This year could be shaping up to be a big one for activist investors if 2023 data are indications.

Amid a volatile market last year, there were 823 new activist campaigns launched globally, marking a 24% increase from the prior year, according to Bloomberg data. But most investors weren’t aware of the scope of the boardroom battles because many were at smaller companies and closed-end funds—both of which aren’t prone to much media attention.

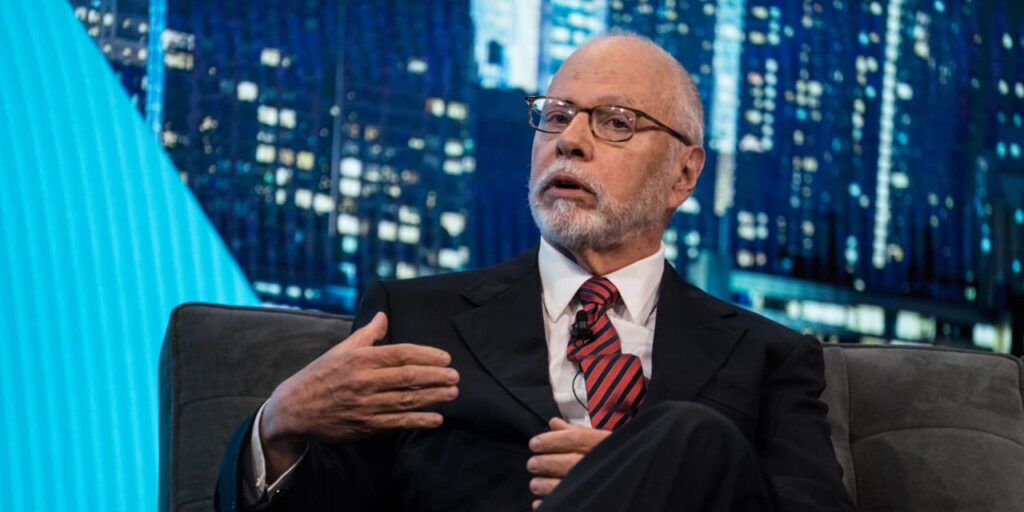

Elliott Management was a standout in 2023. It launched 15 campaigns during the year, topping the league table for campaigns at companies with market caps of more than $1 billion. Three runner-up funds shared the second place spot, each having launched seven campaigns.

Elliott also notched wins, replacing CEOs at some companies—including

Crown Castle

—and added 16 board seats at six companies through settlements, avoiding costly proxy battles.

There’s reason to believe that 2024 will be just as active—for Elliott and the activist community at large.

So far, the biggest battle is brewing at

Walt Disney,

which has four activists, including Trian Fund Management and ValueAct Capital, jockeying for changes at the entertainment conglomerate.

In any case, 2024 is shaping up to be a choppy year for markets as investors digest the Federal Reserve’s path on interest rates. Volatility often provides opportunities for activists to seize upon price discrepancies to build their positions.

Corrections & Amplifications: The CEO of Goodyear has announced plans to retire in 2024. A search for a successor is continuing. An earlier version of this article incorrectly said Goodyear’s CEO had been replaced.

Write to Carleton English at carleton.english@dowjones.com

Read the full article here