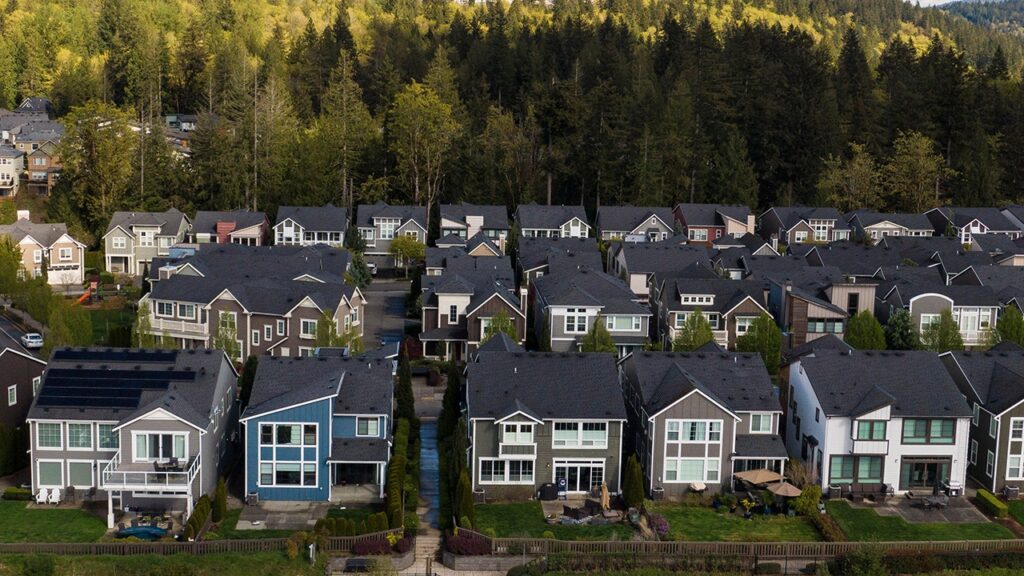

Home prices reached a new record in April amid an ongoing housing shortage, even as high mortgage rates pushed affordability out of reach for more Americans.

Prices increased 6.3% nationally in April when compared with the previous year, the S&P CoreLogic Case-Shiller index showed on Tuesday, down from the 8.3% pace recorded the previous month.

On a monthly basis, prices climbed 0.3%, according to the index.

“For the second consecutive month, we’ve seen our national index jump at least 1% over its previous all-time high,” said Brian Luke, head of commodities, real and digital assets at S&P DJI, in a release. “Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.”

MORTGAGE CALCULATOR: SEE HOW MUCH HIGHER RATES COULD COST YOU

The 10-city composite, which encompasses Los Angeles, Miami and New York, rose 8% annually, compared with an increase of 8.3% in March. The 20-city composite, which also tracks housing prices in Dallas and Seattle, posted an annual gain of 7.2%, which also marks an increase from the 7.5% figure recorded the previous month.

Prices rose in about half of the 20 major metro markets tracked by the index.

“Last month’s all-time high came with all 20 markets accelerating price gains,” Luke said. “This month, just over half of our markets are seeing prices accelerate on a monthly basis.”

The largest price gain once again took place in San Diego, which recorded a year-over-year increase of 10.3%. It was followed by New York and Chicago, with respective gains of 9.4% and 8.7%.

WHY CAN’T YOU FIND A HOME FOR SALE?

Portland, Ore., saw the smallest gain in April, with home prices climbing just 1.7% from the prior year.

The Case-Shiller index reports with a two-month delay, meaning it may not capture the latest ongoings in the market.

There are a number of driving forces behind the affordability crisis. Years of underbuilding fueled a shortage of homes in the country, a problem that was later exacerbated by the rapid rise in mortgage rates and expensive construction materials.

Higher mortgage rates over the past three years have also created a “golden handcuff” effect in the housing market. Sellers who locked in a record-low mortgage rate of 3% or less during the pandemic began have been reluctant to sell, limiting supply further and leaving few options for eager would-be buyers.

Economists predict that mortgage rates will remain elevated in 2024 and that they will only begin to fall once the Federal Reserve starts cutting rates. Even then, rates are unlikely to return to the lows seen during the pandemic.

Read the full article here