© Reuters

Moderna , Inc. (NASDAQ:) director Noubar Afeyan has sold a total of $1,535,820 worth of the company’s stock, according to recent filings with the Securities and Exchange Commission. The transactions, which took place on March 20, 2024, involved the sale of shares at prices ranging from $101.048 to $103.1753.

The sales were executed as part of a pre-arranged trading plan under Rule 10b5-1, which was adopted on February 27, 2023, and amended on November 7, 2023. Such plans allow company insiders to sell shares over a predetermined period of time, providing an affirmative defense against accusations of trading on inside information.

Afeyan’s transactions comprised several blocks of shares sold at varying prices. Specifically, the sales included 2,113 shares at an average price of $101.048, 7,109 shares at an average price of $102.1464, and 5,778 shares at an average price of $103.1753. The sales took place in multiple transactions within the stated price ranges, and Afeyan has committed to providing full information about the number of shares sold at each price upon request.

Following these sales, Afeyan still holds a significant number of Moderna shares. According to the filings, he directly owns 2,129,931 shares after the transactions. Additionally, the filings note indirect ownership through Flagship Ventures Fund IV, L.P. and Flagship Ventures Fund IV-Rx, L.P., amounting to 9,662,114 shares, and a direct holding by Flagship Pioneering, Inc. of 3,924 shares. Afeyan is the CEO and sole stockholder of Flagship Pioneering, Inc. and disclaims beneficial ownership of the indirectly held shares except to the extent of his pecuniary interest.

Investors often monitor insider sales as they can provide insights into an insider’s view of the company’s current valuation and future prospects. However, it’s important to note that insider trading activity can be subject to various motivations and does not necessarily signal a change in company fundamentals.

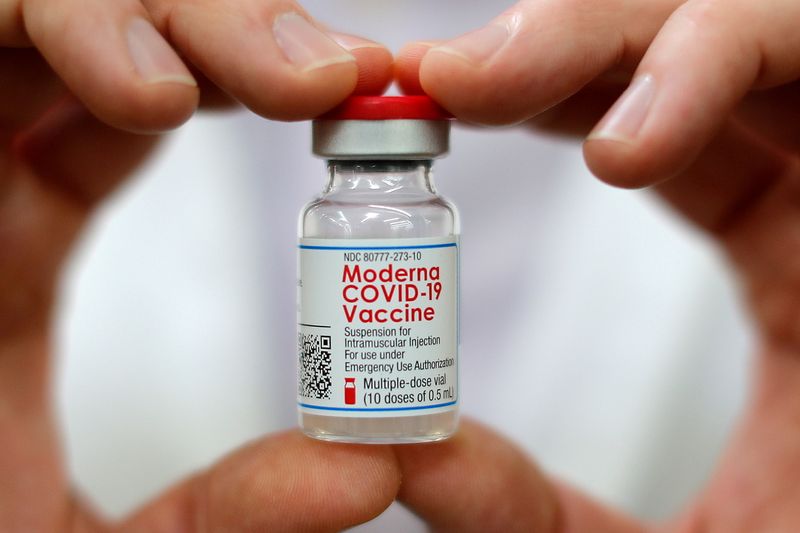

Moderna, Inc. is a leader in the biotechnology industry, focusing on drug development and in particular, mRNA therapeutics and vaccines. The company has been at the forefront of the fight against COVID-19, with its vaccine being one of the primary vaccines distributed worldwide.

InvestingPro Insights

As Moderna, Inc. (NASDAQ:MRNA) continues to navigate the post-pandemic market, its financial health and stock performance are crucial for investors. Recent data from InvestingPro highlights some key metrics that may influence investment decisions. Moderna’s market capitalization stands at $40.37 billion, reflecting its significant presence in the biotechnology sector. Despite facing a challenging period, with revenue declining by 64.45% over the last twelve months as of Q1 2023, the company holds a notable cash position, with more cash than debt on its balance sheet, which is a positive sign of financial stability.

InvestingPro Tips suggest that management has been proactive in returning value to shareholders through aggressive share buybacks. Additionally, the company’s liquid assets surpass its short-term obligations, indicating a strong liquidity position to meet immediate financial needs. However, analysts have tempered their expectations, revising earnings downwards for the upcoming period and anticipating a sales decline in the current year. This is reflected in the negative gross profit margin reported at -39.28% for the last twelve months as of Q1 2023, underscoring the challenges Moderna faces in maintaining profitability.

For investors looking for more in-depth analysis and additional InvestingPro Tips, including insights on stock price volatility and profitability expectations, visit https://www.investing.com/pro/MRNA. With 9 more tips available, these insights could prove invaluable in assessing Moderna’s market position and future outlook. Moreover, investors can use coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription, enhancing their investment research tools.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here