Russel metals inc. (TSX:RUS:CA) operates as a metal distribution and processing company in Canada and the U.S. It operates in three segments: Metals Service Centers, Energy Field Stores, and Steel Distribution.

The Metal Service Centers segment operates a network of metals service centers, which provide metal products in range of sizes, shapes, and specifications, including carbon hot rolled and cold finished steel, pipe and tubular, stainless steel, aluminum, and other non-ferrous specialty metal products.

The Energy Field Stores segment offers specialized products, such as flanges, valves, fittings, and other products to energy industry.

The Steel Distributors segment sells steel products to other steel service centers and equipment manufacturers, which include carbon steel plate, flat rolled products, beams, channels, and pipes.

Russel Metals Inc. was incorporated in 1929 and is headquartered in Mississauga, Canada.

Russel has been a solid performer in this cyclical industry, having exceeded its 15% target return on capital.

The company has a pristine balance sheet, with low debt and a large cash surplus. It has deployed capital in several accretive acquisitions, the most recent having closed in August 2024.

Management has proved to be shareholder friendly, with a good track record of dividend increases and share buybacks.

Current performance reflects the current low point of the steel supply & demand cycle, which has depressed margins from post Covid highs.

I believe that Russel is in a very strong position to take advantage of the near term cycle to continue to acquire competitors at accretive valuations. However, the cycle is not done yet.

I will have a look at the business and share price performance and outlook, and share how I will play the current set up.

Company Performance

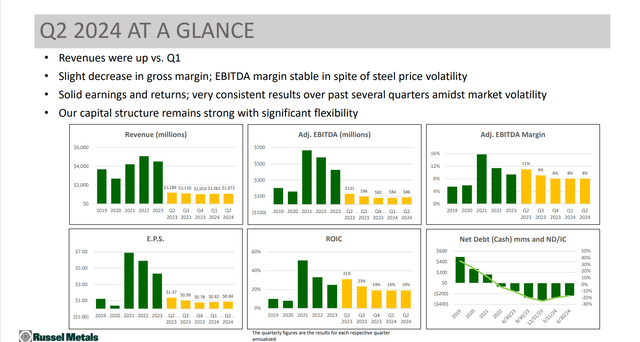

Russel provided a shareholder update with the Q2 earnings release. The figures clearly demonstrate the cyclical nature of the steel distribution business, with pressure on margins driven by steel pricing and demand.

The once slide below has a wealth of information which tells the story quite succinctly.

Russel

The good news is that revenues have held up pretty well in challenging circumstances, with 2024 looking to come out close to 2023. Furthermore, the company has demonstrated great financial discipline, using the excess profits of the post covid high point to clean up the balance sheet, aggressively paying down debt to be in a positive net debt position. Already in 2024, some of this cash surplus has been deployed in a mixture of acquisitions, and share buybacks (more of this later.)

EBITDA margins have been reduced over the period however, from a high point of 16% in 2021, down to a current 8% level. However, this margin compression appears to have flattened out at this 8% level, which has been sustained for the last quarters.

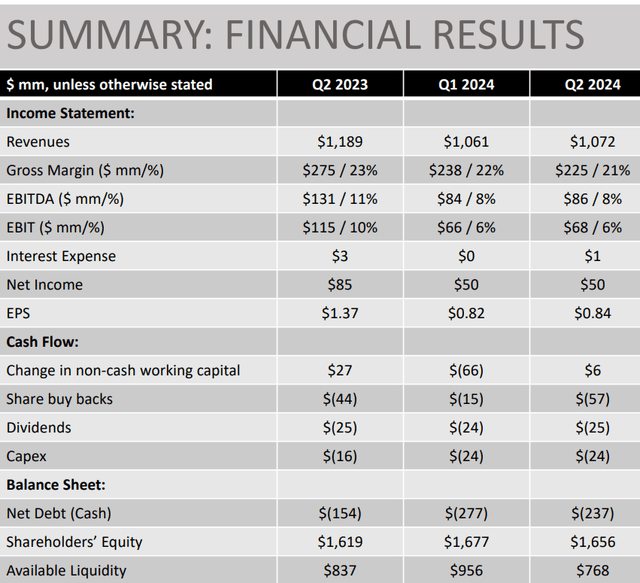

The financial results summary shows the revenue profile starting to flatten out, and net income stabilising at $50m for the last two quarters. Capex is modestly increasing, due to investments in upgrading processing facilities.

Russel

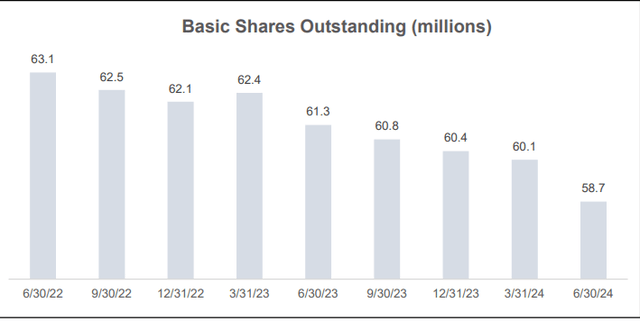

As I mentioned above, Russel has been buying back shares since 2022, and to date has reduced the share count by 8%, with a further buyback authorisation approved after the Q2 2024 results.

Russel

Nevertheless, the EPS has reduced over the last three years, seeming to have bottomed in Q4 2023, with slight increases in the last 2 quarters.

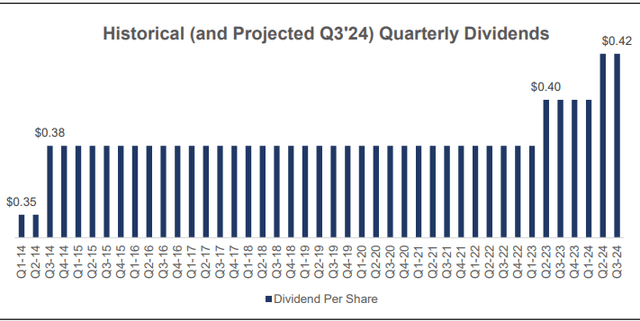

With a capital allocation strategy balanced between investment, buybacks and dividends, and the cyclical nature of the business, dividend growth has been material, but not consistent, around 2% a year over the last decade, but recently accelerating. Current yield is 4.4%.

Russel

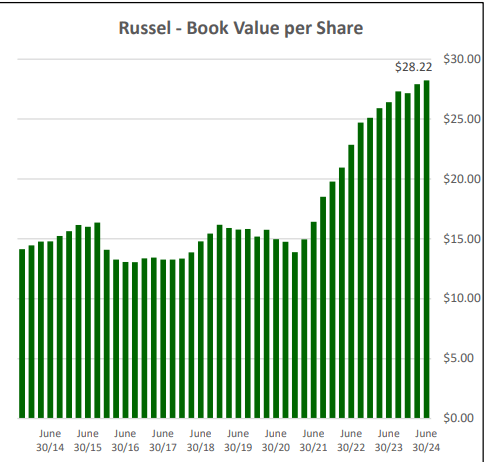

Book value per share likewise shows a cyclical profile, with clear ramps and drops over the last decade, but a step change in the 2022-2024 years.

Russel

Share Price Performance

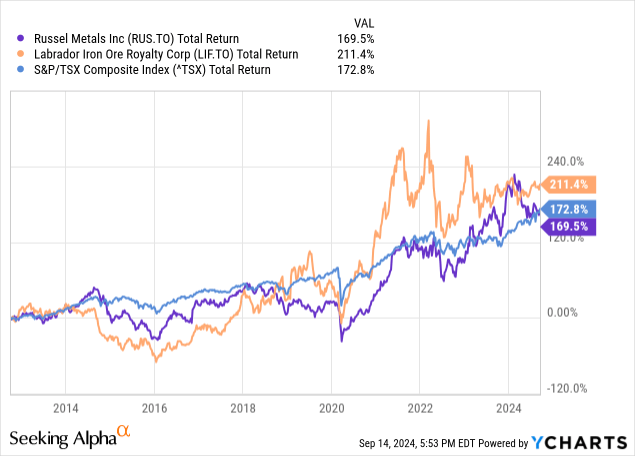

Russel has performed reasonably for shareholders over the last 5 years, mapping the benchmark TSX over the period. I also show the performance of Labrador Iron Ore Royalty, as a proxy for steel as a commodity.

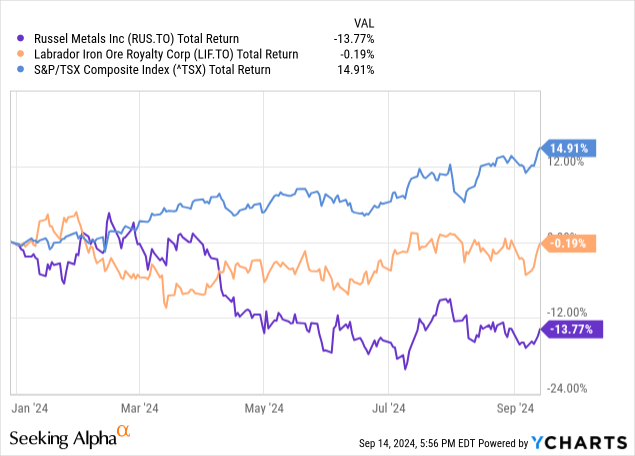

Year to date performance shows a different picture, as the margin compression has shown through the results. Russel has generated a negative return of 14% vs TSX positive 15%, and also underperformed Labrador Royalty.

The Elephant In the Room

The Jumbo sized question for Russel, is of course “Where are Steel Prices Headed and what impact will this have on Russel’s earnings?”

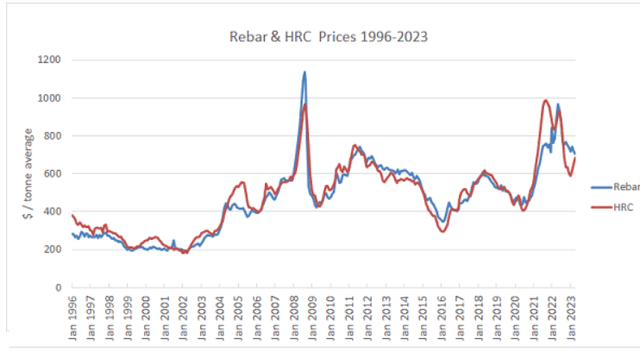

The chart below from this study from Steelonthenet.com underlines how cyclical steel prices are. Drawing data from a number of sources, including Fitch, the OECD and the World Steel Association, the report concludes that steel prices will not bottom until mid 2025.

Steelonthenet.com

Key drivers of the outlook are the impact of a prolonged China steel demand slump, and increases in production capacity.

Russel would argue that their own market is not totally reflective of global steel prices, as they have exposure only in Canada and US, and also have increased their processing capabilities to capture more of the value chain.

They do however admit that Q3 and beyond will continue to show impacts of the down cycle, especially in the steel distribution part of the business, where margins map the overall steel price. The Service Centre business segment is expected to show a dip in Q3 margins, and recovery into Q4, while the Energy segment is seen as stable on margins.

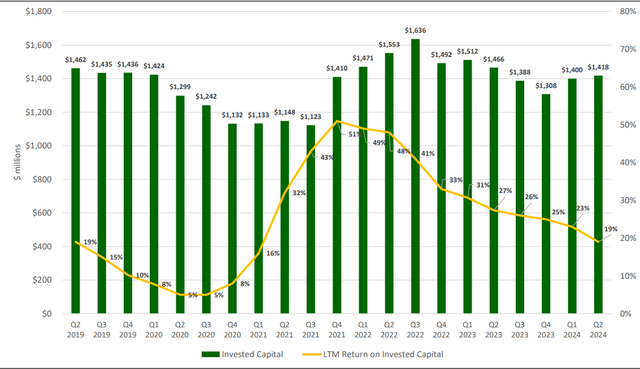

The exhibit below shows the price cycle compression on margins. While Russel is focussed on managing working capital down as margins compress, the return profile has dropped faster than the capital deployed.

Russel

In the last two quarters, working capital has started to increase while returns continue to fall. While the bottom in the margin cycle should stay above the lows of the Covid era, I think it would be reasonable to expect the bottoming and recovery to have a similar shape – the catalysts for a V shaped margin recovery seem slim.

All in all I would expect to see Q3 results under continued pressure on margins. There is also the open question on the revenue impacts of recessions looming in both Canada and US.

Further on the macro front, we have now seen the Bank Of Canada drop interest rates by 0.75% from the peak, with a cut at each meeting. As the Canadian economy remains under clear pressure, the BOC can be expected to continue the cutting cycle, especially as the US Fed starts its own easing programme. While in the long run, this should provide a boost to equities, the short term impact of rate cuts might not be so positive for Russel. With limited interest expense, and a large cash balance, Russel’s cash flow will have benefitted from the recent high rates. This tailwind will be reducing somewhat going forward.

Offsetting these dampening effects, Russel will see the income from recent acquisitions flow through. The recently closed Samuel deal is one of four recent acquisitions which will be contributing into Q3 and beyond. Value created by the increased Capex will likely not contribute until 2025.

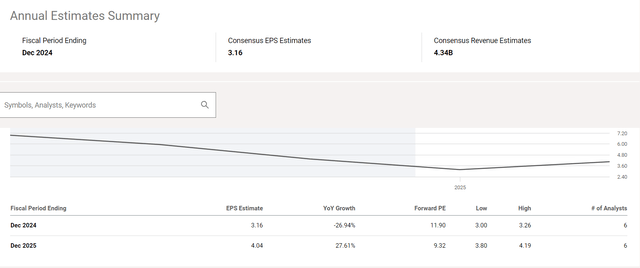

Putting this all together, I would expect to see continued pressure on Russel’s earnings through H1 2025. My expectation is for the quarterly net income to remain at around $50m or $3.2 EPS annualised (including seasonality) before increasing in H2 2025.

This seems to be consistent with analysts estimates, as shown by Seeking Alpha.

Seeking Alpha

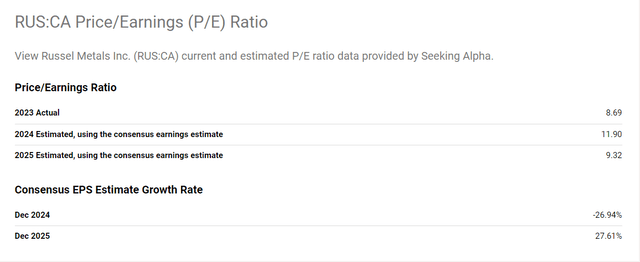

The forward P/E ratio consensus for 2024 is 11.9 x, dropping below 10x for 2025.

Seeking Alpha

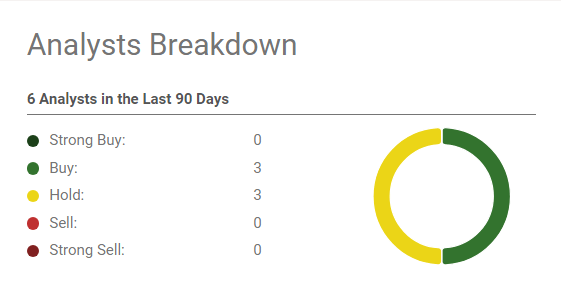

Analysts covering the stock are split evenly between BUY and HOLD ratings.

Seeking Alpha

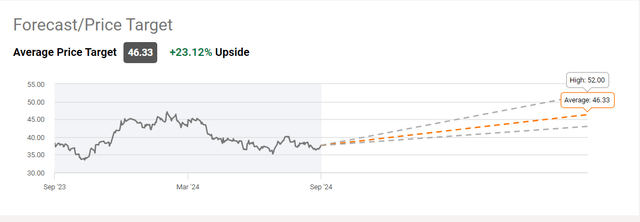

With an average price target of $46, or a 23% upside from current levels.

Seeking Alpha

Risks To The Outlook

I think that with steel prices eyeing a cyclical bottom, this optimism on earnings is warranted. Risks however abound. Here are the main ones:

- Global economy delaying demand recovery for steel.

- Deeper than anticipated recessions in Canada or US.

- China demand suppressing steel prices longer and lower.

- Integration risk of recent acquisitions (I see this as low, due to scale.)

Conclusion – How I Will Play Russel

There’s a lot to like about Russel’s management and execution.

- Strong balance sheet with good cash and liquidity.

- Sensible acquisition strategy.

- Shareholder friendly capital management.

- Good positioning for a cyclical upside.

However, I do think that the margin pressure might be sustained for longer than projected, and I see downside risk to the stock price approaching year end.

- Worse than expected Q3 results.

- Market volatility around the macro outlook and US elections.

- Some tax loss selling towards year end.

- Market multiple dropping below 11x 2024 actual earnings.

As such, I feel that the 2024 share price lows around $34 could be revisited in the coming months. This is around 10% below the price at the time of writing and around 10.75x expected 2024 earnings. I rate Russel a HOLD.

I am currently short via December cash secured $34 puts to target a $34 entry point. I will continue to sell OTM puts and will purchase outright on dips below $34.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here