The Securities and Exchange Commission (SEC) announced charges on Monday against famed 88-year-old investor Carl Icahn and his public company Icahn Enterprises L.P. (IEP), stating that Icahn pledged 51% to 82% of IEP shares to secure billions in personal loans without telling shareholders or regulators for years.

The SEC claimed that IEP and Icahn didn’t disclose information about the pledges on time, delaying from at least 2018 to 2022. Icahn also didn’t file the required amendments and agreements from at least 2005 to 2023, the agency stated.

Icahn and IEP did not admit to the findings or deny them, but they did settle the charges for $500,000 and $1.5 million, respectively.

The SEC said that without the proper paperwork, “existing and prospective investors were deprived of required information.”

“The federal securities laws imposed independent disclosure obligations on both Icahn and IEP,” Osman Nawaz, Chief of the SEC Enforcement Division’s Complex Financial Instruments Unit (CFIU), stated in a press release. “These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time.”

Related: Invested in the U.S. Stock Market? A New Lawsuit Alleges a Government Agency May Have Illegally Collected and Stored Your Data

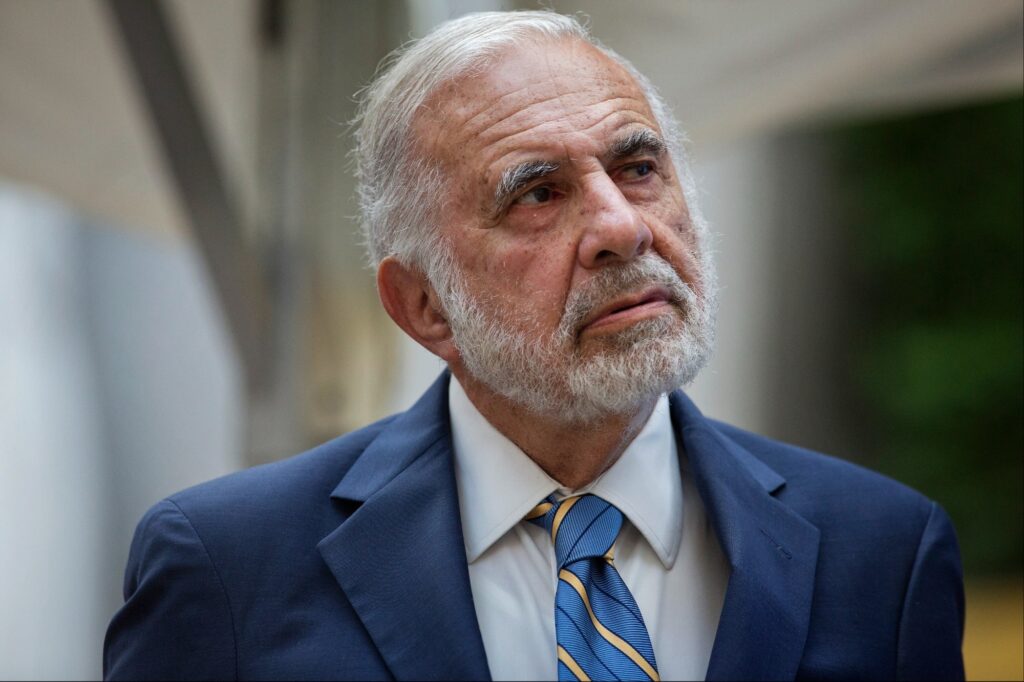

Carl Icahn. Photographer: Victor J. Blue/Bloomberg via Getty Images

Icahn, who is worth over $6 billion according to the Bloomberg Billionaires Index, owns over 90% of IEP. The term “Icahn Lift” was named after him and refers to the increase in investor confidence and stock price that happens when Icahn invests in a company or becomes involved with it.

IEP made up over half of his investing portfolio weight as of the end of Q1 2024.

Related: Billionaires Warren Buffett, Bill Gates, Jeff Bezos and Mark Zuckerberg Have 3 Habits for Success in Common — But Very Different Routines. Which One Resembles Yours?

Read the full article here