Investment Thesis

I recommend holding Sabesp (NYSE:SBS) shares after 2Q24 results. Sabesp reported strong results in 2Q24, even beating market estimates in both revenue and earnings per share. In addition, the company will have much more freedom to make assertive decisions due to the privatization.

However, the valuation is extremely stretched when we analyze the company’s EV/EBITDA against its own history. As an analyst who adheres to the value investing philosophy, I continue to recommend holding the shares, requiring a greater margin of safety to recommend a buy.

Review Of Sabesp’s 2Q24 Results

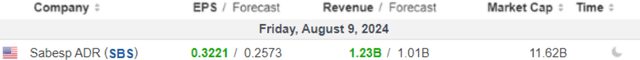

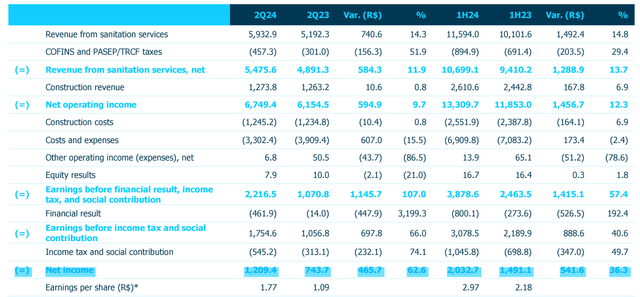

Sabesp released its 2nd quarter results on August 9, and the company beat market estimates for revenue by 21.7% and profit estimates by 25%, as we can see below.

Earnings (Investing)

Next, I will make a complete report on each segment of the results. It is important to highlight that the company discloses the results in BRL, and I will convert them to dollars using the ratio 1 USD = 5.59 BRL, which was the dollar exchange rate in Brazil on the last day of the 2nd quarter. Enjoy your reading!

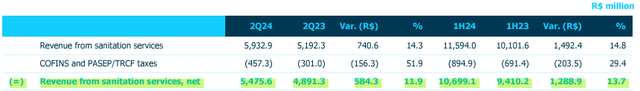

Revenues – Above Expectations

Sabesp achieved a good 11.9% annual revenue growth, reaching BRL 5.4 billion ($979 million). The growth was due to the 6.4% tariff adjustment in May 2024, and also due to the 3.2% y/y increase in billed volume.

Revenues (IR Company)

In my view, privatization should provide greater freedom for management to make improvements to the company. Therefore, I believe that the revenue outlook is for continued growth due to the stability of tariff prices and the extension of strategic concessions until 2060.

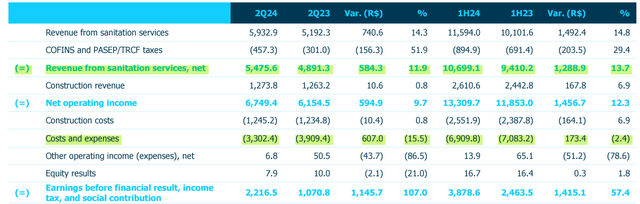

Costs, Expenses and Margins – Good cost control

The company achieved a nice 15.5% y/y reduction in costs and expenses. However, this was possible due to the higher base in 2Q23, when the company implemented its voluntary redundancy plan.

Costs and Expenses (IR Company)

With this, the company achieved an EBITDA margin of 54% against 44.8% in 2Q23. It is believed that the excellent track record of the newest shareholder, Equatorial (which has an excellent track record of capital allocation), will help Sabesp continue to increase revenues, reduce expenses and increase margins.

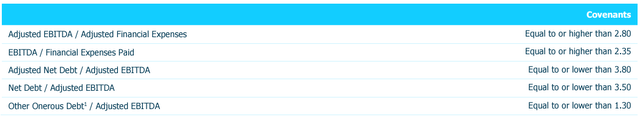

Debt – Healthy Leverage

Sabesp ended 2Q24 with net debt close to BRL 16 billion ($2.9 billion) and a cash position of BRL 5.2 billion ($930 million). As a result, the company reached leverage of 1.6x, well below covenants.

Covenants (IR Company)

As for perspectives, I believe that new tariff repricing, in addition to the focus on efficiency, can further improve the company’s debt profile in the future.

Capex – Strong Investment Ahead

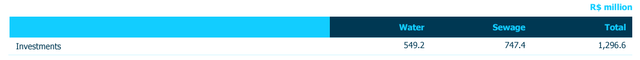

The company reported capex of BRL 1.3 billion ($232 million) in 2Q24. The company is expected to significantly increase investments due to the New Sanitation Framework, and projections point to total investments of BRL 70 billion ($12.5 billion) for the complete universalization of services.

Capex (IR Company)

Therefore, I believe that the next results should show high capex, just as the distribution of dividends should reduce, which is why I believe that the company should have a dividend yield close to 2% for the next 12 months.

Net Income – General Result Considerations

With revenue growth and cost containment partially offset by higher financial expenses, the company achieved a 62% annual increase in profits to BRL 1.2 billion ($216 million).

Net Income (IR Company)

It is worth noting that this expansion in profits was also impacted by a weaker base in 2Q23. However, I believe that the company will continue to expand its operating margins due to the privatization. But if the outlook is so good, why is there no buy recommendation?

Valuation – Very Stretched

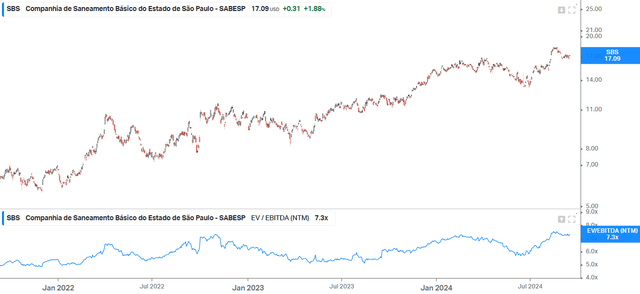

One of the most assertive ways I find to analyze a company is to compare its EV/EBITDA multiple against its own history, and that is what we will do next:

EV/EBITDA (Koyfin)

In the last 3 years, the company has traded at a maximum of 7.6x EBITDA and is currently trading at 7.3x EBITDA. However, if it returns to trading at the historical average of the last 3 years of 6.1x EBITDA, this represents a downside of 16%, which corroborates my recommendation to hold the shares and wait for a more opportune moment to invest in Sabesp.

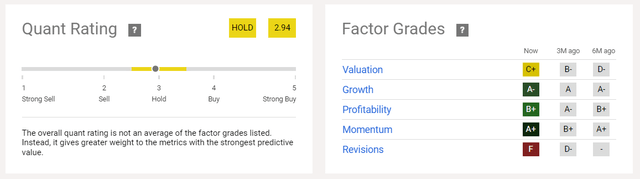

And before talking about the risks of the thesis, it is important to highlight that Seeking Alpha’s powerful tools corroborate my thesis of holding the company’s shares.

Quant Rating And Factor Grades (Seeking Alpha)

Potential Risks To The Thesis

When an analyst recommends holding a stock, this means that if the stock goes up, he will not participate in the rise. Therefore, one of the risks of not buying Sabesp shares is that the company is now private, so it is possible that it will experience an expansion of multiples by the market.

In addition, the company’s main shareholder will be Equatorial Energia (OTCPK:EQUEY), a company with an excellent history of capital allocation in Brazil and one of the largest compounders on the Brazilian stock exchange.

Sabesp’s investment thesis is complex, and investors should conduct a pragmatic and diligent analysis before choosing to invest in the company.

The Bottom Line

My thesis of not investing in Sabesp never took into account the company’s operational aspects. In my view, Sabesp was one of the best state-owned companies, and now as a privatized company, it has even more freedom to make better decisions.

Despite seeing a company with excellent margins, a good debt situation, and good prospects ahead, I do not feel confident in seeing that its EV/EBITDA multiple is at its highest levels in the last 3 years.

Based on this analysis, I recommend holding Sabesp shares. In my view, investors should wait for an opportunity to buy the company’s shares at a more attractive price, such as the potential 16% downside. In my view, the risk/return ratio is not attractive.

Read the full article here