Sundry Photography/iStock Editorial via Getty Images

MKS Instruments (NASDAQ:MKSI) has demonstrated impressive growth over the last decade, increasing their 3-year average revenue at a compound annual rate of 18% over the last decade. The company supplies equipment and components that are used to make electronics and semiconductors, with customers like ASML (ASML) and Taiwan Semiconductor (TSM). It is estimated that their products serve over 85% of wafer fabrication equipment application and ~70% of critical steps in package substrate/PCB processing.

MKS is highly leveraged to the semiconductor business cycle, and earnings can swing dramatically; semiconductor-related revenue dropped by 28% in 2023. With a tailwind from foundry build-outs funded by the CHIPS Act, growth should continue in the coming years. A deeper dive is in order to see if this growth means an opportunity for investors.

Overview of Business

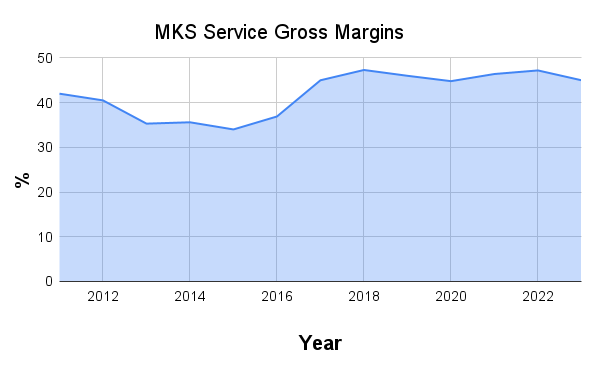

MKS serves the semiconductor, electronics & packaging, and specialty industrial markets through their three divisions: Vacuum Solutions, Photonics, and Materials Solutions. Given that the company services the semiconductor and electronics industries, it is not surprising that over 50% of their revenues come from international markets, and Asia makes up a large fraction of those sales. The company generates ~88% of their revenues from products with average gross margins of 45% and the balance of revenues coming from services with average gross margins of 45%, which is relatively attractive for an industrial company. Gross margins on the products side have been fairly steady, while margins on service have increased by +5% over the last decade.

MKS Instruments gross margins on service (Author generated chart from 10-K data)

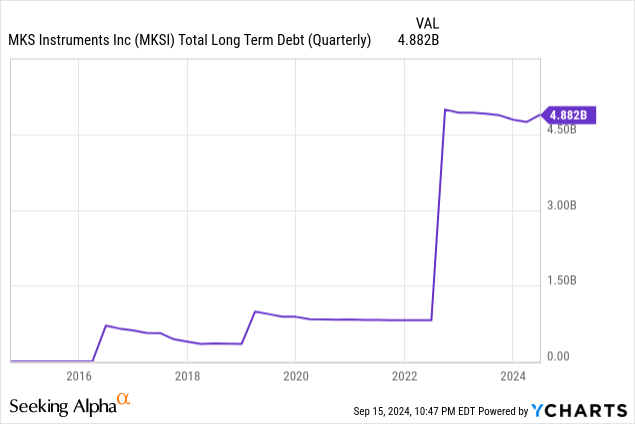

The company has seen significant growth in the top line, with revenues increasing from $669MM in 2013 to $3.62B in 2023. Acquisitions have played a large role in this growth, with three major transactions during that time. The largest and most recent transaction was the purchase of Atotech in 2022 for $4.5B in cash and 10.7 million shares of stock. That is significant considering the current market cap is $7.5B. Despite the larger scale, shares currently trade ~35% lower than when the transaction was first announced. Why are shareholders not seeing better results?

Many Underlying Issues

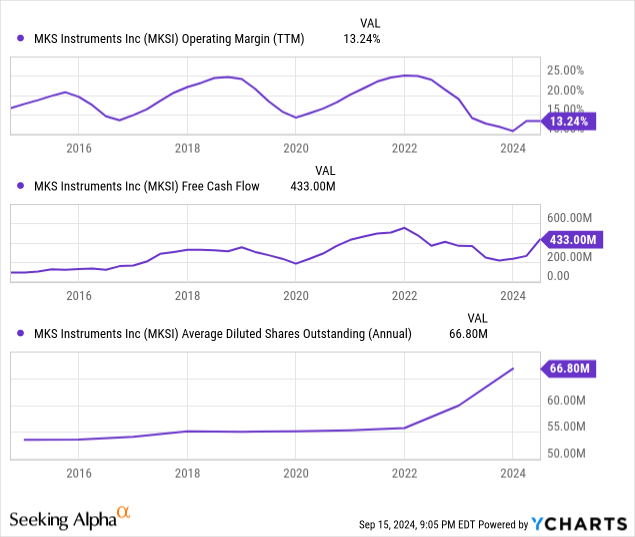

One issue is simply that 2021 marked the top of a cycle, and operating margins in the current trough are lower than during the lows of previous cycles. Free cash flow is down, and the total share count is up by 22% since the end of 2021. Shareholders may face an additional ~13.5% dilution from a convertible bond issued in May.

The release announcing the Atotech acquisition stated that the pro forma annual revenue for the combined company would be $3.8B and revenues in 2023, the first full year after closing, were only $3.2B. The reality is MKS overpaid for the business. They paid an enterprise value of close to $6.5B for a company that did $1.5B in revenue in 2021. Atotech reported a net income of only $7.5MM on that revenue due to an impairment charge of $279.5MM. Ignoring the impairment charge and MKS still paid over 22x earnings. The Materials Service Division that contains the Atotech business generated $1.2B in revenue in 2023. The deteriorating results led to almost $1.4B in impairment charges last year.

MKS also took impairment charges of $537MM on their Electro Scientific Industries business last year, a business that they paid ~$1B in cash for in 2019. Even after these impairment charges, the company still has $4.9B in goodwill and intangible assets on the balance sheet. The balance sheet is stretched with $5.75B in liabilities net of cash and 2024 estimated, adjusted-EBITDA is around $850MM. For those who prefer real financial metrics, cash from operations has averaged ~$500MM over the last three years. The company paid $166MM in interest in the first half of 2024 out of $1.755B in revenue. A May convertible loan offering was used to reduce the outstanding balance of a term loan facility to $3.6B, which is significant given that the average interest rate on this debt is 7.5%.

Additional Risk Factors

Several other red flags came up in reviewing the 10-K.

From page 3 of the 2023 10-K:

Our dependence on sole and limited source suppliers and international suppliers has negatively impacted, and could continue to impact our ability to manufacture products and systems.”

While the COVID pandemic showed us that all companies are vulnerable to supply chain disruption, it is particularly risky when companies are dependent on single source suppliers for critical components. The 10-K indicated that some of these parts are specified by customers, so this issue is largely out of their hands.

And from page 4:

We previously identified a material weakness in our internal control over financial reporting…”

The reported issue was related to access control, intrusion detection, and restoration capabilities for their financial reporting system. The finding was related to a ransomware attack the company suffered in 2023. The attack delayed sales and resulted in net expenses of $10MM. Further, the company was facing two lawsuits due to the breach and may face litigation in the future. The company has also been named in a PFAS-related lawsuit.

As mentioned earlier, a large portion of revenue is derived from international sales, with China representing a significant portion of revenues. U.S. Department of Commerce restrictions on export of semiconductor-related equipment were estimated to have reduced sales by $200 to $250 million in 2023. With tensions unlikely to ease up any time soon, this could be a significant pain point going forward. The company also mentioned that operations at their facilities in Israel could be disrupted if key personnel are called into military service, which is a distinct possibility given tensions in the region.

What About Shareholders?

MKS has generated $3.4B in operating cash flow over the last decade, but shareholders have not benefited much. While there is a share repurchase program, no shares have been purchased in recent years and shareholders continue to see their ownership be diluted through the issuance of shares. The company currently pays a quarterly dividend of $0.22 per share, which hardly makes sense given that they are paying 7.5% on a term loan. That leaves share appreciation as the only avenue for returns for shareholders.

The share price has lagged since peaking in 2021 and pressure is mounting for change. Ramakumar Mayampurath was named as the new CFO last month. The debt is clearly an issue and this will likely be one of Mayampurath’s top priorities, as an economic slowdown could cause the company major issues with servicing the debt. Overpaying for acquisitions is another glaring issue for the company, and they need to be more conservative with valuation projections, but acquisitions are likely out of the question for the next couple of years while the debt load is reduced.

Semiconductor equipment spending should be on the upswing in the coming years as investments are made in new fabs in the U.S. and Europe, but that growth hasn’t hit yet. MKS revenues were essentially flat year-over-year in the first half at $1.76B and the company provided revenue guidance of $870MM +/-$40MM for Q3 in their Q2 earnings release, flat to a slight slowdown versus the first half. MKS revenues are generally higher in the second half of the year, indicating the company is seeing Q3 demand lower than would be expected.

On the bright side, operating cash flow was $189MM in the first half, up $211MM versus the first half of 2023. Assuming revenues and margins are flat for the second half, that would imply free cash flow of around $300MM and ~$4.30 FCF/share. With a closing price of $111.85/share on Friday, that translates to a price to free cash flow of 26, a little too rich even at the bottom of a cycle. I would have to see shares closer to $95 with reduced outstanding debt before considering putting money into MKS.

Final Thoughts

MKS has many quality assets, and they serve a critical role in the semiconductor and electronics industries, both of which should continue to see growth for a long time to come. There are many quality product lines under the MKS umbrella and I could see a larger player potentially acquiring the company in the future, but that may be some time off because it would be hard to pay a significant premium above the current price given the debt situation. That debt load makes it too big of a risk for me as well, and I will not consider investing in the company until the debt level is brought down. With over $8MM in net insider selling so far this year, it seems like the management team isn’t counting on a quick turnaround.

Read the full article here