We have documented substantial gaps in valuation between REIT property sectors. Some of the gaps are warranted by fundamental strength or weakness, while others represent mispricing. In our previous article, we discussed the REIT sectors trading at premiums, and in this post, we will discuss the discounted REIT sectors.

As a reminder, here are the average (unweighted mean) AFFO multiples of each REIT sector.

- Hotel – 10.6X AFFO

- Diversified – 13.8X AFFO

- Office – 14.5X AFFO

- Healthcare – 14.9X AFFO

- Retail – 16.7X AFFO

- Tower – 18.2X AFFO

- Apartments – 18.9X AFFO

- Industrial – 20.0X AFFO

- Storage – 20.4X AFFO

- Manufactured Housing – 21.6X AFFO

- Single Family Rental – 21.7X AFFO

- Data Center – 24.37X AFFO

- Timber – 27.4X AFFO

- Farmland – 39.23X AFFO

Many of the cheap sectors are cheap for a reason, but a few slipped through the cracks. We attempt to sift through the rubble by analyzing fundamental strength relative to what is implied by trading multiples.

Given prevailing market multiples and where interest rates are today, we can infer what the market is anticipating from a given sector based on its multiple. The lower the multiple, the less growth a company needs to generate a market return.

- 8X-11X AFFO multiples imply negative growth, as anything better than negative growth would result in substantial outperformance over the long term.

- 12X-14X implies a flattish AFFO outlook, as that would result in a market-like return.

- 15X-17X implies slight to moderate AFFO growth

- 18X-20X implies moderate AFFO growth

With these hurdle rates in mind, let us examine each of the 7 lower multiple REIT sectors and compare fundamental outlook to the hurdles.

Hotels – 10.6X AFFO

It is difficult to discern the growth rate of hotels because the sector has periods of rapid growth mixed with periods of negative growth. While the positive and negative periods somewhat correspond to economic cycles, hotel earnings are significantly more erratic than a traditional cyclical company.

I have been bearish on hotels for a long time due to poor cost controls.

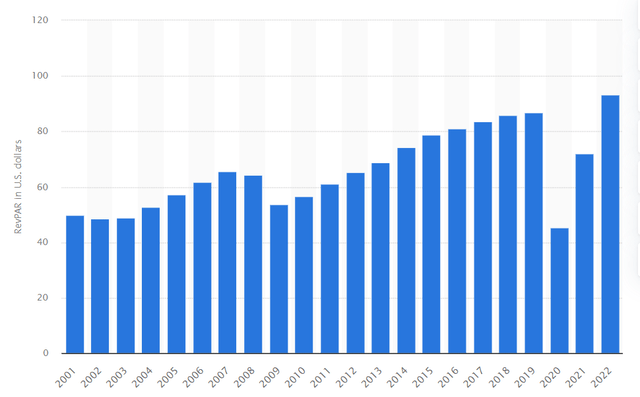

Revenue Per Available Room or RevPAR has grown considerably, continuously hitting fresh all-time highs.

Statista

The above chart only goes through 2022, but RevPAR remained strong in 2023 and so far in 2024.

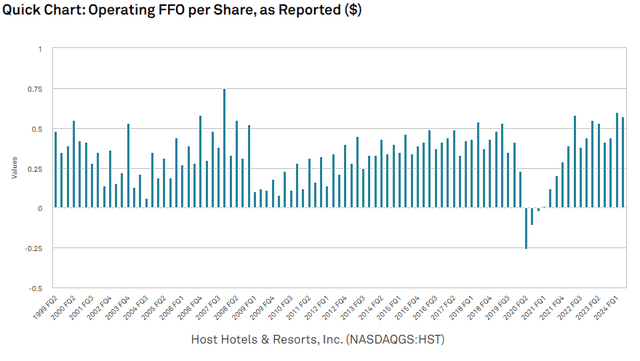

Contrast the strong revenue growth with earnings growth of the largest hotel REIT, Host Hotels & Resorts (HST).

S&P Global Market Intelligence

FFO has been bumpy, but essentially flat for decades.

In my opinion, the weakness is related to out-of-control expenses:

- Constant need for expensive renovations

- Loss of ~20% of revenue to get customers in the door (Online travel agency and branding fees)

- Increasing labor costs

- Taxes and insurance

Additionally, hotels are having to battle new forms of competing supply from Airbnb (ABNB) and equivalents.

So rather than the typical boom and bust of cyclicals, hotels are only okay during the good times and terrible during the bad times.

In my opinion, the sector is cheap for a reason, and I think it will continue to underperform.

Diversified – 13.8X AFFO

Diversified REITs are those with multiple property types, but most often these REITs own some mix of apartments, industrial, retail and office.

Apartments and industrial are broadly liked asset classes, but the market still fears diversified REITs because of their office exposure. What strikes me as strange, however, is how much of a discount is applied for it.

It would make sense to me for a REIT that owns all 4 asset classes to trade at the weighted average multiple of the 4 sectors. Well, office, retail apartments and industrial trade at 14.5X, 16.7X, 18.9X and 20.0X, respectively. That is an average of 17.5X.

Diversified REITs, consisting of these property types, trade at 13.8X. They actually trade below office, which I, and most, would consider the weakest property type of the bunch.

The discounted multiple of industrial REITs is even more bizarre once we take into account the pivots these companies have made. Most of them have substantially reduced their office components. W. P. Carey (WPC) spun off nearly all of its office assets into Net Lease Office Properties (NLOP) leaving the remaining WPC assets as mostly industrial and yet, it trades at 12.5X forward AFFO.

Other diversified REITs such as Armada Hoffler (AHH) and CTO Realty (CTO) only have exposure to office through mixed-use properties, which have distinctly different fundamentals. In each case, the leasing activity has substantially outperformed stand-alone office properties, and yet these companies trade at discounts to office.

In my opinion, diversified REITs are misunderstood by the market and are fertile ground for investment.

Office – 14.5X AFFO

While any sort of office building would be classified as office, the bulk of the office REIT sector consists primarily of office towers. These are glamorous buildings that prior to Covid were considered trophy properties.

Historically, office has been one of the higher multiple REIT sectors, but 2 major changes to fundamentals made them the high-risk asset class:

- Wave after wave of new developments created a sustaining oversupply

- Changes to workplaces in a post-covid world reduced demand in a semi-permanent way

Reduced demand in an already oversupplied sector is a rough combination, making it a legitimately troubled asset class.

In the previous article we discussed the mark-to-market opportunity of industrial where existing leases are at rates well below current asking rents indicating there will be roll-ups upon expiry.

Office is presently in the opposite situation. AFFO has not yet taken the full hit because office lease terms can be quite long and most of the tenants are reliable payers. Thus, there are many leases still in place that are still at pre-covid rent levels.

As these leases expire, there is a significant risk of either rent cuts or vacancy.

So while 14.5X is a cheap multiple, that level of AFFO may not be sustainable. We will get a cleaner read on stabilized AFFO once a large portion of leases have rolled.

If demand eventually returns, I think it is plausible office will outperform. The sector is trading below replacement cost of the properties which should keep future new supply at bay. Additionally, many of the companies are well managed with strong balance sheets.

Under or overperformance will likely come down to what the workplace of tomorrow looks like. That is something I find very hard to predict, so I see it as potentially good but a bit of a gamble.

Healthcare – 14.9X AFFO

It is perhaps misleading to discuss healthcare REITs as if they were a single asset class. The REITs primarily own the following property types:

- Skilled nursing facilities (SNFs)

- Medical Office (MOBs)

- Hospitals

- Senior housing (ALFs and ILFs)

- Retail-facing urgent care

- Memory care facilities

Each has a different set of fundamentals, but broadly speaking, they benefit from an aging population. The various asset types are differently burdened by some combination of insurance hassles, regulatory costs and stingy Medicare reimbursement rates.

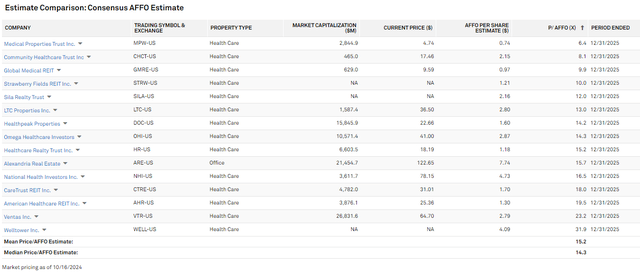

Similarly, the asset types trade at widely varying multiples. Those with significant exposure to senior housing such as Ventas (VTR) and Welltower (WELL) have quite high multiples at 23.2X and 31.9X, respectively.

S&P Global Market Intelligence

Medical office and hospitals trade quite cheaply.

While senior housing is rebounding nicely right now which gives the appearance of strong growth, it is structurally susceptible to oversupply, so I think the multiples there are a bit too high.

Medical office looks like the opportunistic place to invest. Fundamentals have stabilized nicely with steady supply and demand trends positioning the space for steady moderate pace growth. At the multiples the MOB REITs are trading, any growth above 0 is a big win.

Retail – 16.7X AFFO

Retail REITs have moved up nicely in recent quarters but remain at a fairly cheap multiple. 16.7X implies slight to moderate growth which is indeed accurate to recent history.

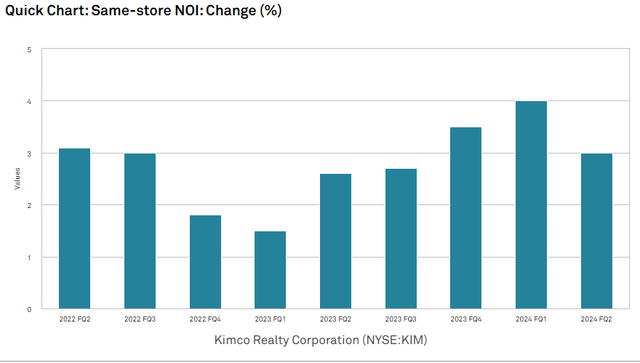

However, I think the market is missing the inflection point inherent in retail lease terms which are often quite long. Take a look at Kimco (KIM) as the bellwether shopping center REIT. Its same-store NOI growth has been decent at 2%-4%.

S&P Global Market Intelligence

That growth rate is quite appropriate for the 16.7X multiple of the shopping center sector.

However, the tepid same-store NOI growth belies the true underlying growth. Due to really long lease terms, any given period only has 5% or maybe 10% of leases rolling, so KIM is generating 2%-4% NOI growth on its portfolio as a whole, but that is coming from huge rollups on relatively few leases.

Historical same-store NOI is failing to capture the growth embedded in the remaining mark-to-market which is now quite substantial. Retail is looking increasingly like industrial circa 2019.

Given retail’s struggles with oversupply between 2007 and 2018, the market has been hesitant to jump in, but as mark-to-market gets visibly bigger each quarter, investors are starting to see the value here.

Towers – 18.2X AFFO

Towers were the premier REIT sector for a long time and often traded at the highest multiples, so this is a new entrant into the cheaper half of REITs.

To a large extent, I think the now cheaper multiple is correct because the growth engine that made towers so successful is waning. Specifically, they benefitted from colocation of multiple cell phone carriers on each tower. As the towers leased up, they could get double, triple or even quadruple rent.

That extra rent remains in place today and looks stable, but with all the rent already in place and the macro tower build out in the U.S. largely complete, it is no longer as potent as a growth driver.

Thus, the tower REITs are instead relying on rental rate growth which is still solid at around 5% annually, but that is well less than the deep into double-digit growth the towers used to produce. As such, the 18.2X multiple strikes me as appropriate.

Towers are an okay place to invest. Decent growth and reasonable dividend income, but largely appropriately valued indicating a market-like return.

Apartments – 18.9X AFFO

Apartments have gotten much cheaper over the last 3 years, cooling from over 30X in late 2021.

S&P Global Market Intelligence

While the sector was arguably overvalued then, I think the pendulum swung a bit too far and it is now opportunistic.

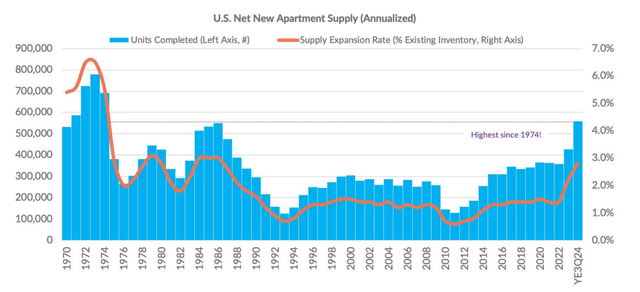

The market’s primary concern with apartments is oversupply, as 2023 marks the highest number of deliveries since 1974.

RealPage Analytics

This wave of construction is indeed impacting the REITs with rental rates flattening out.

However, there are 2 factors that should cause apartment REITs to return to strong growth as early as 2025.

- The wave of supply is subsiding. New starts are minimal, so it will mostly just be deliveries of the remaining units currently in the pipeline

- Demand is coming in unexpectedly strong

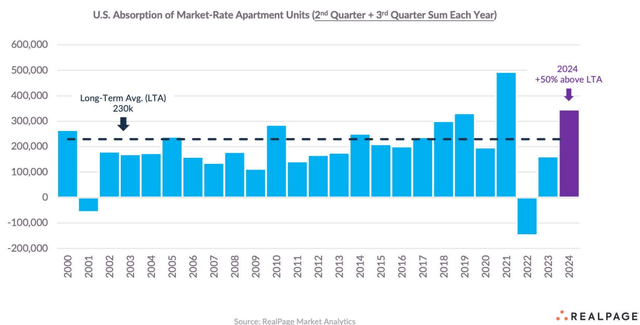

2024 absorption is fully 50% above the long-term average.

RealPage

Strong demand has helped REITs maintain occupancy during the supply boom. Forward demand drivers remain healthy, so as the supply wave subsides, absorption will likely start to outpace deliveries, resulting in higher occupancy and likely increased rental rates which still have room to run relative to the cost of homeownership.

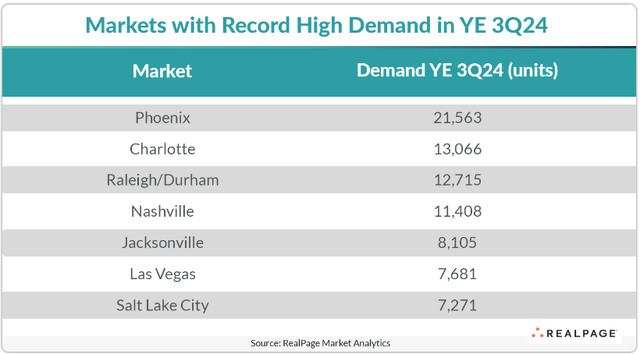

Location matters significantly for the sector, with the sunbelt still receiving the bulk of demand.

RealPage

Sunbelt-focused apartment REITs still trade at discounts to their coastal peers, which enables an investor to get both the higher growth and a cheaper entry multiple.

Wrapping it up

Just as the premium REIT sectors had both bloat and opportunity, the value REIT sectors host a mix of traps and bargains. Given the mispricing present in the market today, it is possible to buy strong fundamentals inexpensively.

Read the full article here