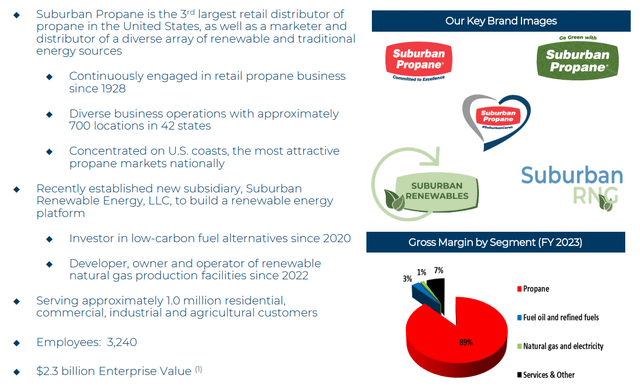

Suburban Propane Partners, L.P. (NYSE:SPH) is a New Jersey-based nationwide marketer and distributor of retail propane, natural gas, refined fuels, and electricity products.

Wells Fargo Midstream and Utilities Symposium

Through these actions, in the past quarter, SPH has recorded revenues of $226.60mn, down 4.64% YoY, alongside a net income of $20.86mn, a 61.49% increase, and a free cash flow of $46.28mn, an increase of 20.65%, driven by rising operating and investing cash flows.

Introduction

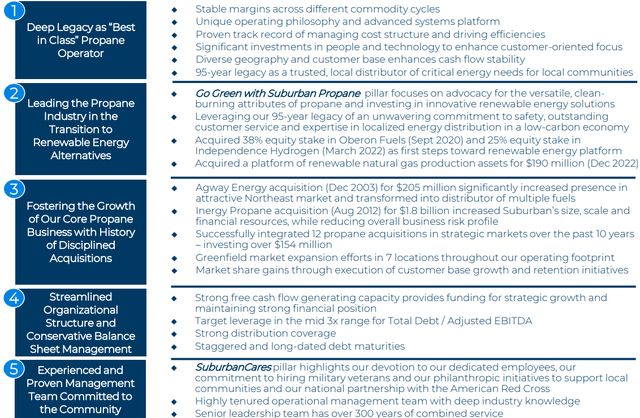

At its core, the majority of SPH’s revenues are still derived from retail propane products. While this segment remains a pillar of SPH’s future, SPH aims to capitalize on its fivefold strategy, pushing towards a more diversified and stable portfolio.

This fivefold strategy includes the perpetuation of stable margins and cash flows through its propane verticals, the expansion of renewable energy alternatives for retail fuel products, continued inorganic growth through opportunistic, value-oriented acquisitions, a well-managed expense base, and experienced management with a holistic and shareholder-value-orientation.

Wells Fargo Midstream and Utilities Symposium

Due to SPH’s strategic strength, alongside a general undervaluation and underpriced growth capabilities, I thus rate SPH a ‘buy’.

Valuation & Financials

Trailing Year Performance

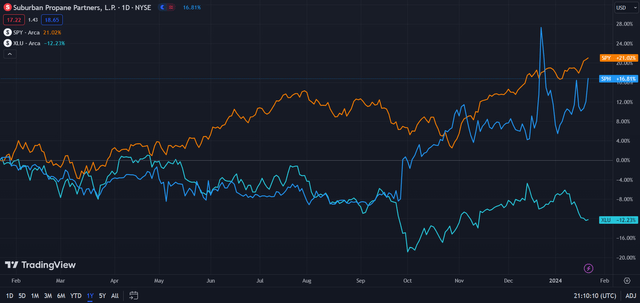

In the TTM period, SPH’s stock, up 16.81%, has seen middling growth between the utility industry, as represented by the Utilities Select Sector SPDR Fund (XLU), down 12.27%, and the wider market, as represented by the S&P 500 (SPY), up 21.02%.

Suburban Propane (Dark Blue) vs Industry & Market (TradingView)

Although SPH’s unique position in the retail propane industry reduces our ability to compare it to other utilities, which disproportionately suffered from the rising cost of capital, it also highlights the firm’s unique pricing and production capabilities and ability to respond to macro demand dynamics, thus enabling long-run growth.

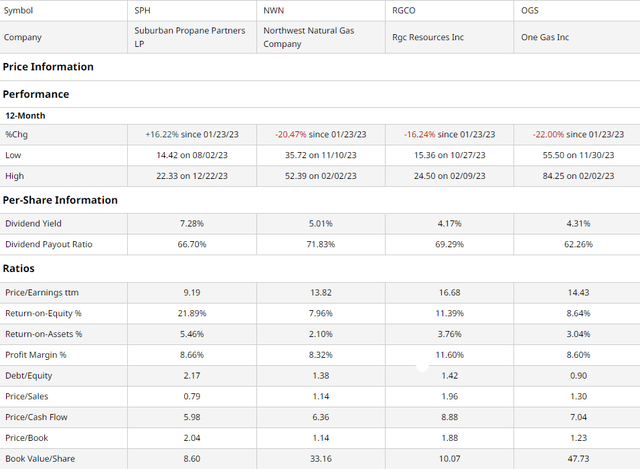

Comparable Companies

Although SPH, as the leader in propane retailing rather than other gas segments, cannot be adequately compared to many of its peers as defined by Seeking Alpha’s ‘Peers’ tab for the stock, SPH is most comparable to these similarly-sized natural gas firms. This group includes the Portland, Oregon-based natural gas utility, the Northwest Natural Gas Company (NWN), the Roanoke, Virginia-based gas distributor, RGC Resources (RGCO), and the Tulsa, Oklahoma-based natural gas firm, ONE Gas (OGS).

Barchart.com

As demonstrated above, SPH has experienced the best-in-class price action over the TTM period. Despite this, I believe SPH is poised to offer investors the best returns in the peer group, both when assessing multiples-based value and growth capabilities.

For instance, SPH maintains the lowest trailing P/E ratio of the group, in addition to the lowest P/S, and the lowest P/CF, demonstrating strength across both the income and cash flow statements.

In terms of growth, SPH retains the highest ROE and ROA.

However, SPH does have the poorest debt/equity levels and book value per share, representing the company’s costly endeavors relating to its expansion into utilities.

Valuation

According to my discounted cash flow valuation, the net present value of SPH, at its base case, should be $19.12, meaning, that at its current price of $18.52, the stock is undervalued by ~3%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 10%, reflecting the higher cost of SPH’s debt-heavy cap structure. Additionally, more liberally, I estimated a forward 5Y average growth rate of ~5%, higher than the trailing 5Y arithmetic average of 1.94% due to the volatile effects of COVID-19, the Russian Invasion of Ukraine, and subsequent price pressures and rate increases.

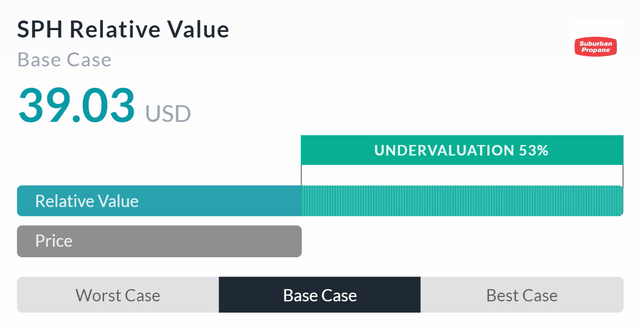

Alpha Spread

On the other hand, Alpha Spread’s multiples-based relative valuation tool is much more optimistic than I am, projecting a base case relative value of $39.03, representing an undervaluation of 53%.

However, Alpha Spread fails to discount SPH’s 7.28% dividend and its debt load from its valuation and therefore over-exaggerates SPH’s value.

As such, taking a weighted average heavier towards my NPV and lighter towards Alpha Spread’s relative value, the fair value of SPH should be $22.61, an ~18% undervaluation.

Leadership in Propane is Enhanced by Geographic Growth

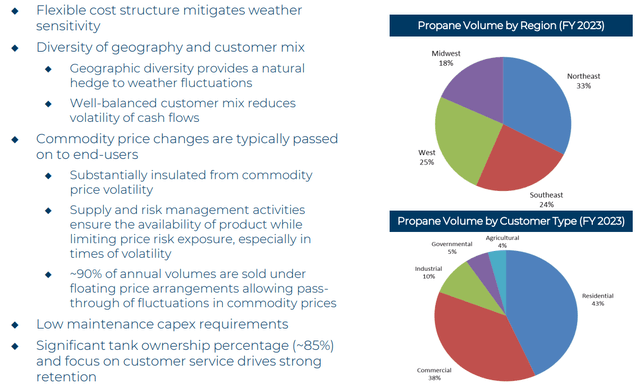

A core tenet of SPH’s value proposition remains their highly diverse, yet flexible, cash flow mix; SPH is able to effectively mitigate weather or customer-related risks while passing on price input volatility to consumers. Additionally, with SPH’s streamlined approach, it’s able to ensure low capex requirements and greater control over its assets.

Wells Fargo Midstream and Utilities Symposium

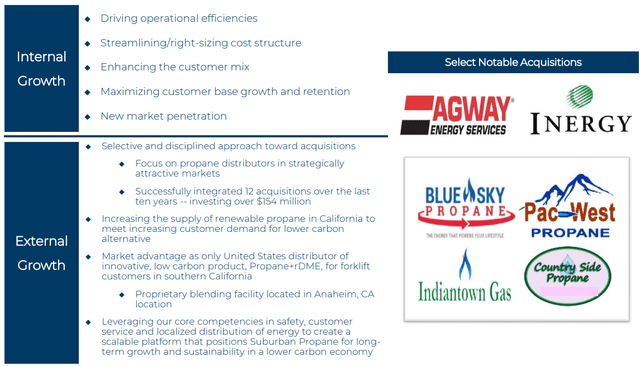

To this end, SPH has developed dual internal and external growth strategies. Promoting organic growth along existing verticals, SPH has dedicated itself to finding operational efficiencies, streamlining its cost structure for maximum efficiency, diversifying and expanding its customer base, retaining existing consumers and extracting greater value from them, and growing geographically and into different laterals. On a more inorganic level, SPH commits to disciplined, accretive acquisitions to expand its geographic and segmented footprint. Moreover, SPH is better able to comply with regulatory pressures with its foray into renewable propane, driven by its acquisitions.

Wells Fargo Midstream and Utilities Symposium

Wall Street Consensus

Analysts are more pessimistic about SPH than me, estimating an average 1Y price target of $16.50, representing an 11.39% decline.

TradingView

However, Wall Street sees a minimal deviation from the average to the minimum projected price target of $16.00- a 14.07% decline. I believe analysts are overly negative on the stock, overestimating the effect of debt alongside the positive effect of M&A discussion on the stock price.

Risks & Challenges

Higher Cost of Capital May Compress Margins, Growth

As previously discussed, SPH maintains a disproportionately high debt/equity ratio, thus exposing it to costs associated with rising or sticky interest rates. Thus, higher interest rates would reduce both SPH’s current profitability and ability to reinvest. Additionally, with a retail focus, demand dynamics for propane are much more elastic than comparable natural gas companies and thus would see compressed revenue growth.

Increased Compliance Costs May Inhibit Growth

Although SPH has extensively worked towards addressing its carbon footprint, leading in the renewable propane segment, the company nonetheless is constrained by potential regulatory pressures and may see limits to growth acceleration to adequately comply with climate and scale-related compliance.

Conclusion

Looking forward, I believe SPH is poised to deliver strong income and likely price appreciation with a strong strategic base and moderate undervaluation.

Read the full article here