By Shariq Khan

(Reuters) – U.S. motorists are likely to see gasoline prices turn sharply higher in the coming weeks as major refinery outages have cut supplies ahead of a seasonal jump in demand, analysts said.

The national average price for a gallon of gasoline has increased more than 9% from the start of the year to hover around $3.40 since March 8, the highest since early November, according to data from the motorist group AAA.

Higher gasoline bills lifted consumer prices solidly last month, adding to stickiness in U.S. inflation. That is set to be a key talking point for both the Democrats and Republicans ahead of this year’s presidential elections in November.

U.S. gasoline stockpiles fell by 5.7 million barrels to 234.1 million barrels in the week to March 8, the U.S. Energy Information Administration said this week. They are now trailing their five-year seasonal average by more than 2%, the data showed.

“There is every reason to believe gasoline prices will screech even higher going forward,” said Tom Kloza, head of energy analysis at Oil Price Information Service, citing higher summer travel demand, the declining fuel stockpiles, and refineries facing multiple issues around the globe.

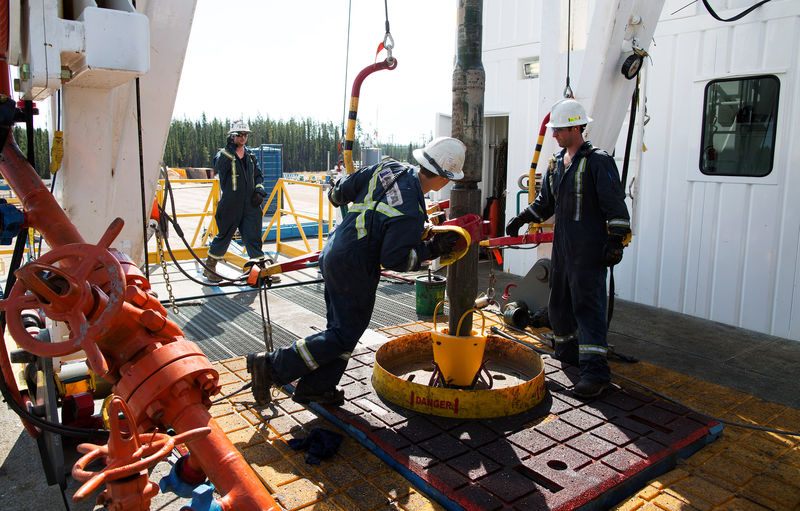

Total U.S. refinery utilization rates have remained below 87% for eight straight weeks, the longest such stretch since 2021. Research firm IIR Energy expects around 1.2 million barrels per day (bpd) of the roughly 18 million bpd in U.S. capacity to be offline this week, and 885,000 bpd next week.

Ukrainian drone strikes on Russian refineries this week have added to supply concerns, lifting fuel and crude prices.

Oil prices were already rising prior to the attacks as a result of extended supply cuts by the Organization of Petroleum Exporting Countries and its allies. As a result, the EIA raised its retail gasoline price forecast for this year by 20 cents to $3.50 a gallon on Tuesday.

oil prices jumped by $2.16 on Wednesday to settle at $79.72 a barrel, and rose $2.11 to $84.03 a barrel.

Read the full article here