Mortgage rates jumped to the highest level this year, throttling demand among would-be buyers and putting more pressure on the already beleaguered housing market.

Mortgage buyer Freddie Mac said Thursday that the average rate on a 30-year loan this week crossed the 7% threshold for the first time this year, jumping from 6.88% to 7.1%. While that is down from a peak of 7.79% in the fall, it remains sharply higher than the pandemic-era lows of just 3%.

“It seems increasingly likely that mortgage rates are not going to come down any time soon,” said Lisa Sturtevant, Bright MLS chief economist. “We are likely to see rates close to 7% throughout the spring, and in the mid- to high-6s into the summer.”

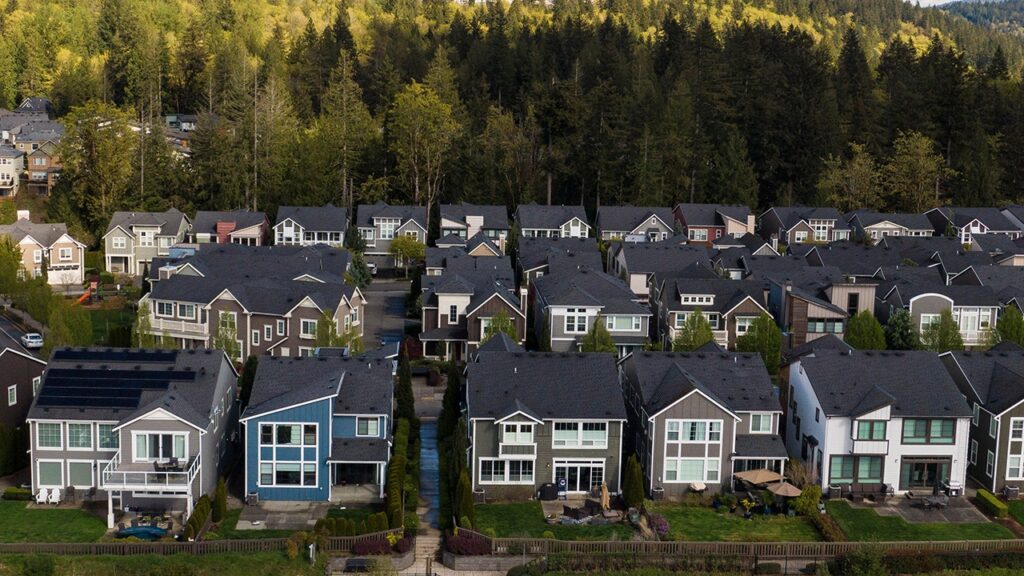

MORTGAGE RATES OVER 7% ARE THROTTLING HOMEBUYER DEMAND

Below, you can calculate how volatile increases and decreases in rates could affect the typical cost of a monthly mortgage.

Even just a minor change in rates can affect how much would-be homebuyers pay each month.

A recent study by LendingTree compared the average monthly payments on 30-year fixed-rate mortgages in April 2022 – when the rate hovered around 3.79% – and one year later, when rates jumped to 5.25%.

WHY CAN’T YOU FIND A HOME FOR SALE?

It found that higher rates cost borrowers hundreds more each month and potentially added as much as $75,000 over the lifetime of the 30-year loan.

In fact, recent findings from Redfin show the combination of steep mortgage rates and elevated home prices has pushed the median monthly housing payment to $2,775 – an 11% increase from the same time last year and the highest level on record.

There are a number of driving forces behind the affordability crisis. Years of underbuilding fueled a shortage of homes in the country, a problem that was later exacerbated by the rapid rise in mortgage rates and expensive construction materials.

Higher mortgage rates over the past three years have also created a “golden handcuff” effect in the housing market. Sellers who locked in a record-low mortgage rate of 3% or less during the pandemic began have been reluctant to sell, limiting supply further and leaving few options for eager would-be buyers.

Economists predict that mortgage rates will remain elevated for the first half of 2024 and that they will only begin to fall once the Federal Reserve starts cutting rates.

Even then, rates are unlikely to return to the lows seen during the pandemic. On top of that, investors are growing skeptical about the odds of a Fed rate hike this year given the string of hotter-than-expected inflation reports at the beginning of the year.

Most homeowners say they are nearly twice as willing to sell their home if their mortgage rate is 5% or higher, according to a separate Zillow survey. Currently, about 80% of mortgage holders have a rate below 5%.

Read the full article here