Portfolio Quality

Portfolio quality is a topic that often appears in the analysis of most net lease REITs (NETL). Beyond the analysis, the topic of quality is almost certain to trickle down into the comment section as readers opine on what makes for a “high quality” portfolio. Quality is a subjective concept and when subjectivity is applied to real estate, it seems to fall apart. Quality is usually relative. Something is superior to another. But, without a point of comparison, determining quality becomes difficult.

REITs are so unique that the idea of quality begins to mean even less. We get lost amongst the contributing factors such as diversification, credit ratings, growth, geography, and myriad other puzzle piece sized considerations. Each of these makes an important contribution to the quality of a portfolio, but they hardly dictate what definitively makes for a high-quality portfolio.

Our articles almost always include a brief summary of high-level portfolio metrics to familiarize the reader with a REIT. For example, our recent coverage of Realty Income (O), the world’s largest net lease REIT, included a section just like this. These sections are important for getting our feet wet, but don’t necessarily provide the context to understand the quality of an asset or portfolio.

The purpose of today’s discussion is to dive into portfolio quality. I will provide my thoughts on what makes for a high-quality asset and cite two contrasting examples of portfolio quality.

The Real Estate Chair

Early in my career, I encountered a successful net lease investor who became a mentor. He had worked on all sides of the net lease puzzle from a REIT analyst at a now non-existent bank to a C-Suite position at a publicly traded net lease REIT. From the beginning he told me there was one, single, paramount concept when it came to analyzing a net lease asset.

He provided an analogy that never left my back pocket. I have shared it with countless friends, students, and other investors who share my interest in real estate… The Real Estate Chair

He said that every net leased asset is sitting on top of a four-legged chair. With all four legs of the chair present and stable, the chair functions normally and you will be comfortable. With three legs in place, you can sit on the chair, but you must maintain your posture and pay attention. With two legs or fewer, the chair will not be able to stand.

Without further ado, let’s introduce the legs of the chair. Note that these do not come in order of any particular importance. As with a chair, each leg is equally important.

Leg #1: Tenant Credit Quality

The first leg of the chair is the credit quality of the tenant on the lease. Most net leases are ten years or longer at commencement. This means long-term cash flow that the REIT is banking on collecting to support their dividend, reinvest into new assets, or at least support the cost of the capital they invested. For a REIT, this means that analyzing the tenant’s ability to pay their rent obligation is one of the most important considerations.

Tenant credit quality can be determined based on a variety of factors, but the importance cannot be understated. Especially during periods of economic stress, tenant creditworthiness can determine rent collection. For example, the pandemic saw a divergence in rent collection, which was highly connected to tenant credit quality. REITs with higher quality portfolios collected rent from larger tenants, while those working with smaller tenants struggled. So, the question becomes, how do we look at credit quality?

REITs have a variety of methods for tackling the credit quality issue. Most REITs have dedicated credit analysts who perform in-house research. These teams are tasked with performing proprietary industry and corporate-level research on prospective deals. This means analyzing financials and developing a report with an opinion on the current financials and outlook. These opinions lie at the heart of a REIT and would be confidential. Each REIT performs a unique degree of due diligence around the creditworthiness of prospective tenants. As with REITs themselves, some are better than others.

If we are to put our trust in credit research teams aside, most net lease REITs also provide details on the credit quality of their largest tenants. In fact, most REITs provide a list of their top ten or twenty tenants and the corresponding percentage of annualized base rent, or ABR, that they comprise. We can analyze the top tenancy to decide whether we agree with their investments based on our own analysis of publicly available financials.

However, this research is cumbersome, and a thorough analysis amounts to a full-time job, hence why REITs employ full-time analysts. Alternatively, at a higher level, we can search for the percentage of rent generated from tenants who are rated “investment grade” by a major rating agency.

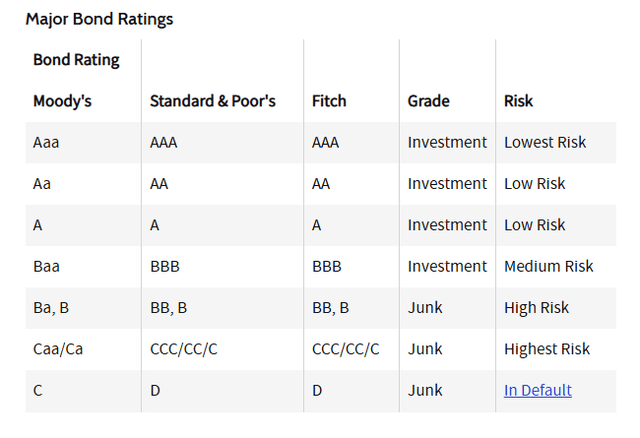

Corporate credit ratings are opinions provided by independent rating agencies regarding the likelihood that a company will meet their forward financial obligations. Simply, a company’s ability to pay their debt. The three largest rating agencies are Standard & Poor’s, Moody’s, and Fitch. These three provide a unique, but similar, scale of ratings to determine the creditworthiness of a borrower. Each has seven rankings from the lowest risk to companies currently in default. Below is an illustration of each company’s list.

Corporate Finance Institute

Investment grade rated companies signify a low-risk investment that is likely to be able to repay their debts. These companies are rated in the four highest categories from AAA-BBB on the S&P scale. Companies rated below these benchmarks are called “Junk” which are generally better than the name implies. That said, they lack the creditworthiness of companies that have earned an investment grade rating.

Typically, investment grade ratings are a critical bellwether for creditworthiness in the world of REITs. Often, an IG rating is enough to check the credit box for some REITs given the likelihood that the underlying company would be able to pay back their debt.

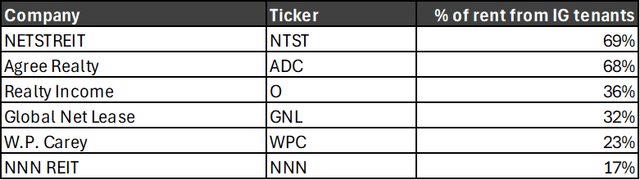

Zooming back to the REIT level, most companies report the percentage of portfolio level rent that is coming from investment grade tenants. As with any credit portfolio, this percentage becomes an important marker of a REIT’s long-term creditworthiness. In most cases, a higher percentage of rent coming from investment grade tenants indicates a higher quality portfolio. Below is a representative sample of net lease REITs with their corresponding percentage of ABR sourced from investment grade tenants, sorted highest to lowest. We used primarily retail and diversified REITs with a history of investment grade tenancy for the sample.

REITer’s Digest

Leg #2 Unit Level Performance

Paired closely with the creditworthiness of the parent company is the unit level performance. Now, as a disclaimer, this concept applies primarily to retail assets. Office and industrial assets are gauged based on their “mission-critical” status instead. This is a far more subjective measure of how important the asset is to the company’s operations.

For example, is the single tenant office the company’s headquarters or a lightly occupied satellite office which has transitioned to remote work? Alternatively, is the industrial facility manufacturing the company’s entire product line, or is it responsible for a specific product that management may soon phase out? These questions are critical to the survivability of the asset. These are also much more qualitative issues, which can also change based on management’s strategy.

In contrast, unit level performance for retail assets is a considerably more complex science. Using quick service restaurants, or QSRs, as an example, historical unit level performance is generally used to set rents in a sale leaseback scenario. If the restaurant has several years of operating history, the franchisee will negotiate with the REIT to determine a “rent to sales” ratio. The rent to sales ratio uses historical top-line revenue to set a sustainable rental figure from which the lease will be set, usually landing in the high single digit percent range. This works by applying a customized rent to the location, as opposed to negotiating off of what would be considered a “market” rent.

Setting the rent to sales ratio appropriately is critical. Set too high and the tenant could fail to pay their rent in the event of declining performance. Set too low and the franchisee is leaving money on the table by not maximizing their leverage through the sale leaseback. In my experience, the standard lies somewhere between 5% and 10%, typically landing near the midpoint.

Once rent is set, the REIT begins negotiating sale proceeds based on an initial capitalization rate, which is generally negotiated independently. On occasion, these two variables can be negotiated concurrently, making the process considerably more complex. Once the transaction is complete, the REIT either holds the asset perpetually or chooses to sell down the road. At any point, unit level performance remains an ongoing consideration. If the asset is leased for 20 years, why is unit level performance relevant?

In the event of a parent bankruptcy, unit level performance is used to determine which assets are kept and which are rejected. High performing assets are more likely to survive a bankruptcy cycle. However, even under the worst circumstances in which an operator becomes non-existent, assets with strong unit level performance are more likely to be quickly scooped up by a competitor. Think about it this way, if a particular location was booming, the parent’s failure isn’t necessarily indicative of the asset’s merit. Even until the bitter end, there were strongly performing Bed Bath & Beyond stores.

Unfortunately for us, unit level performance is difficult to measure from the outside looking in. REITs typically require tenants to report unit level profit & loss statements that are tracked to ensure long-term financial viability. These reports are critical for tracking current performance and projecting problems, which could materialize.

Leg #3 Location, Location, Location

The classic real estate motto… location, location, location. Tied closely to the second leg of the chair, geography is a critical piece of the net lease puzzle. Unit level performance measures the financial performance of the asset through their profit and loss statements. Location is another, equally important, asset level consideration. Location presents opportunities and risks for a REIT.

Looking at the portfolio level, investing across geographies provides diversification. Most REITs choose to target wide geographies, especially in the net lease sector, where geographic expertise provides limited value. Some REITs choose to go even wider, such as O who invests across the globe. Net lease is quickly expanding, and REITs are moving across the world to capitalize on new opportunities.

At the asset level, location has more specific qualities to consider. First and foremost, analysts will look at the market or metropolitan statistical area, shortened to MSA. This analysis looks at the macroeconomic factors of the surrounding area, such as population density, income, education, etc. These considerations are unique to different assets. For example, dollar stores are often situated in low-income areas, moving closer to their target demographic. In contrast, this quality would not work for a luxury retailer such as Restoration Hardware (RH). A grocery store will have different priorities than other big box retailers such as Walmart (WMT). Over the long term, the quality of the location determines the likelihood that a retailer will stay. As cities change, retailers abandon underperforming markets.

Looking even closer some assets such as QSRs or convenience stores, abbreviated to C-stores, will search for convenient positioning such as hard corners with good access for vehicles and foot traffic. QSRs will often look to cluster themselves close to one another, creating food corridors. Each asset class has a unique set of considerations for their location.

However, location also plays an important role in an asset for a downside scenario. Assets located in dense markets like Southern California have more valuable land due to the number of potential reuses and elevated demand. In contrast, assets in rural areas lack the value of the underlying dirt because there is little demand for the space. This means two identical assets have very different value trajectories over the long term. Assets in desirable locations are generally better investments, but as expected, are much more expensive.

Being on the corner of “Main & Main” is surprisingly important and often hidden within the details. REITs have massive portfolios which often provide limited descriptions of geographies, let alone independent addresses. Faith is placed in management that they are investing in strong assets located in good geographies.

Leg #4 Fungibility Of Assets

The final leg of the chair is a far more nuanced piece of the puzzle. Fungibility of the underlying asset is a critical consideration for the long term. In this case, fungibility is the reusability of an asset by another tenant. Net leased real estate is often occupied by tenants who demand a specific format for their business. The degree of the specifics can become problematic for the landlord down the line, should the original tenant change their format or choose to leave.

The simplest example of this would be gas stations. The underground storage tanks of gas stations are an environmental nightmare for a landlord or future tenant. They can often be a limiting factor for the reuse of a site and can demand considerable effort to remediate leaking tanks. The financial burden can be enormous for a landlord. This scares away other prospective tenants, making their potential reuse limited. Over the long term, this makes gas stations and C-stores with pumps hazardous investments, even with tenant agreements to remove tanks in place.

However, the glaring examples are often non-issues. There are workarounds for many of these large-scale issues, and some REITs even specialize in taking this head on. For example, Getty Realty (GTY) invests specifically in C-stores.

A more nuanced and problematic example is Sonic Drive-In. Close your eyes and imagine the typical Sonic Drive-In. The restaurant format is extremely unique, resembling no one else in the fast food world. Typically, Sonic locations are a small building, less than 1,000 SF, and a large, covered parking lot where customers park. This format is unaccommodating for any future tenant who does not share the drive-in business model. Without a dining room, the building is limited to room for the kitchen staff. Should Sonic choose to leave the location, the most likely scenario for the tenant is to redevelop the site completely.

This is costly for a REIT, especially in the net lease sector where investors expect predictable cash flows. REITs are not in the business of redeveloping assets and outlaying large amounts of capital on a speculative basis.

On the other hand, Pizza Hut restaurants are notoriously re-leasable assets. The traditional red roof format became an iconic staple in small towns across America. Many of these have been secondarily re-leased to a variety of tenants including local restaurants. Some have even been repurposed into different uses such as fitness centers or showroom style retail.

When investing, net lease REITs often look at qualitative aspects like fungibility and valuation metrics such as replacement cost to determine if the pricing of the building itself is reasonable. Assets that are not fungible present considerable long-term risk for the landlord. Assets built with a simple format have an opportunity to lease faster in a downtime scenario and require less capital outlay to attract a replacement tenant.

The Bottom Line

We arrive back at the four legs of the real estate chair. Each leg is equally important in holding the weight of an asset. An asset needs at least three of the four legs to be successful. In a perfect world, all four legs of the chair will be there to support your case.

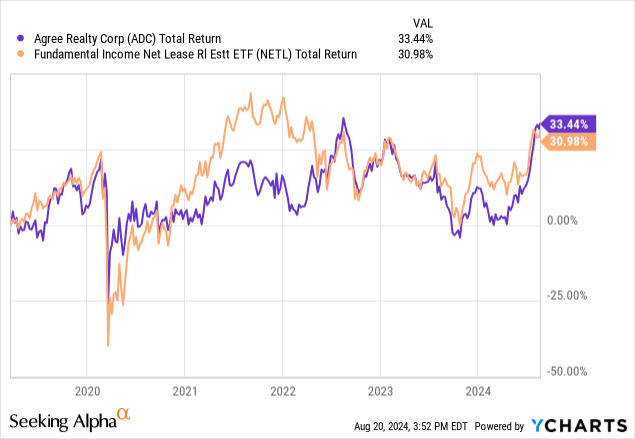

With these elements in mind, let’s focus on two companies. The first executes on these principles well and has benefited tremendously. The second has struggled to apply the concepts and has trailed sector performance as a result.

Agree Realty

Agree Realty (ADC) is one of the largest REITs focusing on single tenant retail assets. We recently covered ADC’s Q2 earnings release, rating the company a “Strong Buy”. We have long lauded ADC as one of the best managed REITs in the net lease sector. The company owns a diverse portfolio of single tenant assets and ground leases. Seeking Alpha provides the following company profile of ADC:

Agree Realty Corporation (the “Company”), a Maryland corporation, is a fully integrated real estate investment trust (“REIT”) primarily focused on the ownership, acquisition, development and management of retail properties net leased to industry leading tenants. The Company was founded in 1971 by its current Executive Chairman, Richard Agree, and its common stock was listed on the New York Stock Exchange in 1994. As of March 31, 2024, the Company owned 2,161 properties, with a total gross leasable area (“GLA”) of approximately 44.9 million square feet.

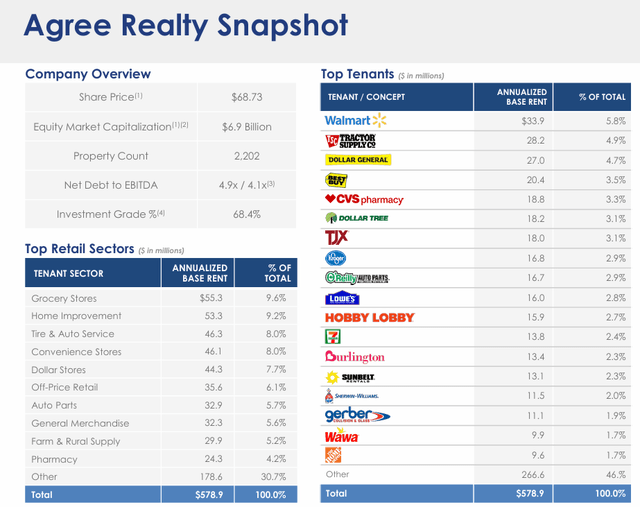

ADC Investor Presentation

ADC exemplifies the four legs of the real estate chair.

Looking from top to bottom, ADC has one of the highest portions of rent generated from investment grade tenants. At nearly 70%, ADC generates most of their revenue from highly rated tenants, including WMT, who is the largest, accounting for almost 6% of rental revenue. ADC’s largest tenants are some of the most creditworthy names in the sector.

ADC’s identification of strongly performing assets was also evident when the company led the sector in rent collected during the pandemic. While the best REITs, including blue chip O, struggled to collect from tenants, ADC continued collecting nearly the entirety of their revenue at the deepest points of the shutdowns. The company also has a reputation of investing in highly fungible, well-located assets. I have heard the motto “if you like square buildings, you’ll love ADC”, highlighting the reusable nature of the company’s portfolio. The company’s recent announcement of a development on a highly trafficked corridor was also a positive sign that the company’s assets are situated in desirable locations.

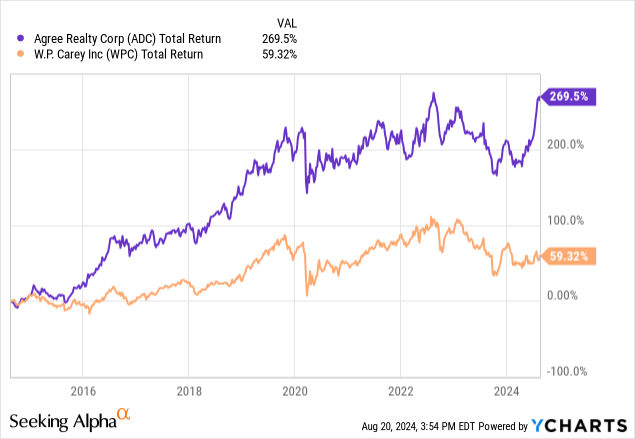

ADC discipline has benefited the company financially, making ADC one of the top performing net lease REITs over the past ten years.

W.P. Carey

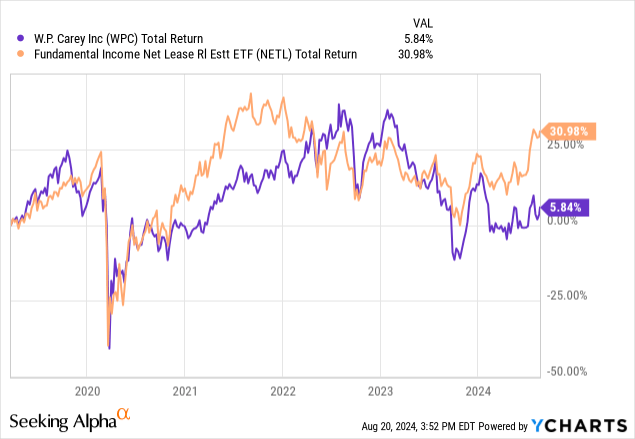

In contrast to ADC, W.P. Carey (WPC) has struggled to maintain the value of their portfolio. WPC is one of the oldest net lease REITs with a storied history of change. We recently covered WPC’s Q2 earnings release, highlighting strong near term performance and an improving outlook. In the article, we provided the following description of WPC:

W. P. Carey is one of the largest publicly traded REITs in the United States. The company is also one of the oldest publicly traded REITs with a long and well-established history. Over time, WPC has reshaped itself, adding and removing a third-party asset management business and changing their portfolio significantly. Originally, WPC was a sale-leaseback specialist who virtually pioneered the deal structure in Europe. WPC has also been a longstanding provider of development and capital expenditure funding. To my knowledge, WPC was one of the first U.S. REITs which focused primarily on Europe, with a portfolio of office and “mission-critical” industrial facilities.

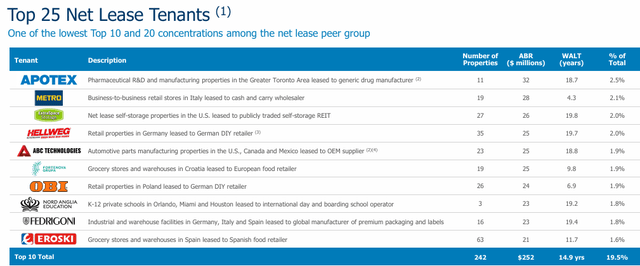

WPC was a pioneer of the sale leaseback, assembling a portfolio of diversified assets that covered industrial, office, and retail around the United States and Europe. Acting as a capital partner for a wide range of business, WPC established an impressive deal network that built the company over decades. However, over time, issues with tenant credit quality and the portfolio has presented troubles reaching the bottom line.

WPC Investor Presentation

WPC’s sale leaseback-centric business model means partnering with companies at varying stages of the corporate life cycle. In each case, the tenant is selling the building to either generate capital or work to recapitalize. Either way, pulling money out of the business by selling real estate. Inevitably, this means that some of the tenants are going through financial changes that could become material. For WPC, this has become an unfortunate reality. As we mentioned in the Q2 coverage, the company currently has more than one tenant in the top 20 that are in financial distress.

The trouble continues as the company’s largest tenant U-Haul (UHAL) repurchased their assets, removing one of the highest quality tenants from the roster. The past three years have been unkind to WPC’s portfolio as quality deteriorates. The trouble has reached the bottom line, causing WPC to trail in growth of AFFO.

Investor Takeaways

Quality always matters. In the net lease world, quality remains one of the key considerations for long-term success. Companies like ADC, which continue building high-quality portfolios, will reap the benefits. Meanwhile, companies that deteriorate like WPC will continue to be exposed as their troubles eventually reach the bottom line. For the investor, doing your homework is essential.

Reading beyond an investor presentation to understand the assets is a key consideration for long-term success.

Read the full article here