Retail Opportunity Investments Corp. (NASDAQ:ROIC), incorporated in 2007 and headquartered in San Diego, CA, acquires, owns, and manages community and neighborhood shopping centers on West Coast markets.

The outlook for shopping centers is generally good given the steady demand and constrained supply, but the past performance of ROIC indicates a deceleration in growth. With the price rising rapidly after the report that Blackstone intends to acquire the REIT, I think the best course of action is to wait. It’s not unlikely we will see a better price level once again.

Portfolio and Outlook

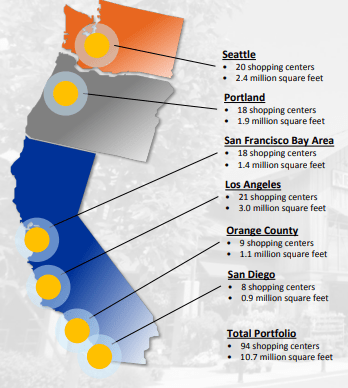

The REIT’s portfolio consists of 94 properties that aggregate 10.7 million square feet and are spread across 6 markets. It’s concentrated in California with the highest exposure to L.A.

Investor Presentation

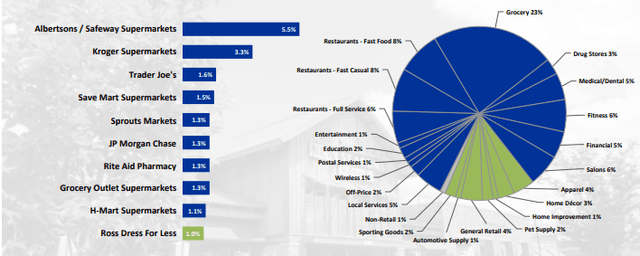

Despite the lack of diversification regarding its geographical focus, its industry exposure looks much better, with essential and e-commerce-resistant retailers accounting for 82% of ABR.

Investor Presentation

Additionally, its top tenant accounts for 5.5% of ABR and as you go down the list of the top tenants, the reliance rapidly diminishes to ~1.5% of ABR, reflecting a highly diversified tenant base.

ROIC usually underwrites long-term leases for essential retailers to establish stable long-term cash flows and short-term ones for destination shop retailers to capture higher cash flows while mitigating risks. With more than half of its current leases expiring in the next 4 years, the REIT stands to enjoy decent internal growth just from marking up its rates. In the past 5 years, it has consistently re-leased space at double-digit spreads and renewed at mid to high single-digit spreads. At the same time, its occupancy rate hasn’t been lower than 97% in the last 5 years, reflecting a very strong demand for its assets.

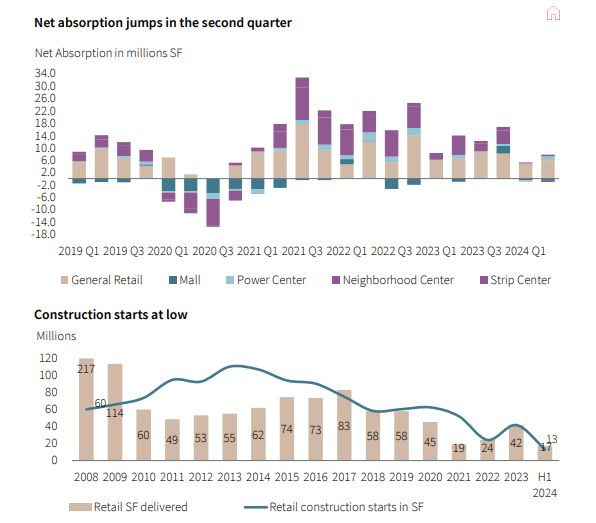

Of course, while the REIT’s managers may have done a good job and the portfolio reflects steady demand fueled by e-commerce-resistant tenants and essential businesses, a tight supply for shopping centers must be another important driver. There are significant barriers to entry present here, such as strict zoning laws in California, substantial initial capital requirements, and competition for large tenants. Today, this favorable market condition for ROIC is even more pronounced as net absorption has recovered to good levels since the pandemic started and construction starts/deliveries are at historically low levels:

JLL

So, not only do I see a low risk regarding the REIT’s upcoming lease expirations and already high occupancy level, but I also think that lease spread growth will persist and occupancy could still trend higher as the supply seems to be slow in catching up with current demand.

Performance

To be completely fair, however, the recent operational results of this REIT and prospective growth are not as good as those of many other retail REITs.

In 2023, ROIC experienced a 22% spread on new leases and 7% on renewals. Occupancy was also pretty high at 97.7%, although it was 40 bps higher at year-end 2022. Same-center NOI increased by 3.68% to $211 million. However, FFO decreased by 3.04%.

In the second quarter of 2024, the spread was 12% for new leases and 6% for renewed ones, indicating a deceleration in growth. The occupancy was at 97%, which is 70 bps lower since the year-end 2023 and 130 bps lower YoY. What may be even more disappointing is that same-center NOI increased only by 1.73% and FFO decreased even more this time by 4.25%.

The guidance that is provided by management for 2024 is consistent with the relatively slow growth as same-center NOI is expected to grow only by 1% to 2%. Additionally, the low end of the FFO guided range implies a 1.89% decrease in 2024 and the high end only a 0.94% increase.

These results, along with the guidance are reflective of a deceleration in the REIT’s operational growth. While the outlook is good for ROIC based on the market dynamics, its past performance is problematic as a doubt that the company can continue to grow at an attractive pace in the next few years becomes reasonable for investors to have. The same market conditions that have existed in the past and are expected to continue to exist in the future can only establish a reasonable bullish thesis if the past performance and short-term expectations already reflect them.

Leverage & Liquidity

ROIC scores well when it comes to the quality of its balance sheet. Its debt finances only 41% of its assets and only 2.3% of the debt is secured. Additionally, 85% of the debt is fixed-rate.

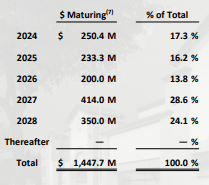

With a debt/EBITDA ratio of 6.6x and interest coverage at 2.7x, its liquidity level also looks good. Moreover, its $438 million in available liquidity makes the upcoming maturities manageable:

Investor Presentation

Dividend & Valuation

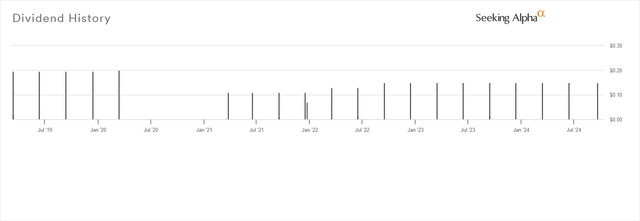

ROIC currently pays a quarterly dividend of $0.15 per share, resulting in a forward yield of 3.75%. With a payout ratio of 57.69%, ROIC seems like a relatively solid dividend stock. However, the yield should be low for many income investors these days. To be fair, your yield on cost could improve over time because management has been raising the dividend since they reinstated it back in 2021 and it’s on its way to reaching pre-pandemic levels:

Seeking Alpha

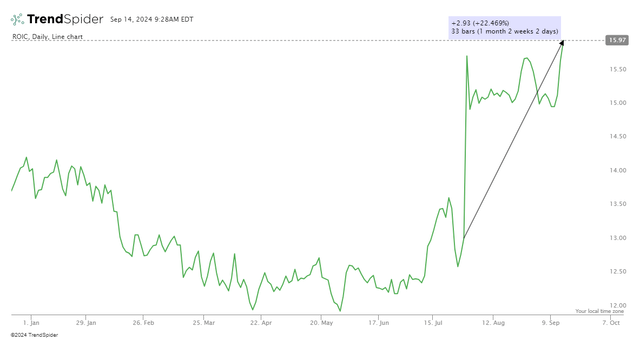

Also, its 6.51% forward FFO yield is not bad at all and in any other case I would think that ROIC shares are cheap. However, because the stock price is up more than 20% since it was reported that Blackstone was in talks with the company to acquire it back on July 30, I’m having doubts:

TrendSpider

Because of this rumor, the stock is now trading at an above-average 15.38x FFO multiple (as compared to retail REITs’ average of 14.8x). Moreover, its implied cap rate is pretty low at 5.94%. For comparison, cap rates for retail assets should be around 6.4% on average today, so ROIC is trading at a 14.39% premium to NAV ($13.96) right now.

Risks

First, if down the road it’s clear that an acquisition isn’t happening, the price may face some pressure. Also, its sensitivity to changes in interest rates presents a similar short-term but more unlikely to be realized risk. Last, its geographical concentration could prove problematic for long-term holders down the road, unless it’s clear that the REIT can expand its operations to more states.

Verdict

All in all, ROIC may have potential in the long run, but the current price and low yield are difficult to justify given the mediocre performance. Perhaps it’s best if we wait to see what happens when it comes to the acquisition discussions first. I am rating ROIC a hold for now.

What do you think? Do you own this stock or do you favor some other REIT? I’d love to know! Also, please leave a comment if you found this post useful; it means a lot.

Read the full article here