. For context, this is better than the 60% debt-to-capital ratio that rating agencies like to see from the industry per The Dividend Kings’ Zen Research Terminal. That’s why the utility possesses an A credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to AWR’s Q2 2024 Earnings Press Release, AWR’s Q2 2024 Earnings Presentation, and AWR’s Q2 2024 10-Q Filing).

Fair Value Is Nearing $95 A Share

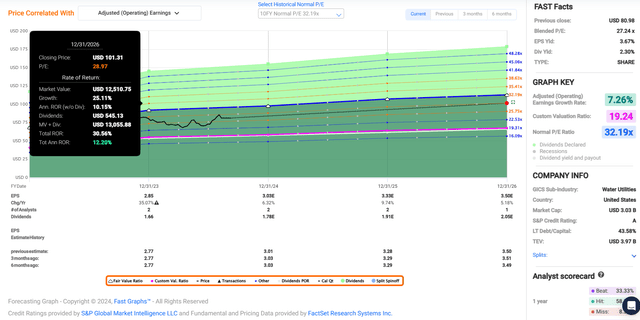

FAST Graphs, FactSet

Since my previous article, shares of AWR have risen 9%. This is three times the 3% gains of the S&P 500 index (SP500) in that time. Even after this rally, though, the utility still looks to be a solid value.

AWR’s current-year P/E ratio of 26.7 is less than the 10-year normal P/E ratio of 32.2 per FAST Graphs. This is despite an annual forward adjusted diluted EPS growth forecast of 7.3% through 2026. For perspective, that’s higher than the 10-year average annual growth rate of 6.7%.

If that wasn’t enough, the outlook for interest rates has improved in recent months. My previous belief was that interest rates would remain somewhat higher than the 10-year average of approximately 1.8% per Macrotrends.

However, Morningstar anticipates that the federal funds rate will be between 1.75% and 2% by year-end 2026. So, there’s a realistic path to interest rates returning to their 10-year average in the next couple of years.

This is why I’m reaffirming my fair value multiple of 29 for shares of the utility. That arguably builds at least a modest degree of conservatism into my fair value estimate.

The calendar year 2024 will be 71% complete after this week. That means another 29% of 2024 and 71% of 2025 lies ahead. This is how I get a forward 12-month adjusted diluted EPS input of $3.24.

Applying that with a valuation multiple of 29, I compute a fair value of $94 a share. Compared to the $81 share price (as of September 9th, 2024), this is equivalent to a 14% discount to fair value. If AWR meets the growth consensus and returns to fair value, it could post 30% cumulative total returns through 2026.

The Longest-Reigning Dividend King Is Just Getting Started

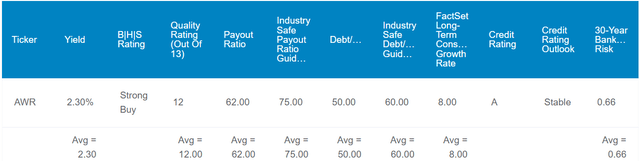

The Dividend Kings’ Zen Research Terminal

AWR’s 2.3% forward dividend yield is materially less than the utility sector median forward yield of 3.7%. This explains the D- grade from Seeking Alpha’s Quant System for overall dividend yield. As I have emphasized in the past, though, water utilities do tend to offer lower starting income versus other utilities.

Looking beyond its lackluster starting income, AWR is interesting in every other aspect. The company’s EPS payout ratio is on track to register in the high 50% range in 2024. This is comfortably below the 75% EPS payout ratio that rating agencies prefer from the industry per The Dividend Kings’ Zen Research Terminal. Thus, the Quant System awards a B+ grade to the utility for overall dividend safety.

This positions AWR to boost the dividend at least as fast as earnings growth in the years to come. That’s why after a 10-year compound annual growth rate of 7.9%, the Quant System projects 8.1% annual forward dividend growth. This is above the 5.3% sector median and sufficient for an A grade for the metric.

That should allow AWR to extend its 70-year dividend growth streak in the years ahead. This is leagues better than the sector median of 10 years and adequate for an A+ grade from the Quant System for overall dividend consistency.

Risks To Consider

AWR’s reputation for dividend growth is a testament to its underlying quality. Just like any other business, however, it isn’t entirely shielded from risks. No additional risks have been mentioned in its most recent 10-Q Filing, so I’ll be revisiting risks from prior articles.

Chief among the potential concerns facing the utility is its geographic concentration. As noted in previous articles, AWR’s water and electric segments derive all of their operating revenue (76.3% of H1 2024 operating revenue) from the California market.

The remaining quarter of operating revenue originates from its contracted services business. This provides military base locations with water and wastewater services throughout Texas, New Mexico, Virginia, Maryland, South Carolina, North Carolina, Florida, Kansas, and Massachusetts.

That means the utility’s growth prospects rely on constructive rate case outcomes in California. If rate case outcomes are unfavorable for the company, its growth potential could be significantly harmed. That could hold back future dividend growth and result in poor future total returns.

Another potential consequence of its mostly California-based operations is natural disaster risk. Devastating wildfires are becoming more commonplace in the state. This could inflict substantial damage on the company’s infrastructure. If that was beyond its commercially insured amounts, this could impair its earnings power.

Another worry is that AWR’s electric operations could be found liable for a wildfire. If this happens, it may result in sizable litigation against it. That could also shatter the investment thesis.

Summary: A Classic “Boring” Business Buy

As a dividend grower, AWR is arguably the best of the best. The utility’s high-single-digit annual adjusted diluted EPS growth potential is strong for a utility. AWR’s balance sheet is A-rated. The company’s dividend is secure and poised to keep compounding at around 8% annually. Not to mention that shares are priced almost 15% less than my fair value estimate.

AWR isn’t a get-rich-quick pick, but it’s an all-around great business on sale. This is enough for a 12% annual total return potential by the end of 2026, which is why I’m reaffirming my buy rating.

Read the full article here