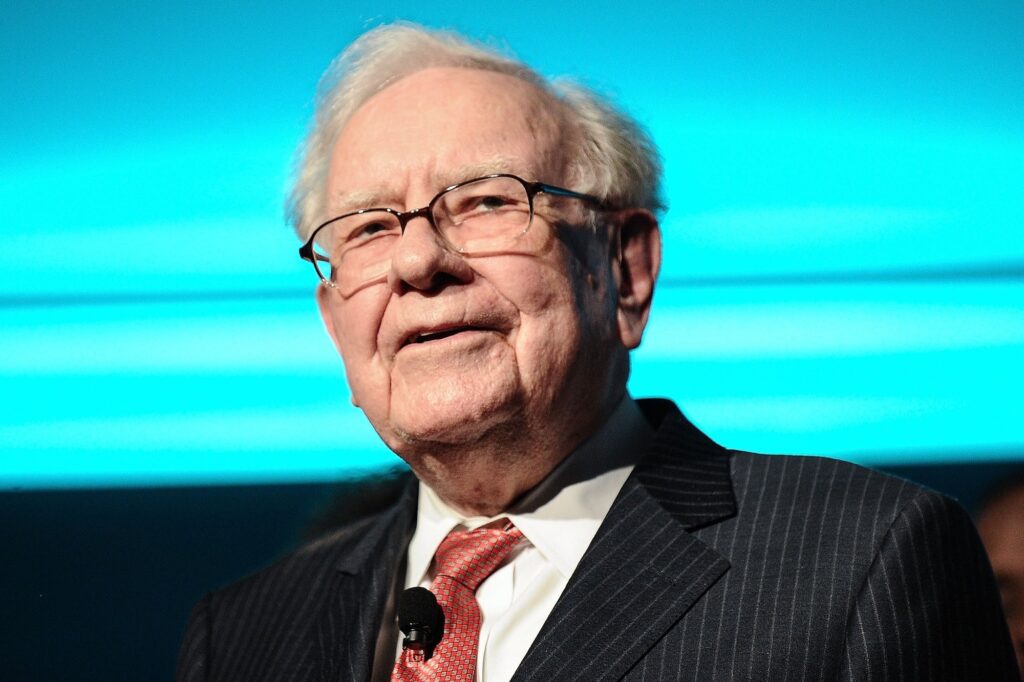

Warren Buffett’s Berkshire Hathaway has been mysteriously investing millions of dollars into an anonymous company for two quarters — but now, thanks to a new filing with the U.S. Securities and Exchange Commission, the mystery has been solved.

A Wednesday filing revealed that Berkshire has purchased 26 million shares of insurance company, Chubb, an estimated $6.7 billion stake.

The Swiss insurance giant was acquired by Ace Limited for $29.5 billion in 2016, combining the two companies under the Chubb name.

Chubb had an exceptionally strong Q1 2024, with net income up 13.3% to $2.14 billion and core operating income up 20.3% to $2.22 billion.

Related: ‘I’m Smarter Now…But Also Poorer’: Warren Buffett Says Berkshire Hathaway Ditched Its Entire Stake in Paramount at a Big Loss

“We began the year with a simply excellent quarter,” Chubb CEO Evan G. Greenberg said in an earnings release. “We produced double-digit premium revenue growth from across the globe with strong results in our commercial and consumer P&C and Asia life businesses.”

The investment has been kept under wraps for two quarters after Berkshire Hathaway was granted special permission to do so, something that the company has done previously after purchasing stock in Chevron and Verizon in 2020.

This isn’t Berkshire’s first major investment in insurance — the conglomerate owns 100% of Geico, National Indemnity, and Gen Re.

Earlier this month, Berkshire Hathaway held its annual shareholder meeting in Omaha, Nebraska, where Buffett revealed that the company had offloaded its entire stake in Paramount at a loss.

Related: Warren Buffett Learned A Lot About His iPhone This Week

“I was 100% responsible for the Paramount decision,” Buffett told attendees at the time. “It was 100% my decision, and we’ve sold it all, and we lost quite a bit of money. That happens in this business.”

Presumably, thanks to Buffett’s seal of approval, Chubb was up over 4.3% in a 24-hour period and over 32% in a one-year period as of Thursday morning.

Read the full article here