I love franchising. This industry helps people achieve their dreams of business ownership. It helps founders scale their brands into national or international successes. It can be a pathway to personal satisfaction and financial freedom. To achieve all that, franchises must act responsibly — and the vast majority of them do. There are hundreds (or even thousands!) of brilliant, energetic, innovative, responsible brands.

But at the beginning of my career, I worked for a brand that was none of those things. It tortured me.

This was 2017, and I had taken a job in franchise sales, scaling a decades-old service business by signing up new franchisees. I was taught: If a prospective franchisee has $30,000 in the bank, try to sell them five units. Some of these people were in their 60s or 70s, only made $50,000 to $60,000 a year, and $30,000 was the only capital they had. This seemed odd to me, but I was new and didn’t ask questions. Later, I’d learn that these people rarely succeeded as franchisees. Many of them lost a lot of money. They blamed me, and sometimes cussed me out on the phone. (The company now has new owners, and the bad practices have stopped.)

As my career in franchising progressed, I gained a clearer understanding of what happened. Although most franchise brands are devoted to their customers and franchisees, some are just devoted to numbers — selling as many units as they can, no matter what. I also came to understand why this happens; it often starts with well-intentioned franchisors who don’t do their homework and get trapped trying to raise cash as fast as possible, and start working with consultants and salespeople who make the problem worse. This bad-acting minority can harm this industry’s reputation, which is tragic.

Related: Why Do Some Franchisees Crush It and Others Fail? It Comes Down to This Formula.

I knew there had to be a better way, so I went in search of it. I started talking to others in the industry, learning from leaders who do it right. After a few years, I became the franchisor for a 34-year-old residential and commercial power-washing company called Rolling Suds, where I put these best practices into place myself. Now I can say with confidence: When franchising is done right, it transforms lives for the better. I’ve seen it with my own eyes! That’s why I became so passionate about stopping irresponsible sales techniques, like the ones I was once forced to do.

Along with many like-minded peers, I decided to start talking about these solutions as simply a series of best practices. I want people to think of it as a movement — a movement called Responsible Franchising. I believe in this industry and the opportunities it presents, and I’m writing this article because of this passion. This text calls upon all stakeholders in the franchising industry to embrace this movement, and to actively and openly champion integrity, resilience, and sustainable growth. Most of you already do. I know that. But even a few bad actors can harm our entire industry’s reputation, which is why we must all speak up. That’s when everyone truly thrives.

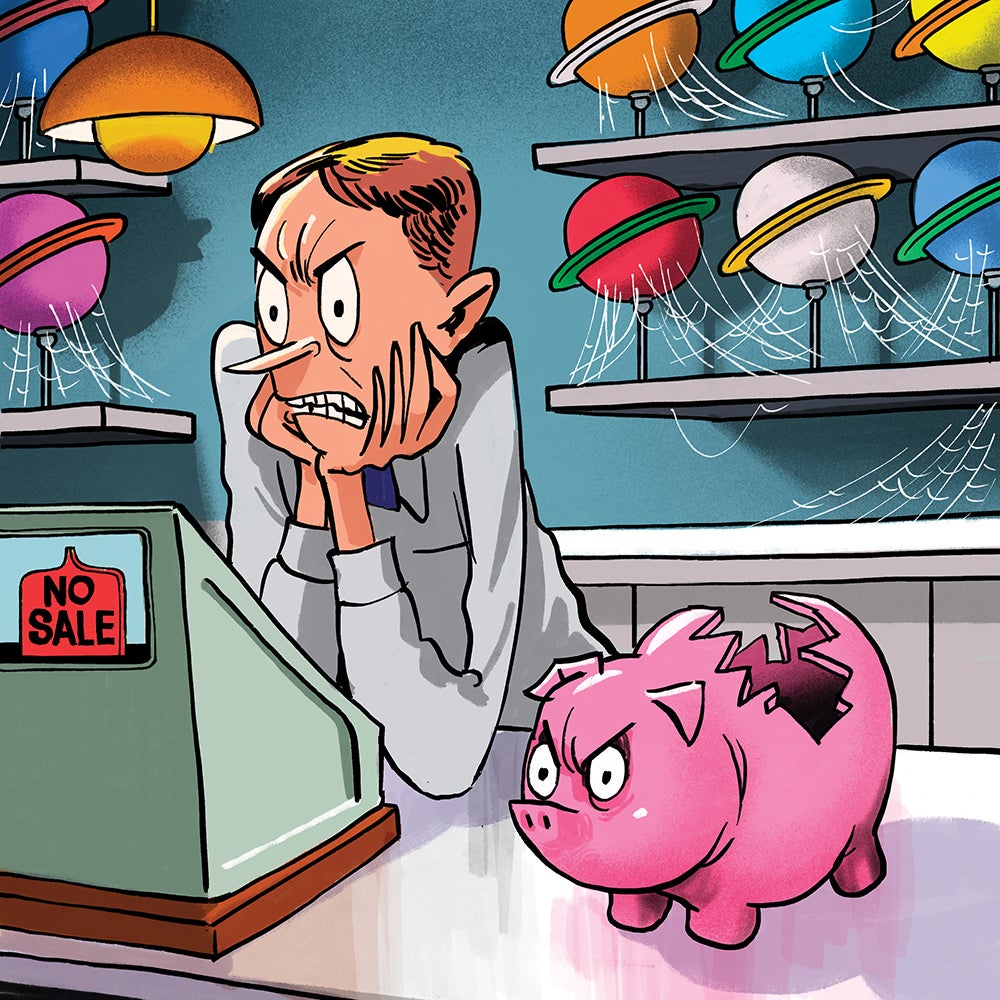

Image Credit: Zohar Lazar

The Problem

How did we get here?

When franchising boomed in the 1950s, bad actors and salespeople saw opportunity: They made unfounded promises to new franchisees, ultimately draining people of their savings in exchange for businesses that would never succeed. After many attempts at solving this problem, in 2008, the Federal Trade Commission stepped in with the Franchise Disclosure Document (FDD). Franchisors must legally produce this document, which provides prospective franchisees with the details of a franchise’s history, the fees involved, and the franchisee’s responsibilities. This way, prospective franchisees can see what they’re buying.

The FDD is great in many ways, but it contains a hole: The franchise can misrepresent the level of support it provides franchisees, or wrongly claim that a business can be run without much effort (or in sales lingo, it can be run “absentee” or “semi-absentee”). This is why most experts, including Entrepreneur magazine, always advise that prospective franchisees do their own research — looking at the FDD, yes, but also talking with (and even shadowing) current franchisees, and taking other actions to truly understand how a brand operates. That’s good advice. You’ll find the best brands that way.

Related: Measure Up to These 5 Standards and Watch Your Franchise Business Skyrocket

Now, here’s a question: Why would a franchisor misrepresent itself like this? Why tell people that a business can be run part time, if it’s not true? The answer is complicated — so to appreciate it, let’s imagine a new franchisor we’ll call Steve.

Steve built a local business, and now wants to franchise it. He doesn’t know much about franchising, so he hires lawyers and consultants to help. Those services are expensive — sometimes upward of $100,000 — and do not always fully prepare a franchisor for the costs and challenges ahead. By the time Steve’s franchise is created, he has little money left, and no idea how to find franchisees. Steve needs sales help, so he turns to the two kinds of organizations that help with sales — franchise sales organizations (FSOs) and franchise brokers.

FSOs are like a supercharged, outsourced sales team: They help franchises grow by taking over their sales efforts, selling the brand to prospective franchisees, and managing the sign-up process. Brokers are like career guides for prospective franchisees, helping a franchisee find the right brand for them. To be clear, FSOs and brokers don’t only work with newbies like Steve; they also help accelerate growth for established brands. Many of them are honorable, responsible, and truly committed to a franchise’s success. I’ve worked with many of them, and like them both personally and professionally. But some of them act irresponsibly. FSOs and brokers are paid in many ways, and a common way is to be paid for every sale they make — which means the more franchises they sell, the more money they make. You can see how, in the wrong hands, those incentives create problems.

I’ve seen all sorts of tricks. I saw one FSO promise to help emerging franchises sell more than 100 units in under two years, which is unsustainable for most new brands. I’ve also seen FSOs and brokers misrepresent or downplay the time commitment needed to open a unit, claiming that people can run it as a passive investment. That may be possible for a limited number of brands, but most franchises are full-time work.

Now we’ll return to Steve, our new franchisor. Let’s say he hires an overly aggressive FSO, and they sell his first 50 franchises. That sounds great — but FSOs are costly. Some charge high commissions for their sales; others take equity or a share of royalties. When Steve looks at the numbers, he broke even or lost money on those 50 sales. That means Steve can’t afford to build a team to support his new franchisees — and his franchisees may have been sold a totally wrong idea about how much work their business will take. Steve’s new franchise is on the brink of failure. He needs a way out.

So what happens next? Maybe Steve’s business goes under. Maybe he sells it. Or maybe Steve was never a well-intentioned franchisor to begin with — and in truth, he just wanted to pump up sales to raise his company’s valuation, so he could sell it quickly at a high price. After all, private equity has taken a strong interest in franchising and is actively buying or investing in early-stage franchises. Sometimes this works out well — the PE firm provides operational and strategic support, and the brand (and its franchisees) are stronger as a result. But sometimes it falls apart.

Related: 5 Reasons Social Responsibility Is a Step in the Right Direction for Small Business

The moral of the story is this: Because Steve didn’t do his homework, he got into franchising without understanding its costs. He sold a lot of franchise units, but his business was never healthy — and his franchisees didn’t get the experience they deserved.

This doesn’t just hurt Steve’s franchisees. It hurts all of us. People hear about a friend who bought a franchise and regretted it, and the industry’s reputation and trust is harmed. According to FRANdata, hundreds of new franchisees offer an FDD every year — and hundreds of them may stop after just one year. That’s an incredible amount of churn, and it is simply not sustainable.

But we can fix this. Here’s how.

Solutions

If you love franchising the way that I do, then I have good news: Franchising itself isn’t the problem; irresponsible sales and a lack of education are the problems. And those problems are solvable.

I’ve seen it myself. My first franchise sales job was a disaster, but my second job showed what change can look like.

The year was 2020, and I was leading growth at a different home services company. The company was recently acquired, and I’d been empowered to reshape its processes. I interviewed the current franchisees and discovered how little support they had. My team and I listened to their concerns, then built systems around training, coaching, marketing, and technology, and taught each franchisee how to recruit employees.

Instead of a typical seller-buyer relationship, I began working with each franchisee in a collaborative and transparent way from the first call to them opening their business. I turned away prospective franchisees who weren’t right for the system, and I was clear about the challenges they could face. The first franchisee who launched with the systems in place was seeing positive cash flow within the first month of operation. Over the next two years, I awarded 223 units to 83 franchisees. But more importantly: They all opened on time and were thriving.

What did I do to succeed? It wasn’t rocket science, and I certainly wasn’t the first or only one to do it. All I’d done was franchised responsibly — in the best interests of the franchisee. To succeed in this industry, both sides must be set up to win. The franchisor’s job is to create the system, and the franchisee’s job is to execute the system. Once I saw how powerful Responsible Franchising could be, I wanted to do it on my own. That’s why, in January 2023, I acquired the franchise rights to Rolling Suds, the power-washing business that I mentioned previously. We’ve now brought on over 40 franchisees and are in the process of opening more than 75 units in 25 states this year.

Related: 7 Strategies Businesses Can Use to Be Profitable and Sustainable

So what exactly does it mean to franchise responsibly? It starts in the franchise sales process and continues through supporting the franchisee. The sales arm and operations arm of the company must be totally aligned to ensure a positive experience for franchisees.

Here are the four core tenets of Responsible Franchising:

1. Set clear expectations.

I almost never sign on a prospective franchisee if they hope to only work part time. That’s simply not realistic for most business owners.

It’s better to clearly lay out what the franchisee can expect, how many hours they’ll likely devote to the business, and how much money they may spend before it becomes profitable. Franchising is a great model, but it is rarely a passive business, especially for first-time franchisees or emerging brands.

Many prospective franchisees have never owned a business before, so they don’t know how to hire and manage staff, secure a lease, or negotiate with suppliers. It’s up to the franchisor to train and support them.

2. Carefully determine capital adequacy.

Franchisors and franchisees can both underestimate the amount of capital required to be successful. That’s a mistake.

Here’s a data point about franchisees: Last year, Entrepreneur analyzed five years of data and found that franchisees with lower-cost franchise brands tended to fail more often. When the initial investment was between $15,000 and $25,000, the failure rate nearly doubled — going to 9.3%, compared to an average failure rate of 5% for people whose startup costs were higher than that. And I understand why. Lower-cost franchises can appeal to people on more limited budgets, who underestimate what it will cost to truly run their business.

Now here’s a data point for franchisors: Whatever you think it’ll cost you to start franchising your business, you may want to double that. Many factors can impact the amount of startup capital you’ll need, including the industry you’re entering, the amount of experience you have, the speed at which you want to grow, and endless outside factors from real estate (if you’re entering a brick-and-mortar business) to the cost of labor (if you need employees). And if you plan to work with an FSO, broker, or other third-party seller, make sure you have even more cash on hand. You’ll need it.

3. Choose the right franchisees.

At my first franchise sales job, there was a franchisee, a gentleman in his 60s, whom I still think about. I sold him five territories, and he had about $60,000 in the bank. When he went to training to learn how to use the equipment, he clearly wasn’t the right person to run this business. He didn’t seem engaged and struggled to operate the equipment. He ran the business for less than a month before it went under.

He should never have been sold that business.

A franchisor needs to know what type of person will be a successful franchisee, and only work with those kinds of people. At Rolling Suds, our ideal franchisees are business-savvy, outgoing people who are comfortable networking in their community and have a desire to build a big business. They have grit and determination, and they demonstrate behaviors that align with our core values, including living an honest life with integrity and purpose. They are compassionate and helpful to those around them. If someone doesn’t have these skills or values, they’re probably not a right fit. Sales and operations experience is less important, because I can teach those skills — but I can’t teach grit and compassion.

I find most of my franchisees through brokers — because as I said above, most brokers are wonderful and ethical people (even if some of their peers are bad actors). And ultimately, as a franchisor, it is my obligation to only accept franchisees who will succeed with my brand. I’ve turned away more than 50 people over the past year, even though they had enough capital. That works out to turning down about $10 million in revenue. It was the best money I’ll never make. Those prospective owners weren’t the right fit, and that’s all that matters.

4. Aim for sustainable growth.

While it’s tempting to sell 100 units in a year or two, that’s not a sustainable level of growth for most franchises. It’s important to only open the number of units that can reach profitability.

How does a franchisor determine the right pace? It’s all about how much capital is available, as well as the staff and infrastructure available to support the franchisees. If a franchise has one person on staff and only $200,000 in capital, it simply cannot support 100 units. Not even close. I advise any emerging brands to figure out exactly how much it will cost in infrastructure to get one unit open and profitable. They can back into that number based on the available capital, and only sell the number of units they can feasibly open.

Some people might look at my numbers of 40 new franchisees in one year at Rolling Suds and say I’m growing too fast. But I have a huge staff working for me, plus years of experience in the franchise industry and fully developed systems in place. I also consider the experience of the franchisee when I decide how many units to sell. I don’t award anyone more units than they can reasonably open.

Related: 10 Ways to Make Your Business More Socially Conscious

Image Credit: Zohar Lazar

That’s what Responsible Franchising is: Setting clear expectations, ensuring the right amount of capital for both the franchisee and franchisor, choosing the right franchisees who are prepared for the risks associated with running a business, and growing at a sustainable pace.

Like I wrote above: I don’t take credit for this strategy, nor do I think it’s exclusively mine. I know that most of my franchising peers also act this way. But as my career progressed, and I saw the power of Responsible Franchising, I became convinced that it is more than just a growth strategy. It must be a philosophy — written down, spoken about often, and with core principles that we can all adhere to, for the good of this industry and everyone who seeks to benefit from it. We must also shine a light on bad actors so we can change the landscape internally.

This is the reason I gave a keynote speech about this at the International Franchise Association Emerging Franchisor Conference, have written about it extensively, visit Capitol Hill every year to discuss this with lawmakers, plan to launch a podcast soon, and am now writing this declaration for you to read. I want to accelerate this movement of Responsible Franchising. Joining the movement is simple: If you are in franchising, and if you franchise responsibly, then you’re in! Now it’s time to help others act responsibly too. If we are to succeed as an industry, and to fulfill our true mission of creating economic opportunity for those who believe in us, then we must franchise responsibly.

If we do not, the consequences can be larger than anyone thinks.

Related: 6 Ways to Build Sustainable Principles Into Your Business

What Happens If We Don’t Act

Recently, lawsuits have reverberated throughout the industry. In one case, multiple franchisees sued a brand that worked with an FSO to sell them their units. In their claims, the franchisees say they were told their business could be profitable with minimal effort — taking far fewer hours and making much more money than was possible.

The government is clearly watching the franchise industry. Last year, the National Labor Relations Board changed a rule called “joint employer” that could have made franchisors jointly responsible for a franchisee’s employees. It was struck down in court, but the effort shows you what regulators are thinking. And last year, the U.S. Government Accountability Office issued a report recommending changes to franchise disclosure practices — pushing for more education and outreach.

The threat of lawsuits and regulation will hopefully motivate change, but the franchising industry can also do more to hold itself accountable. For example, the IFA endorsed a bill in California to increase regulation of FSOs and brokers, as well as provide more disclosure to prospective franchisees. Next, let’s ask: Should there be state-mandated licensing for FSOs, brokers, and other third-party sales advisors? Should emerging franchisors have to complete a standardized licensing course before they can begin franchising, to ensure that they know exactly what they are getting themselves into? I think the answer to all of these is yes, but I want the industry to discuss!

This issue is resonating across the industry. When I give talks about Responsible Franchising, people approach me afterward to thank me. Employees who work at irresponsible franchise companies are reaching out to me, seeking work with a franchisor that operates responsibly. They tell me they can’t sleep at night with some of the things they are seeing. Franchisors and industry leaders are rallying behind this. Matt Haller, the president and CEO of the IFA, now speaks about it regularly.

I’ve said it before, and I’ll say it forever: When done responsibly, franchising is truly a great business model — and there’s plenty of money to be made without any misleading sales tactics or unsustainable growth. I don’t think there’s a quicker way for a person to generate wealth than to find the right brand and execute it. Investing $150,000 in the stock market will almost never generate the same return as investing $150,000 into a successful and responsible brand. It’s a win-win. And if we prioritize the success of franchisees, that’s how it will stay.

Related: These 3 Critical Factors Determine Whether Franchisees From the Same Brand Will Flourish or Flounder

Read the full article here