Performance Assessment

Last year, I was bullish on the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) relative to the Schwab U.S. Dividend Equity ETF (SCHD). This view played out for the most part, however in December 2023, the alpha created by JEPI relative to SCHD was nullified to close to 0 as there was a reversal in the pair trade. I have discussed more details on this performance in my latest article on SCHD.

By the way, please note that my stance on SCHD has changed to a ‘Neutral/Hold’, which I have expressed in a pinned comment.

Now, in this article, I analyze JEPI as an investment option, particularly compared to the S&P 500 (SPY) (SPX), which is my personal benchmark. If you are a yield-focused investor, your benchmark may be slightly different, however, I think the analysis is relevant even if you are a yield-focused investor.

Downgrading JEPI to a ‘Sell’

I am downgrading JEPI to a ‘Sell’ as I believe it will underperform the S&P 500. To get into the reasons, let’s first examine the net exposure profile of JEPI vs SPY.

Anticipating a common question; I prefer JEPI to SCHD. This article and my last piece on SCHD would highlight why.

Analyzing net exposures of JEPI vs SPY

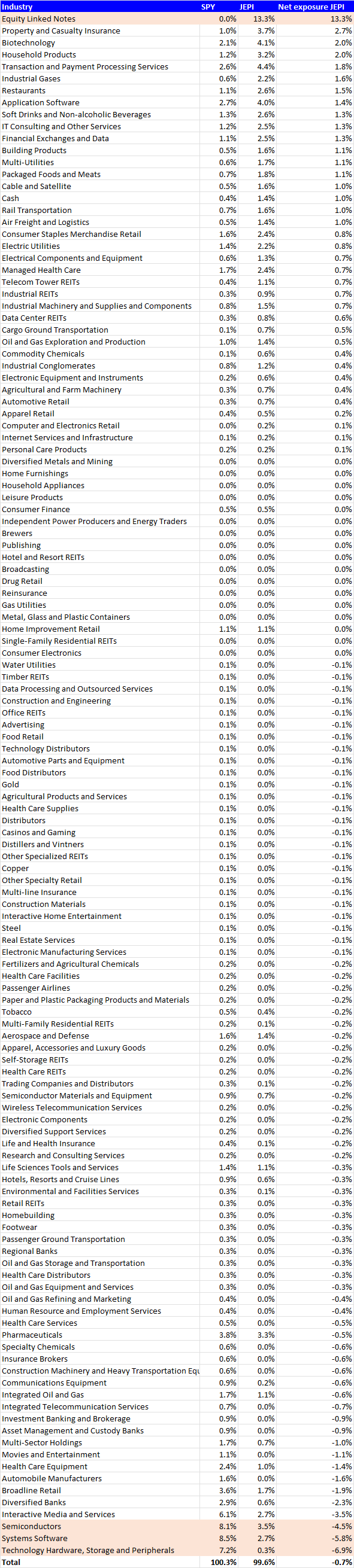

The table below shows the net industry exposures of JEPI vs SPY. I’ve highlighted the largest variances that I will discuss further:

JEPI Net Industry Exposure vs SPY (JEPI, SPY Websites, Author’s Analysis)

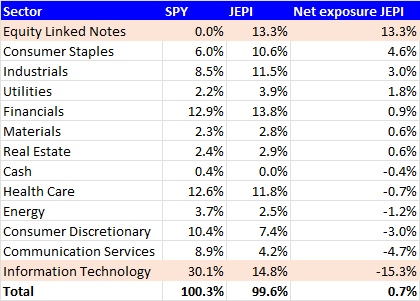

Let’s also take note of the net sector exposure of JEPI vs SPY:

JEPI Net Sector Exposure vs SPY (JEPI, SPY Websites, Author’s Analysis)

I draw my thesis for SPY preference over JEPI from this net exposure data. So do refer back to it as we go through the exposure preferences:

Information Technology Underweight is Unfavorable

At an industry sector level, JEPI’s 15.3% underweight in Information Technology vs the SPY is the most conspicuous observation. Digging into this further, we can split the underweight into 2 broad categories:

Systems Software

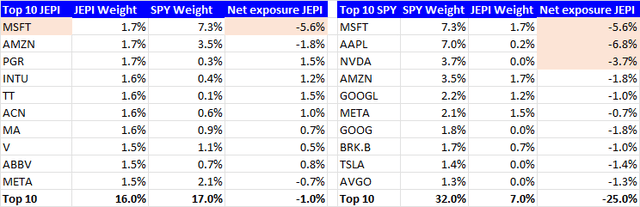

JEPI has a 5.8% underweight in Systems Software vs the S&P 500. Looking at the top 10 exposure differentials in JEPI and the SPY, it is clear that JEPI’s 5.6% relative underrepresentation of Microsoft (MSFT) is a major reason for this variance:

Top 10 JEPI vs SPY Exposure Differentials (JEPI, SPY Websites, Author’s Analysis)

I have a bullish outlook on Microsoft as I think it has a lot of growth tailwinds in the most significant parts of its portfolio, a clear roadmap for improving the quality of revenues and margin expansion, as well as a strong case for beating consensus estimates in the Q2 FY24 results release next week. I have discussed this thesis in more detail here. Given this optimism on Microsoft, naturally, I believe an underweight in it is unfavorable for JEPI.

Semiconductors and Technology Hardware

JEPI has a total of 11.4% underweight in the semiconductor and technology hardware industries. When looking at the top 10 holding comparisons, Apple (AAPL) and NVIDIA (NVDA) contribute 10.5% of the overall 11.4% underweight in these categories. Given the AI chip shortages in the current environment and how that is constructive for chips pricing, I think NVIDIA has a healthy growth tailwind behind it right now. Recently, leading semiconductor equipment manufacturer ASML (ASML) (OTCPK:ASMLF) reported that orders have tripled. This indicates that semiconductor foundries are undergoing capacity expansion to alleviate the current chip shortages. I think this is bullish for semiconductors more broadly and that includes NVIDIA. Indeed, Wall St analysts expect upside in virtually all semiconductor names. Seeking Alpha analysts have a bit of a mixed view on NVIDIA; however Wall St analysts are all extremely bullish given the prevalence of ‘Strong Buys’:

NVIDIA Ratings by Seeking Alpha and Wall St Analysts (Seeking Alpha)

I lean more towards Wall St’s sentiments for NVIDIA. I will be sharing details on why in an upcoming piece. However, the bottom line is that I think JEPI’s underweight in NVIDIA is more likely to be a drag on relative performance vs the S&P 500.

On Apple, I have a less strong view. However, I did find LEL Investment LLC’s case for AI-powered product growth catalysts in 2024 to be convincing. Hence, I have a moderate bullish slant on Apple too, which is why I view JEPI’s underweight in the stock to be unfavorable.

Now I can imagine some of you may be thinking:

Wait a minute… in the last SCHD article, you said Systems Software and Information Technology underweights were favorable due to their higher valuations. Now, you’re saying these underweights are favorable. What gives?

I believe it was a mistake to make a case against something purely based on valuations and without any regard for business momentum. Such lines of thinking are dangerous as the market often disrespects optically higher valuations as it favors bullish operating signals a lot more. Also, AI-led product opportunities are opening up many promising growth avenues that extend beyond the 1-yr horizon captured in 1-yr fwd PE multiples. Hence, a DCF valuation penciling in the growth opportunities over a longer period of time is arguably a better way to estimate valuations. This is what I realized and did in my recent analysis of Microsoft.

Ultimately, my chance in stance in SCHD from bullish to ‘neutral’ is also due to this realization that seemingly high 1-yr fwd PE valuations alone without any regard for the operating growth and margin momentum may not be the best method of assessment.

JEPI’s covered call strategy won’t fare well if SPY is seeing a genuine breakout above ATHs

The goal of the JEPI ETF is to generate income with less volatility by selling covered calls, particularly in OTM options. It aims to deliver returns associated with S&P 500, but with less volatility. JEPI executes the covered call tactics via equity-linked notes (ELN), which make up 13.3% of the portfolio. Now this tactic does not fare well when the underlying S&P 500 index goes up. As noted in JEPI’s prospectus:

When the Fund sells call options within an ELN, it receives cash but limits its opportunity to profit from an increase in the market value of the underlying instrument [S&P500] to the exercise price

– Risk of JEPI’s ELN covered call strategy as outlined in the prospectus, Author’s bolded highlights

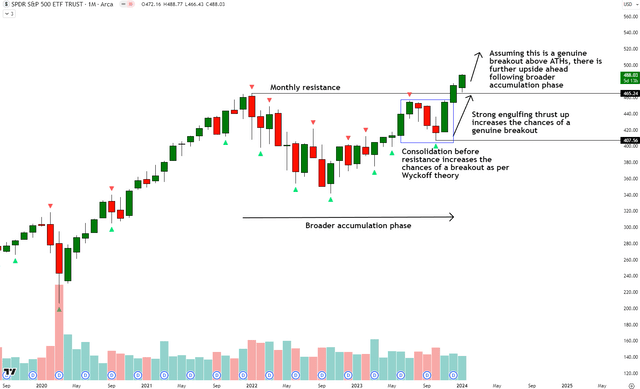

I anticipate this very opportunity for profit to be dragged back for JEPI going ahead because from a technical analysis perspective, I think we have a genuine breakout above all-time-highs (ATHs) in the S&P 500, suggesting further upside ahead:

SPY Technical Analysis (TradingView, Author’s Analysis)

In my technical read of SPY, I believe we are posting a genuine breakout above the ATHs. I view the consolidation before the monthly ATH resistance as a sign of buildup before the breakout; in my experience, this signature when accompanied by strong engulfing thrusts up (which we also have here) increases the chances of a genuine breakout move up. As we are very early into the breakout following a broader accumulation phase, I believe there is further upside ahead.

Valuation

JEPI is trading at a 1-yr fwd PE of 24.37x, which is basically the same as SPY’s 24.58x. Hence my takeaway here is that JEPI has relatively unfavorable portfolio exposure without any meaningful valuation discount to compensate.

Key Risks and Monitorables

At its core, my thesis is largely based on the idea that JEPI’s underexposure to Microsoft, Apple, and NVIDIA is unfavorable. Naturally, the earnings releases of these 3 companies would be a very key monitorable and risk factor that can play spoilsport to my view of JEPI’s underperformance vs the S&P 500. I have recently published an analysis of Microsoft, which discusses why I am expecting revenue and margin beats over consensus estimates.

Takeaway and Positioning

Overall, JEPI is an ETF that has the same valuation as the S&P 500, but with the disadvantages of underexposure to software, semiconductor, and technology names, particularly Microsoft, NVIDIA, and Apple. I believe this is a disadvantage as I am bullish on Microsoft, which I think will continue its AI-led product supremacy, bolstering the quality of its revenue profile and enjoying margin expansion along the way. I think NVIDIA is poised well to benefit from a shortage in chips used in AI applications; bullish order intake by semiconductor equipment manufacturer ASML supports this view. And for Apple, I have a relatively less strong view, but I did find a fellow Seeking Alpha Analyst’s note on Apple’s growth catalysts in 2024 to be convincing.

Also, from my read of the technicals, the SPY is posting a genuine breakout above all-time highs, suggesting further upside ahead following a 2-year accumulation period. This does not bode well for 13.3% of JEPI’s portfolio, which is dedicated to writing covered calls as that tactic is a money-loser in rising markets.

Personally, I prefer to be invested in the Vanguard S&P 500 ETF (VOO). For yield-focused investors, given my bullish outlook on private equity and alternative asset managers, I think the Invesco Global Listed Private Equity ETF (PSP) is a better option that has greater chances of outperforming the S&P 500. Among individual names, I like Brookfield Asset Management (BAM) and hold it in my portfolio.

Rating: ‘Sell’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher-than-usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher-than-usual confidence

The typical time horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Read the full article here