The WisdomTree Floating Rate Treasury Fund ETF (NYSEARCA:USFR) invests in floating rate treasury notes. These investments have comparable credit risk to t-bills, with marginally higher yields and consistent outperformance. In most cases, floating rate treasuries are a superior alternative to t-bills, making USFR a solid, above-average cash ETF, and a buy. Longer-term treasuries or higher-yielding bonds should outperform long-term, but USFR is still a solid choice for more short-term or risk-averse investors.

USFR – Overview and Analysis

Holdings

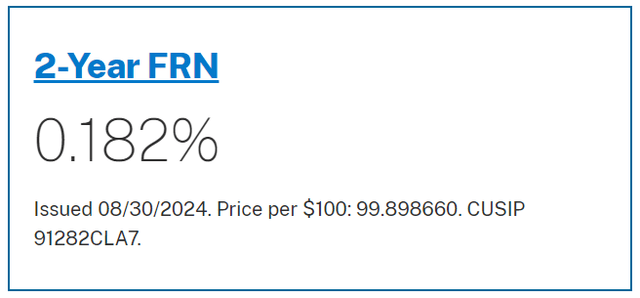

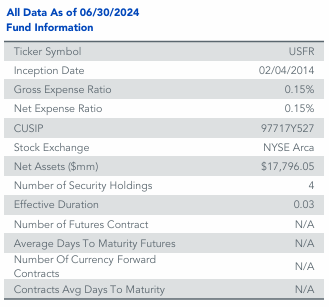

USFR invests in floating rate treasury notes. These securities are quite similar to t-bills, being issued by the U.S. Treasury, and with negligible duration and duration. Unlike t-bills, floating rate treasuries have maturities of two years. Rates are reset weekly and are currently equivalent to t-bill rates plus 0.182%. Floating rate treasuries consistently trade with a small spread to t-bills. See here for more details.

USFR

Dividend Yield Analysis

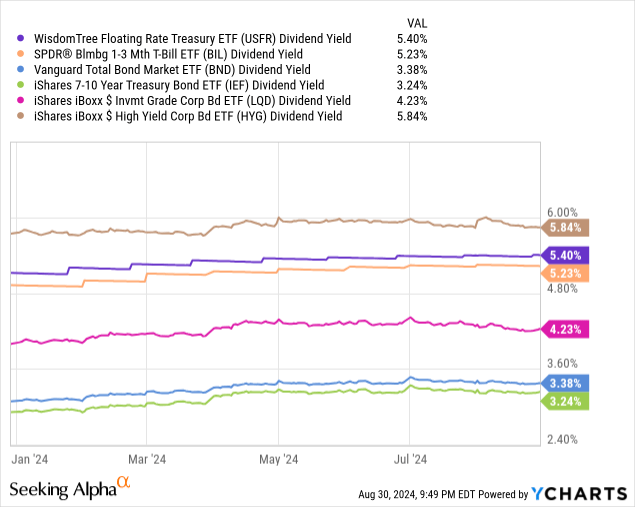

USFR currently yields 5.4%. It is a reasonably good figure, moderately higher than that of most bonds, marginally higher than t-bills, in line with the above. Of the major asset classes, only high-yield bonds sport higher yields, but with much greater credit risk.

Data by YCharts

The Federal Reserve is guiding for several rate cuts in the coming months. USFR’s dividend yield should decline alongside these cuts, more or less immediately. Although the fund’s dividend yield should remain competitive for a few years, longer-term and riskier securities should outperform long-term. As such, USFR seems mostly appropriate for more conservative or short-term investors, in my opinion at least.

Spread to T-Bills

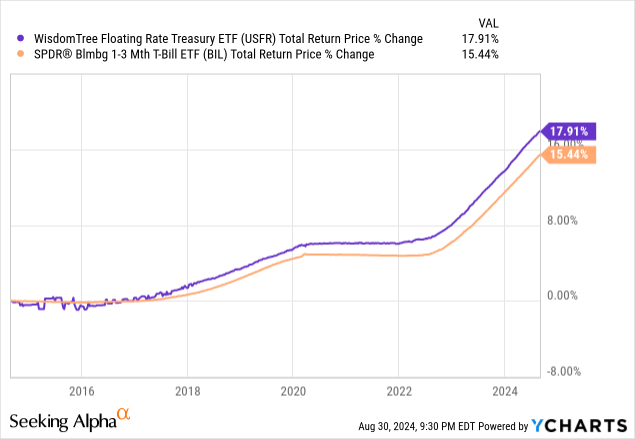

USFR’s most important benefit and advantage is its small spread relative to t-bills. It is a small benefit, but an incredibly certain one: dividends are consistently higher, which should lead to consistent outperformance.

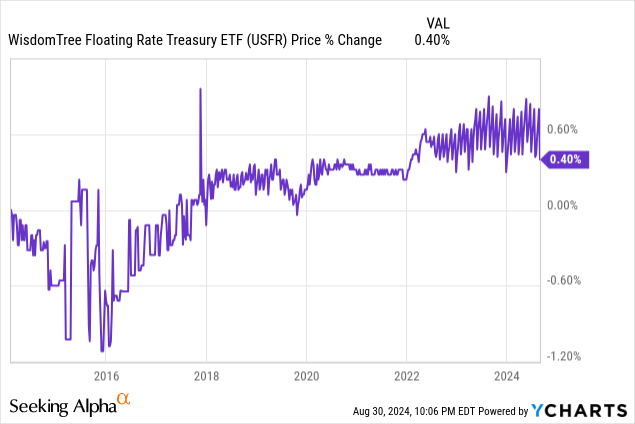

USFR has outperformed benchmark t-bill ETFs since inception, as expected. As an aside, the (small) volatility from 2015 to 2017 was because the fund started out small and illiquid, so small shifts in investor demand would impact its share price.

Data by YCharts

As USFR’s most significant benefit is inherent to its underlying asset class, investors should consider investing in these securities directly. Doing so avoids USFR’s 0.15% in expenses and should lead to marginally higher returns too.

As mentioned previously, these are small benefits, but also certain ones, so picking USFR and floating rate notes over t-bills is a no-brainer.

Credit Risk

USFR invests in floating rate treasuries, issued by the U.S. Treasury, and backed by the full faith and credit of the U.S. Federal Government. Credit risk is effectively nil, barring an unprecedented U.S. default.

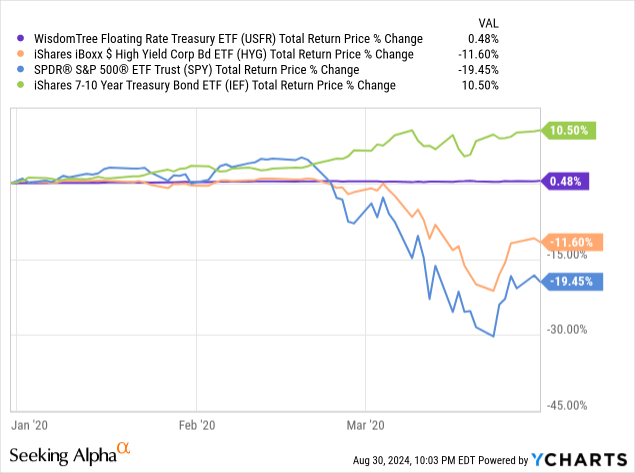

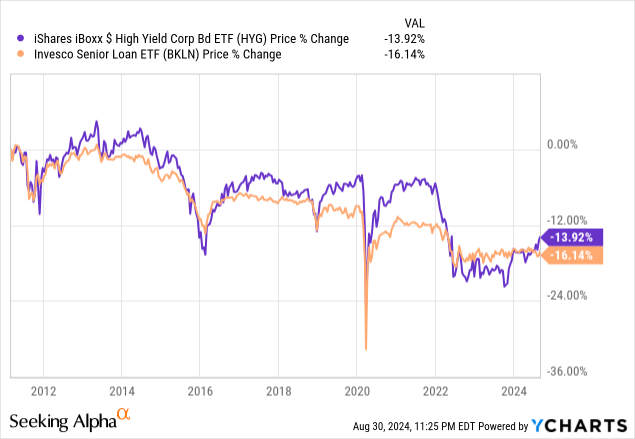

USFR’s extremely low credit risk minimizes losses during downturns and recessions, especially in comparison to riskier bonds and equities. As an example, the fund was not impacted by the coronavirus pandemic, seeing effectively zero losses, draw-downs, or volatility throughout. This compares to double-digit losses for high-yield corporate bonds and equities both. On a more negative note, USFR does not experience the significant gains other high-quality investments, especially treasuries, do during downturns.

Data by YCharts

USFR’s extremely low credit risk also effectively ensures long-term capital stability, making it all but impossible for the fund’s share price to decline long-term. USFR’s share price has been marginally up since inception, marginally outperforming expectations.

Data by YCharts

On the other hand, funds focusing on riskier bonds should see their share prices decline long-term, due to a steady drip of defaults. As an example, benchmark high-yield bond and senior loan ETFs have seen double-digit share price declines since inception, both over a decade ago. Share prices have declined by around 1.0% per year, with lots of volatility.

Data by YCharts

USFR’s extremely low credit risk is a significant benefit for the fund and its shareholders.

Interest Rate Risk

USFR’s treasury notes are floating rate instruments, with effectively zero duration or rate risk.

USFR

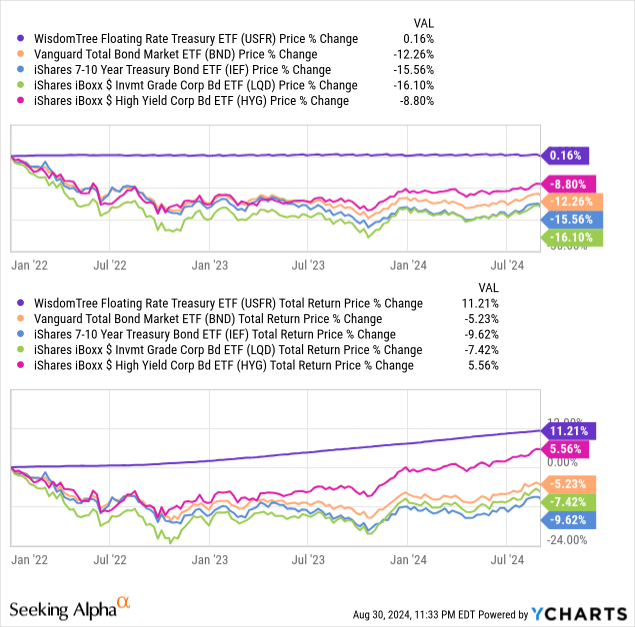

This minimizes capital losses when interest rates increase, leading to outperformance during the same. As an example, USFR’s share price has been flat since early 2022, compared to double-digit reductions for most bonds and bond sub-asset classes. High-yield bonds are the only exception, as these have below-average duration. USFR’s stable share price led to significant outperformance, as expected.

Data by YCharts

On the flip side, USFR’s floating rate instruments see their coupon rates (almost) immediately decline as the Fed cuts rates, and do not see higher prices from these. As a result, these investments should start to underperform in the coming months.

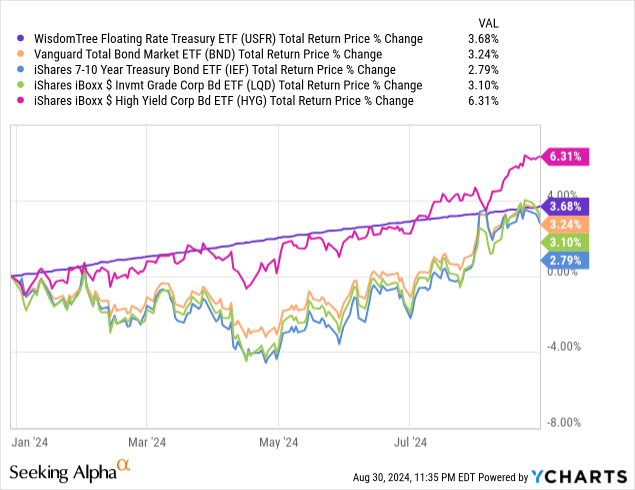

In my opinion, as these investments currently sport above-average yields, and as the market is pricing in several rate cuts already, their performance should remain strong for a year, perhaps two. As partial evidence of this, USFR has outperformed most bonds YTD even though Fed rates are flat, with market interest rates declining due to dovish sentiment. Results are excellent considering the ultra-low risk of USFR’s investments.

Data by YCharts

Conclusion

USFR invests in floating rate treasury notes. These securities are similar to t-bills, with functionally identical risk and volatility, but slightly higher yields and returns. USFR is a solid cash ETF, a strong alternative to t-bills, and a buy for the conservative, short-term investor.

Read the full article here