It’s not just the name:

BlackRock,

the world’s largest asset manager, has its roots in

Blackstone,

the world’s largest alternative investment manager. On the back of a multiyear boom in private equity and credit, it would make sense that the former wants to move closer to the business of the latter.

That came nearer to reality Friday. Alongside its fourth-quarter results,

BlackRock

announced that it had acquired Global Infrastructure Partners in a deal worth some $12.5 billion. Expected to close in the third quarter, the transaction comprises $3 billion in cash—which BlackRock intends to fund through debt—and 12 million shares of the company’s common stock, which closed at $792.61 on Thursday. BlackRock said that around 30% of the total consideration, all in stock, will be deferred and is expected to be issued in about five years.

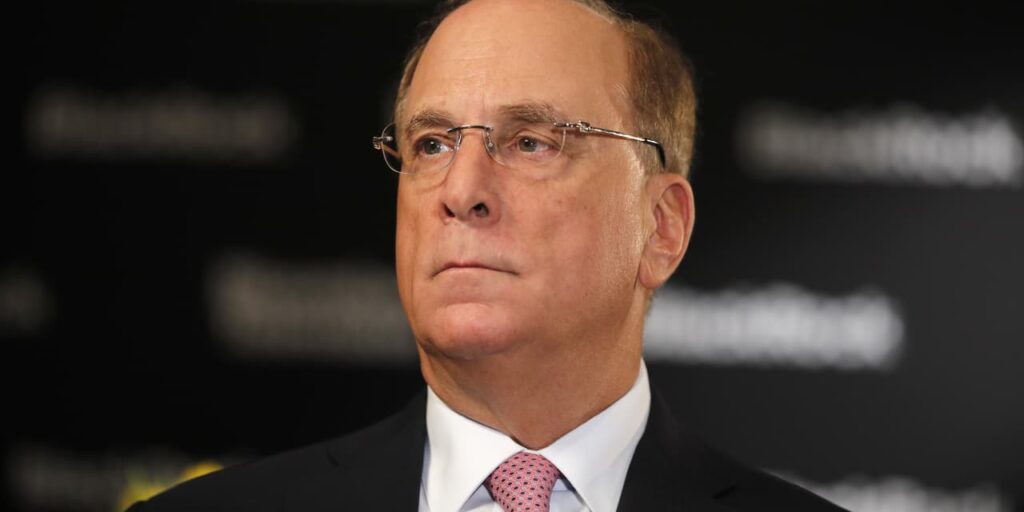

“We believe that the next 10 years is going to be a lot about infrastructure,” BlackRock Chairman and CEO Larry Fink said on a Friday morning conference call. Private capital will be needed to digitize power grids, fund renewable energy projects, and capture carbon from the air.

“Deficits matter,” Fink said. “More and more governments are going to have more difficulty finding deficit financing.”

GIP is one of the largest independent equity and debt fund managers focused on infrastructure, with more than $100 billion in client assets targeted toward energy, transport, water and waste, and digital infrastructure. Infrastructure is currently a $1 trillion market, BlackRock said, and is forecast to be one of the fastest-growing segments of private markets in the years ahead, supported by structural trends including upgrading digital infrastructure like telecoms.

“The combination of BlackRock infrastructure with GIP will make us the second-largest private markets infrastructure manager with over $150 billion in total [assets under management], providing clients … with the high-coupon, inflation-protected, long-duration investments they need,” Fink said in a statement. “This ambitious transformation of our firm positions us better than ever.”

The deal makes sense for BlackRock. It has produced billions in profit amid the explosion of investor interest in exchange-traded funds over the past two decades, a shift linked in turn to a rise in passive investment strategies. Much of the group’s assets under management—$3.5 trillion as of the end of 2023—sits in its ETF business.

But there recently has been speculation that passive investing has reached its peak. With so much of the world’s investment capital already sitting in ETFs—and BlackRock’s margins under pressure, as recent layoffs laid bare—the group would have faced questions of where to find the next era of profit growth.

The answer—private equity—should have been obvious amid the institutional mania over private markets this year, particularly private credit. BlackRock’s deal to buy GIP spells it out explicitly.

“Our marriage with BlackRock is a marriage made in heaven,” GIP Chairman Adebayo Ogunlesi told the Friday audience.

Write to Jack Denton at jack.denton@barrons.com

Read the full article here