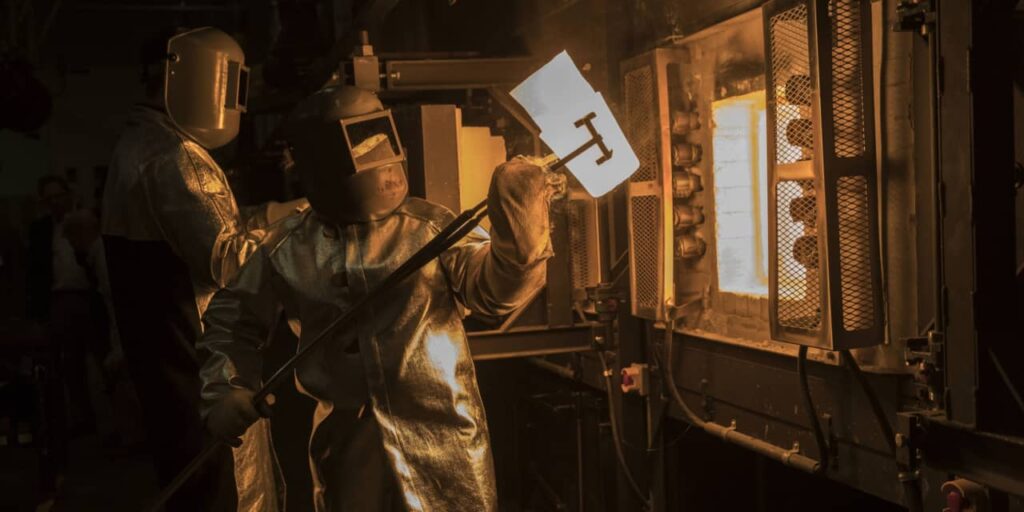

Corning

stock jumped Tuesday after the specialty glassmaker provided an upbeat outlook for 2024 for its key end markets, like flat-panel displays and optical communications.

Corning

shares spiked 6% higher to $33.05 in recent trading.

Corning has been seeing weakness in most of its markets in recent months, but it expects better performance as 2024 rolls on.

“We continue to make solid progress advancing our market leadership, strengthening our profitability, and improving our cash-flow generation even in the lower-demand environment we’ve experienced,” CEO Wendell Weeks said in a statement. “We are entering 2024 operationally strong, and we have an opportunity to increase our sales by more than $3 billion in the medium term as our markets normalize.”

The company said it expects the 2024 first quarter to be the weakest of the year. Corning sees core sales of $3.1 billion for the period—a smidgen below the Street consensus of $3.17 billion as tracked by FactSet. It forecasts first-quarter earnings of 32 to 38 cents a share; the midpoint of that range falls short of the Street consensus at 38 cents a share.

As for the fourth quarter, Corning posted core revenue of $3.3 billion, down 5% from a year earlier but in line with consensus estimates.

Adjusted earnings were 39 cents a share for the period, likewise matching Wall Street expectations. Under generally accepted accounting principles, sales were $3 billion, down 6% year over year, and the company lost 5 cents a share.

For the full year 2023, Corning posted core sales of $13.6 billion, down 8%, with adjusted profits of $1.70 a share.

Display technologies sales—mostly for flat-screen TVs—were $869 million, up 11% from a year ago, but down 11% sequentially. Corning sees glass volumes at retail up in the mid-single digits, in percentage terms, in 2024.

Optical communications sales in the quarter were $903 million, down 24% from a year ago. The company said that business has been hurt by telecommunications carriers drawing down inventory, but adds that the long-term opportunity remains strong, given growth drivers like artificial intelligence and cloud computing.

The company’s specialty materials segment, which includes smartphone cover glass, had revenue of $473 million, down 6% from a year ago. The environmental technologies segment, which includes automobile pollution control products, had sales of $429 million in the quarter, up 9%, but off 4% sequentially.

Write to Eric J. Savitz at eric.savitz@barrons.com

Read the full article here