Introduction

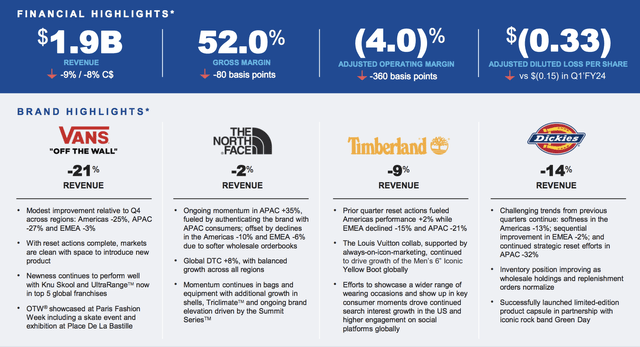

I last covered V.F. Corporation (NYSE:VFC) on April 26th, calling it my “top turnaround for 2024” and assigning a “Strong Buy” rating. At the time of publication, shares were trading at $12.64, and since then, have soared 38.58%, significantly outperforming the S&P 500’s modest 4.79% return over the same period. VFC reported its Q1 FY2025 earnings earlier this week, which I would describe as “less bad” than expected. Revenues reached $1.91 billion, slightly beating analyst expectations by $61.65 million. The company reported an adjusted net loss of $0.33 per share, beating the consensus estimate of a $0.37 loss. Nonetheless, Mr. Market liked what he saw and pushed shares up over 14% during the trading day. As always, opinion follows trend, highlighted by seven analysts raising their price targets following earnings.

VFC investor relations

Given the significant rally since my initial article and the resulting valuation, I am lowering my rating from “Strong Buy” to “Buy.” VFC remains one of my portfolio’s largest positions, accounting for roughly 9% weight. In this article, I’ll give an update on the Supreme divestiture, the ongoing turnaround at Vans, the balance sheet, and a revised valuation. I believe the V.F. Corporation turnaround is just getting started, and here’s why:

$1.5 billion Supreme divestiture

In 2020, V.F. Corporation completed the $2.1 billion acquisition of Supreme – a deal that certainly raised some eyebrows, given its lofty valuation of 15x EBITDA and 4x price-to-sales. In my opinion, the acquisition was the biggest misstep under the Rendle leadership regime, with VFC significantly overpaying for the streetwear brand and over leveraging its balance sheet in the process.

Over the past handful of years, it’s clear that Supreme has yet to live up to its hype. Management initially projected a $1 billion revenue opportunity by FY2024, a target that is nowhere near the ballpark of where we stand today. Supreme’s revenues were $523 million in FY2023 and $538 million in FY2024 and are forecasted to reach $600 million in FY2025. While this year’s forecast positions Supreme as the fastest-growing brand under the VFC umbrella (10% growth), the brand never fits well in the company’s portfolio. Supreme operates a luxury business model with limited drops and a primarily direct-to-consumer (DTC) approach. This strategy starkly contrasts the rest of the VFC brands and limits potential synergies within the portfolio, making Supreme an obvious candidate during the strategic portfolio review.

Fast forward to July, V.F. Corporation announced an agreement to sell Supreme to EssilorLuxottica for an all-cash deal of $1.5 billion. Truth be told, this price tag exceeded my expectations, as did many sell-side analysts. I was expecting a haircut of over 50%, considering the goodwill charge of $394.1 million and the intangible asset charge of $340.9 million in FY2023. The $1.5 billion sale, which values Supreme at nearly 12x EBITDA and 2.5x price-to-sales, is an excellent outcome for VFC given the current M&A environment. The sale comes from a position of strength, with Supreme returning to strong, profitable growth in FY2025. With looming debt maturities of $1.75 billion, management entered this deal with little to no leverage and a critical need to get it done. Overall, this was as good of a deal as shareholders could have hoped for and marks the most significant accomplishment in VFC’s turnaround thus far.

Vans ongoing recovery

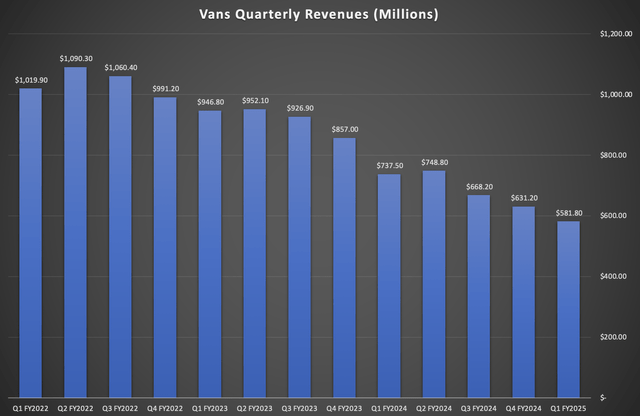

The VFC turnaround story is predicated upon one key element: Reigniting growth at Vans. In FY2022, Vans was VFC’s largest brand, generating $4.16 billion in total revenue. In the most recent fiscal year, Van’s revenues plummeted to $2.78 billion, representing nearly $1.4 billion in lost revenue over the past two years. This collapse of the former golden child resulted from several factors, the biggest being a loss of focus on its core youth audience and culture.

VFC investor relations, Author’s work

A primary initiative of Project Reinvent was the appointment of a new Vans president to succeed Kevin Bailey. During the search for the new president, CEO Bracken Darrell devoted much of his time to working hands-on at Vans to gain a deep understanding of the key issues. The good news is that Bracken has officially been relieved from his fill-in duties. Sun Choe, Lululemon’s former Chief Product Officer, was appointed Van’s new president in late May. During Choe’s seven-year tenure as Chief Product Officer at Lululemon, the company saw its revenues quadruple and became one of the most respected apparel brands worldwide. Choe was instrumental in Lululemon’s entry into footwear and is a highly respected leader in the apparel industry, as evidenced by the 7% increase in VFC shares following the announcement. Former colleagues and employees have noted that Choe has been an avid fan of Vans skate shoes for years and is well known for wearing Vans Old Skools to the office. I believe that this hire is exactly what Vans needs – a leader with a history of building a product-driven, strong brand culture. The core issue was never the Vans product itself, but rather a disconnect from its core audience. I am confident Sun Choe has the skills and experience to bridge that gap.

While Choe’s hiring is a huge step in the right direction, it won’t solve Van’s problems overnight. In Q1, Van’s revenues fell by 21% to $581.8 million. On a positive note, this represents a solid improvement over the 27% decline in Q4 and suggests that the rate of decline is stabilizing. A primary focus at Vans has been resetting channels and inventories, evidenced by the 30% reduction in inventories last fiscal year. As of Q1, the reset actions are complete, and new products are set for introduction. Management has also continued to close unprofitable Vans stores, focusing specifically on the U.S. and China regions. While these actions dampen revenues in the short term, they position the brand for healthy, profitable growth over time.

With operations cleaned up and a new brand president, the focus now shifts to reigniting growth at Vans. Management has a solid plan in place for this, and it all starts with innovation. Vans has recently released a variety of new shoes that are performing exceptionally well. For example, the Knu Skool shoes have quickly become the number two franchise globally, while the UltraRange shoes are now the fifth most popular franchise. In addition to these new product launches, Vans has rolled out several new marketing campaigns. These include the “Grassroots” campaign, “Always Pushing” campaign, and the influencer campaign. The influencer campaign has been particularly successful, with key figures at the forefront of culture wearing Vans. Celebrities like Emily Ratajkowski, Sofia Richie, and Morgan Stewart McGraw have been spotted wearing the classic checkerboard Vans, driving a 5,000% spike in Google search trends over the past 90 days. This traction has also carried over to TikTok, where videos about this trend have garnered over 41.6 million views. Vans publicity isn’t just limited to TikTok and influencers; it has been on full display by athletes at the Paris Olympic Games this summer. Vans has over 20 sponsored athletes competing at the games and, just this week, secured gold and silver in the women’s skate event.

Looking ahead, management remains optimistic about Van’s near-term outlook. Future order books continue to show strength and green shoots are beginning to emerge. For instance, EMEA is showing early signs of a recovery, with wholesale up in the region for the first time in six quarters. With that said, after eight consecutive quarters of declining YoY revenues, I believe all signs point toward a second-half inflection at Vans. The combination of new products less reliant on promotional activity gaining traction, healthy inventories, and successful marketing campaigns support this bullish outlook. Additionally, lapping easier year-over-year comparisons, primarily due to aggressive destocking and reset actions that temporarily dampened revenues, further suggest a second-half turnaround and a return to modest growth in FY2026.

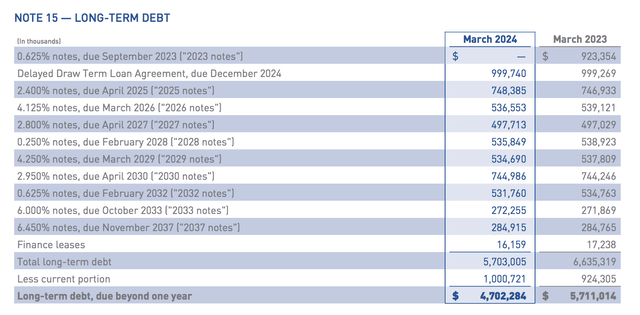

Balance sheet and debt

One of Bracken Darrell’s key initiatives under the “Project Reinvent” program has been strengthening the balance sheet and reducing overall leverage. Management has made solid progress, reducing net debt by $587 million year over year. A key goal for management has been to avoid refinancing two upcoming debt maturities: a $1 billion draw term loan due in December 2024 and $750 million in 2.4% notes due April 2025.

VFC FY2024 annual report

With $637.4 million in cash and cash equivalents and FY2025 free cash flow projected at $600 million ($460 million after accounting for quarterly dividends), there was still a significant gap to cover these maturities. However, the $1.5 billion sale of Supreme, expected to close by the end of the calendar year, has resolved this problem. The sale enables management to clear both tranches early and avoid the associated interest expenses. After both tranches are paid off, VFC’s net debt will be reduced to approximately $3.5 billion. Without the burden of an over-leveraged balance sheet, Bracken Darrell will have the flexibility to focus on the core brands and position them for a return to growth in FY2026.

While the sale of Supreme provides plenty of room to repay upcoming maturities, it doesn’t rule out the possibility of further divestitures. For example, there have been rumors about a potential divestiture of the Packs business for over two years. This business, which includes JanSport, Kipling, and Eastpak, is collectively valued at approximately $500 million. With prior reports of significant interest from multiple parties, I wouldn’t be surprised to see additional asset sales on the horizon. While Bracken mentioned no specific plans, I believe investors will hear more details at the upcoming investor day on October 30th. I expect management to provide a long-term financial outlook, including deleveraging plans and an update on the overall brand portfolio. If there are additional asset sales, this will likely be when investors learn about them.

Updated valuation

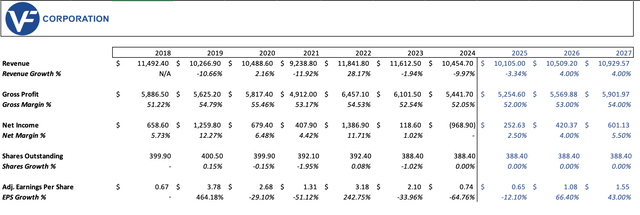

VFC investor relations, Author’s calculations

I have revised my initial valuation to consider the Supreme divestiture and Q1 earnings. For FY2025, I now project revenues will decline to $10.1 billion, followed by 4% sequential growth through FY2027. This return to modest growth assumes a second-half inflection for Vans and a return to growth for the brand in FY2026. Additionally, I expect The North Face will return to modest growth in FY2026.

I projected relatively flat gross margins for FY2025 and modest sequential growth to 54% by FY2027. While management hasn’t offered much guidance thus far, I expect to hear a detailed financial outlook on the upcoming investor day, including future growth rates, margins, and free cash flow.

With these updates, my FY2027 adjusted earnings per share target is $1.55. Applying a 20x P/E multiple, consistent with VFC’s five-year average, lands at a share price of $31. This target implies a potential upside of 77% from the current share price. Over three years, this boils down to a 21% compound annual growth rate.

Risks

While I’m incredibly bullish on the VFC turnaround, there are always risks to consider with any investment. These risks include:

- Decline in consumer confidence: As a consumer discretionary apparel brand, VFC’s performance is closely tied to overall consumer health. Any downturn or recession could pose significant challenges.

- Solvency risk: VFC has $5.3 billion of net debt. Failure to complete the sale of Supreme by the end of the calendar year could lead to serious solvency issues.

- Failure of the Van’s turnaround: A key part of my investment thesis is the successful turnaround of Vans, VFC’s second-largest brand. If management cannot do so, revenue growth could remain under pressure for the foreseeable future.

Bottom line

Overall, V.F. Corporation had a solid quarter and provided investors with several key updates. These include the $1.5 billion sale of Supreme, the appointment of Sun Choe as the new president of Vans, and an upcoming October investor day. With the balance sheet concerns lifted, the focus now shifts to reigniting growth. Bracken Darrell has set the stage for the turnaround; it all comes down to execution. I’m looking forward to hearing more about VFC’s future outlook at the investor day on October 30th. I am adjusting my “Strong Buy” rating to “Buy,” with a revised three-year price target of $31.

Read the full article here