By Andrew Prochnow

Numerous investors and traders track the CBOE Volatility Index (VIX) to gauge market sentiment in the U.S. stock market. Nonetheless, it could be contended that the U.S. Dollar Index (DXY) holds comparable significance in assessing investor sentiment within the U.S. financial markets.

The dollar, after all, is the world’s top reserve currency and has been for nearly 80 years. These days, about 59% of the foreign reserves held by global central banks are denominated in USD. Moreover, roughly half of all international trade is invoiced in dollars.

As a result of the greenback’s key role in the global economy, the value of the dollar – as well as the narrative surrounding it – can heavily influence other areas of the financial markets. That’s especially true amidst a major trend, a key shift in direction, or when the dollar hits a historical extreme.

Of course, the dollar’s story always starts in the currency markets. When the dollar increases in value, that means another currency (or basket of currencies) is depreciating in value against the dollar, and vice versa. To wit, the Dollar Index is calculated using the exchange rates of six major world currencies, including the euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound (GBP), Swedish krona (SEK) and Swiss franc (CHF).

In terms of trends, the U.S. dollar embarked on a remarkable ascent against numerous prominent currencies from May 2021 to October 2022. During this period, the U.S. Dollar Index surged by approximately 25%, climbing from 90 to 113. Subsequently, the DXY retreated to around 104.

Beyond the realm of foreign currency markets, fluctuations in the dollar can significantly impact other facets of the financial landscape. This is because the dollar serves not only as the world’s reserve currency but also as the sovereign currency of the United States, home to the largest global economy.

As with other sovereign currencies, the dollar mirrors changes in the domestic U.S. economic landscape. In recent years, a prominent theme in the U.S. economy has been the tightening of monetary policy, evidenced by escalating interest rates.

When monetary policy becomes more stringent, the respective sovereign currency typically follows suit. This was notably evident with the dollar’s ascent for much of 2022 as the U.S. Federal Reserve raised benchmark interest rates.

Unsurprisingly, the dollar has experienced a recent decline as expectations for a first-half 2024 interest rate cut have strengthened. A weakening dollar underscores the importance of recognizing that the fortunes of U.S. corporate entities can also shift alongside the greenback, particularly for export-oriented businesses. Approximately 40% of U.S. corporate earnings originate from abroad.

Taken all together, that means a decline in the value of the dollar can make U.S. exports relatively more attractive, boosting the potential revenues and earnings of export-focused companies. That’s one reason that shifts in the value of the dollar can reverberate well beyond the currency markets.

For example, when the DXY rallied to a 20-year high in 2022, U.S. exports became far less attractive to foreign buyers. Unfortunately, reduced sales typically translate to reduced earnings, which may help explain why the record strengthening in the dollar may have coincided with the 2022 pullback in the stock market.

Speaking to that dynamic, Tanner Ehmke – an economist for CoBank – recently told the Successful Farmer, “That’s a problem for our exports because our foreign buyers have to buy dollars first before they buy our products. They have to buy strong dollars, and so therefore they can’t buy as much.”

Considering that context, one can see how the 2023 reversal in the dollar – falling back from all-time highs – may have provided support for last year’s stock market rally. After peaking above 113 in late October 2022, the DXY fell all the way back to 99 during 2023.

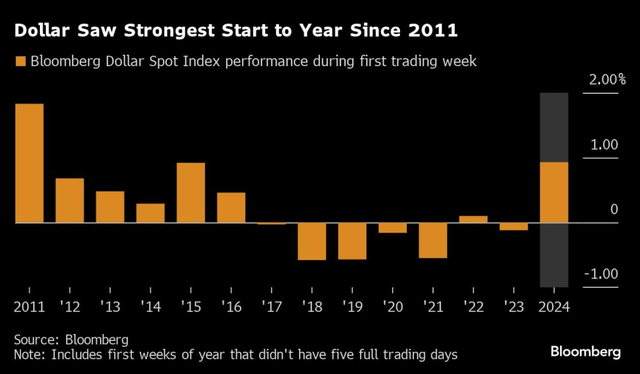

Interestingly, the dollar recently staged another reversal – at the start of 2024 – and has risen by about 3.5% over the last 30 days. That may help explain why the rally in the stock market has slowed during the first month of the year. Because a stronger dollar once again makes U.S. exports relatively less attractive.

Bloomberg

The S&P 500 saw a rise of approximately 14% in the final two months of 2023, yet it has only increased by about 3.5% year-to-date in 2024. Should the dollar persist in its ascent, it could pose a persistent challenge to stock prices, potentially dimming the appeal of U.S. exports.

However, there’s a silver lining in that the DXY likely won’t surge back to its all-time highs. This projection stems from the current stance of the U.S. Federal Reserve, which is poised to reduce interest rates, thereby tempering the dollar’s momentum.

Overall, this suggests that while the Dollar Index might edge slightly higher in the upcoming weeks, it’s unlikely to surpass its 52-week peak of 107. If the Fed indeed cuts rates in the first half of 2024, the dollar might even reverse its trajectory and regress toward 100. Such a scenario would offer a modest boost to U.S. corporate earnings, potentially bolstering the stock market further.

Regardless of its direction, the dollar will remain a significant force in global financial markets. Therefore, investors and traders should continuously monitor the dollar narrative, as it furnishes valuable insights into broader financial dynamics, complementing the analysis provided by the VIX.

This is especially important in a presidential election year. As a reminder, the dollar often spikes in value when geopolitical uncertainty hits the global financial markets, which in itself provides a compelling reason to constantly monitor the DXY.

Read the full article here