By Gerben Hieminga, Senior Sector Economist & Coco Zhang, ESG Research

Hydrogen provides a way to transition away from fossil fuels

Efforts to decarbonise the global economy are starting to reach a turning point as the COP28 climate conference reached agreements to transition away from fossil fuels. But the potential for renewables is limited in energy-intensive sectors, as electrons often cannot substitute the very high-temperature heat. Nor are they a substitute for hydrocarbon molecules from fossil fuels that are needed to make products like steel, plastics, pharmaceuticals, and fuels for aviation, shipping, and trucking.

Carbon capture and storage (CCS) could reduce CO2 emissions from these fossil-based activities to some extent but does little to ‘transition away from fossil fuels’. Some fear that CCS might even prevent or delay this transition.

Hydrogen does, on the other hand, hold that promise as it is a substitute for fossil fuels – especially green hydrogen. It can generate high-temperature heat and, by reacting with a carbon source like CO2, it can create the feedstock needed to make steel and plastics. So here, we’ll share our thinking on what will happen with hydrogen in 2024.

2023 failed to bring rapid and large cost declines

The year 2023 was somewhat disappointing. Project developers delayed investments in earlier announced pilot projects, especially for green hydrogen. It took politicians more time to work out the complex details of policies to build and scale up a hydrogen economy. Europe and Asia still face high energy prices, making the energy-intensive hydrogen production and transportation process a costly business. Finally, new expensive, and unproven electrolysers don’t get a lot cheaper in just one year, especially when pilot projects are postponed.

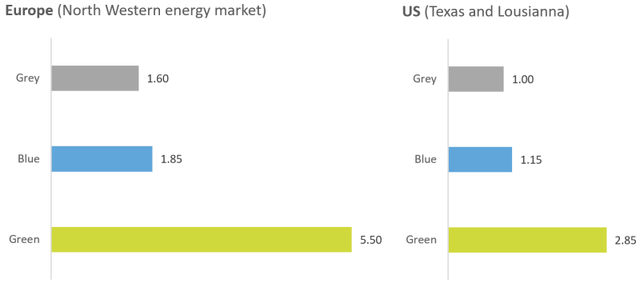

Green hydrogen is still very expensive, especially in Europe where energy prices are high

Indicative unsubsidised hydrogen production costs in euros per kg

ING Research

The prices of green hydrogen still put tears in taxpayers’ eyes, in particular in Europe. Even with proposed subsidies in the range of €3/kg, it fails to be cost-competitive with grey or blue hydrogen in many cases.

Higher interest rates have increased rather than decreased electrolyser costs in 2023. The anticipated learning curve for electrolyser costs has not materialised as expected due to fewer projects that reached final investment decisions in 2023. And while wholesale power prices came down last year, grid tariffs have increased considerably in many countries. Finally, strong cost declines for hydrogen are anticipated once there is a large global hydrogen market in which hydrogen users benefit from low-cost production regions. Currently, the market is still very local, especially for green hydrogen, and it will take years to develop import and export hubs across the globe.

2024 will bring more realism to the hydrogen buzz

And optimism simply might have been too high in this early stage of the hydrogen economy, a trend that is common for new technologies. It took three to four decades to make renewable power cost-competitive with power from coal or gas-fired power plants. The solar and wind industry went through major boom and bust cycles during that process. The challenge for hydrogen is to reach this stage of market maturity twice as fast and without major market setbacks. We expect a lot more realism about the scale of such a challenge in 2024.

Hydrogen will show its true colours – and emissions – in 2024

We’ve been stressing that green hydrogen does not by definition lead to lower CO2 emissions compared to using fossil fuels like gas. The CO2 intensity of the power grid determines whether green hydrogen is good or bad for the climate. This is very relevant as power systems in many countries still depend to a large degree on fossil fuels.

As a result, politicians have expended a lot of effort on complex regulations to define the emission performance of hydrogen.

In Europe for example, the Renewable Energy Directive now includes rules for green hydrogen production with renewables:

- Geographical correlation: the solar panels or wind turbines that feed the electrolyser must be close by – that is, in the same bidding zone. That is likely to limit the use of Power Price Agreements (PPAs) that span multiple bidding zones or even countries, which is currently common practice (for example, using green hydropower from Norway in the Netherlands through a PPA).

- Temporal correlation: hydrogen can only be called green if its production coincides with the production of renewable power from solar panels and wind turbines (monthly correlation until 2027 and hourly correlation afterward). This time-matching requirement can lead to more interest in projects where electrolysers and solar panels or wind turbines are co-located. Or it could trigger interest in off-grid development.

- Additionality: after 2027, only newly added renewable capacity can support green hydrogen production as existing power from wind turbines or solar panels is already used for other activities, such as charging electric vehicles.

Developers are likely to comply with these guidelines if they want the highest possible subsidies for their projects.

Apart from green hydrogen, progress in Europe is also being made on defining low-carbon hydrogen from natural gas and CCS (blue hydrogen) or nuclear power (purple hydrogen). The ‘Hydrogen and Decarbonised Gas Market Package’ defines emission thresholds that include standards to deal with upstream methane leakage and downstream hydrogen leakage as well as accounting rules for indirect emissions (the nuclear power and energy use of CCS). This regulatory clarity could boost activity in blue and purple hydrogen in 2024 and the years beyond.

In the United States, the long-awaited guidance on the 45V hydrogen tax credits from the Inflation Reduction Act was issued in 2023, albeit in draft form which is likely to become final in 2024. The scheme puts less focus on the hydrogen colour code, but more on emission levels. The tax credits can be as high as $3 per kilogram of hydrogen if the production process results in life cycle greenhouse gas emissions of less than 0.45 kg of CO2 per kg of hydrogen. And projects must meet similar guidelines on locality, time-matching, and additionality as in Europe.

We expect more final investment decisions for green hydrogen projects in 2024 because of clearer guidance on the definition of green hydrogen and requirements for policy support. A lack of guidance left project developers in the dark in 2023, which was one of the reasons that projects were delayed.

Should the focus be on hydrogen emissions or building an electrolyser industry?

Industry and academics are still split over the need for strict definitions of green hydrogen production at this early stage of the market. Politicians clearly adopted a strict approach in order to ensure that every electrolyser has a positive climate impact. Some have advocated for a softer approach, fearing that strict rules are a barrier rather than an enabler of a green hydrogen market. They argue that most power markets will be almost carbon neutral from 2030 onwards, so why bother about the emissions of small pilot projects in the meantime?

In their view, the main purpose of current pilot projects is to develop and produce electrolysers, not so much to produce low-carbon hydrogen. The main goal, for now, is to build an electrolyser industry that can produce large-scale and cost-competitive electrolysers from 2030 onwards. That’s when many power grids almost entirely run on low-carbon sources, and electrolysers cannot produce anything other than very low-carbon hydrogen. It is also time that power systems are in dire need of large-scale electrolysers to absorb the vast oversupply of renewable power. Without electrolysers, wind turbines and solar panels should simply be curtailed, which is a shame and economic loss.

So, proponents of this view put more emphasis on the need for long-term industry support to build a green hydrogen economy rather than making sure that every pilot project results in lower carbon emissions compared to the use of fossil fuels.

Hydrogen won’t surprise in 2024 unless demand kicks off

In our view, the industry is currently too focused on the supply side. Yes, hydrogen producers need subsidies to produce low-carbon hydrogen, otherwise, they continue to only produce grey hydrogen. And yes, hydrogen infrastructure is needed to build the hydrogen economy and bring hydrogen to locations where it can be used. But will it be used?

That will only happen if clean hydrogen solutions are cost-competitive with fossil-based production methods. Unfortunately, that’s far from reality yet. According to our calculations, switching from gas or oil to green hydrogen could increase the cost of plastic production by as much as 50% in Europe. Steel from green hydrogen could be twice as expensive compared to coal-based steel. And in shipping and aviation, cleaner hydrogen-based fuels can be up to ten times more expensive compared to regular fossil-based fuels.

Unfortunately, demand-side incentives have lagged far behind support for hydrogen production. Developers struggle to secure offtake agreements which then adds risk to the project, causing project sponsors to postpone the final investment decision.

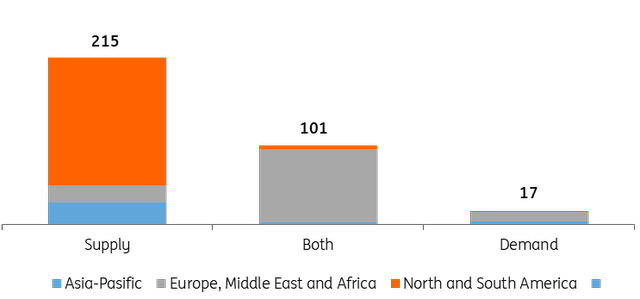

Building a robust hydrogen market is all about balancing supply and demand, but support on the demand side is lacking

Global subsidies available for clean hydrogen in billion dollars

BloombergNEF

Note: ‘Supply’ funds support equipment manufacturing and H2 production. ‘Demand’ funds support end-use technologies and H2 use. ‘Both’ refers to programs that can fund supply and demand, and H2 transport and storage. Data as of 20 December 2023.

However, this could all change in 2024.

In the US, Colorado and Illinois have introduced a subsidy of about $1 per kg for users of clean hydrogen, which is particularly aimed at stimulating hydrogen demand in hard-to-abate sectors like manufacturing. Pennsylvania has released a tax credit of $0.81 per kg of clean hydrogen purchased from a regional production hub.

And in Europe, the EU’s Fit for 55 strategy and EU Emissions Trading System carbon trading scheme are starting to drive clean hydrogen demand in the coming years. Users of grey hydrogen must replace 42% of their hydrogen volume with green hydrogen. Under the ReFuelEU Aviation initiative, 1.2% of fuels supplied to aircrafts at EU airports must be hydrogen-based by 2030. And the FuelEU maritime initiative requires shipping companies to reduce emissions by 2% by 2025 and to pay a carbon price under the EU ETS scheme by 2026, which already increases demand for hydrogen-based fuels like ammonia and methanol.

Shipping and aviation companies operate globally and can tap into the lowest-cost hydrogen markets. Air France (OTCPK:AFRAF), KLM, and Delta Air Lines (DAL) signed a seven-year sustainable aviation fuel offtake agreement with US-based synthetic fuel producer DGFuels, made from over 800 megawatts of electrolysers, according to Bloomberg New Energy Finance. Maersk (OTCPK:AMKBY) has signed the largest green shipping fuel offtake contract so far through a binding offtake agreement for methanol with Chinese renewable energy developer Goldwind.

However, a lack of transparent pricing currently is another barrier for demand to kick off. Hydrogen offtake contracts are often bilateral and are undisclosed to other players. The market can benefit from initiatives to increase market transparency, for example by providing demand, supply, and pricing statistics. The EEX Hydrogen Index in Germany is a good start, though development is still at an early stage. We expect and hope to see more progress on the demand side in 2024. The hydrogen economy simply won’t take off without it. And increasing demand will feed into the supply side again, as more hydrogen storage facilities need to be built and exploited.

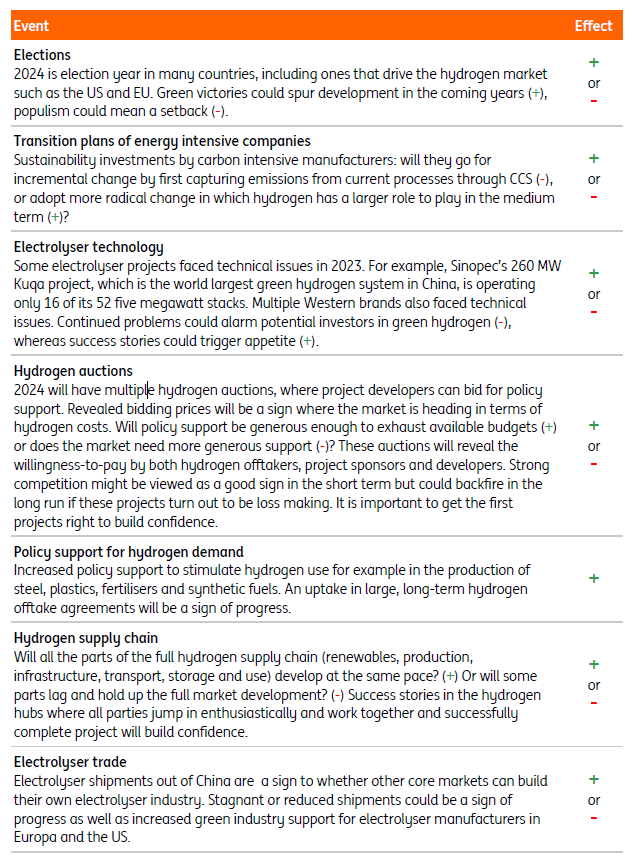

Key developments to watch in 2024

Overall, we expect more activity in the hydrogen market in 2024. At this early stage of the market, the exact number of projects or capacity added is less relevant. 2024 will be about laying the foundations for future growth and realising the first success stories that trigger confidence. These are the key developments the industry should be closely monitoring this year.

Key developments to watch in 2024

Developments that can spur (+) or delay (-) progress in the hydrogen market

ING Research

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here