RLJ Lodging

RLJ Lodging (NYSE:RLJ) is a hotel REIT that owns premium-branded full-service hotels. These hotels are leased to well-known hotel management companies like Hilton, Hyatt, and Marriott. They are geographically diversified with hotels in 23 states.

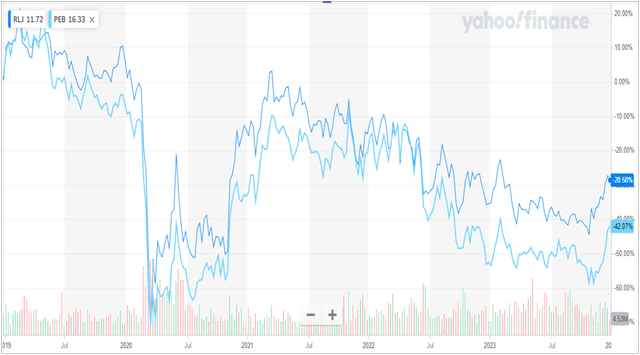

RLJ has a boatload of cash on its balance sheet, which is likely part of the reason it has outperformed Pebblebrook over the last 5 years, which includes the COVID period when many hotels were shut down.

Yahoo Finance

As you can see, during this difficult period, RLJ’s common stock dropped 28% while PEB fell 42%.

Many years back, RLJ bought another hotel REIT named FelCor. It was FelCor that had the convertible preferred stock which RLJ inherited and gave it the ticker RLJ-A (NYSE:RLJ.PR.A). Because it was a convertible preferred, RLJ could not call it as there is no call provision in the prospectus. Thus, RLJ-A has unlimited upside which is fairly rare in the preferred stock world.

Although RLJ-A is a convertible preferred stock, the convertible feature has little to no value, so this preferred stock should simply be viewed as a normal preferred stock but one that cannot be called.

Pebblebrook Hotel Trust

Like RLJ, Pebblebrook (NYSE:PEB) has premium-branded full-service hotels with geographically diverse locations. Their hotels also include some resort-style hotels. The size of PEB is almost identical to RLJ which helps make for a good comparison.

Unlike RLJ, however, PEB has very little cash on its balance sheet and has been spending cash to buy back its common stock. While that may possibly work out for common stockholders, its leveraging up of its balance sheet is certainly not good for its preferred stockholders.

I harken back to Qurate (QRTEA) which thought its stock was a bargain at $11.00 and was burning its cash buying back stock and paying special dividends only to find that business turned down and the stock now trades below a dollar. And its preferred stock is down 70% from its high.

Pebblebrook has 4 preferred stocks outstanding with the tickers PEB-E (PEB.PR.E), PEB-F (NYSE:PEB.PR.F), PEB-G (PEB.PR.G) and PEB-H (PEB.PR.H).

Comparison of RLJ-A to PEB Preferred Stocks

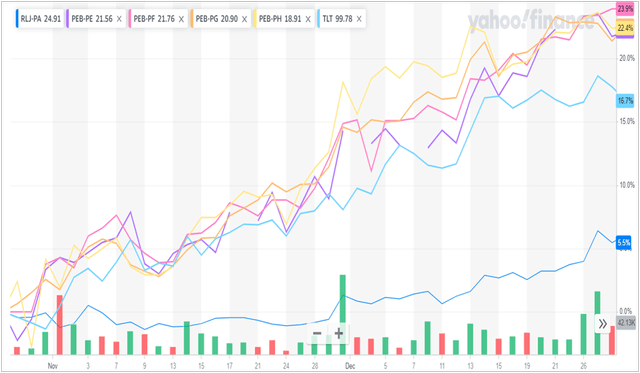

What has been amazing is the disconnect in pricing between RLJ-A preferred stock and those of PEB over the last 2 months for no apparent reason. When I see this, I want to investigate further.

2-Month Price Chart

Yahoo Finance

As you can see, RLJ-A is up only 5.5% during the big fixed-income rally over the last 2 months while the long bond ETF, symbol TLT (light blue line), is way up by 16.8%. And RLJ-A’s lag versus its closest peer hotel REIT preferred stocks is just massive, with RLJ-A underperforming PEB preferreds by 17% in the last 2 months. This type of price disconnect without reason often offers up opportunities.

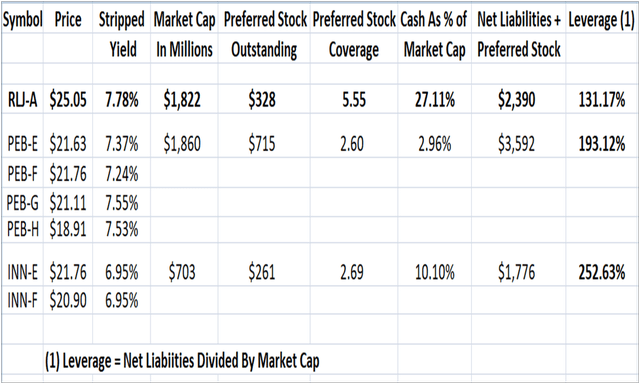

While I love to buy into fixed-income securities that have massively lagged a rally for no apparent reason, we still need to check the fundamentals to see if RLJ-A is extremely undervalued relative to its peers as the above chart might indicate; and whether we truly have a large amount of total return potential here. So here is a chart of the most important fundamental information on RLJ-A as well as the PEB preferred stocks. In addition, I added information on another smaller hotel REIT, Summit Hotel Properties (INN), and its 2 preferred stocks, INN.PR.E and INN.PR.F. I have done this to further confirm the undervaluation thesis for RLJ-A. The prices used are from Friday’s close.

Author

As you can see from the “Market Cap” column, RLJ and PEB are virtually the same size hotel REITs with INN being a smaller REIT. And although it would appear to those unfamiliar with RLJ-A that it doesn’t have much upside at its current $25.05 price, RLJ-A is a convertible preferred and cannot be called. So it actually has unlimited upside whereas the others don’t. Before COVID hit, RLJ-A was selling at $29.00 per share. So let’s look at the important metrics in the above chart.

Yield Comparison

RLJ-A’s 7.78% yield is better than its closest peers from PEB. PEB preferred stocks average only around 7.45% and RLJ-A’s balance sheet is much better as we will see soon, making the mispricing quite large. PEB-F really looks like a preferred stock to be sold. To confirm that RLJ-A is undervalued in terms of yield, its 7.78% yield is also hugely better than highly leveraged INN preferred stocks which yield a mere 6.95%. That is an insane mispricing and makes RLJ-A look like a serious bargain here.

Preferred Stock Coverage

As we can see, RLJ’s market cap covers its preferred stock by 5.55 times whereas PEB covers its preferred stocks by 2.6 times.

Cash

RLJ-A has a massive amount of cash which is one of the reasons I find it very safe, certainly much safer than INN and PEB. RLJ currently has $494 million in cash while its preferred dividends only amount to $25 million per year. So that looks excellent. And when compared to its PEB, RLJ’s cash position is equal to 27% of its market cap while PEB’s puny cash balance makes up less than 3% of its market cap.

Leverage

I computed leverage as net liabilities plus preferred stock divided by market cap. With this logical formula, RLJ-A’s leverage is only 1.31 times its market cap while PEB’s leverage is significantly higher at 1.93 times and INN’s leverage is very large at 2.52 times.

So how can RLJ-A be paying such an oversized yield versus INN and PEB preferred stocks when it has a cash position that is huge compared to peers, preferred coverage that is much larger, and with leverage that is much lower than its peers. The answer is there is a large relative mispricing going on here.

Fair Yield For RLJ-A

So if very leveraged INN preferred stocks yield 6.95% and leveraged PEB preferreds yield around 7.45%, what should RLJ-A’s yield be given its much superior balance sheet and safety? It would seem to me that a fair value yield of 7% would be a conservative estimate.

Relative Fair Value Price of RLJ-A Is $27.80

For RLJ-A to trade at its fair relative yield, it should trade at $27.80. At that price, it would offer up a 7.0% yield. So it is $2.75 undervalued. Actually, I would say that it is even more undervalued than that relative to INN preferred stocks. Maybe the market has forgotten that RLJ-A can’t be called and people don’t want to pay much over par for it, but investor misunderstanding can often lead to bargains.

So those holding PEB preferred stocks (and INN preferreds as well) should strongly consider swapping them for RLJ-A. And if you don’t own PEB or INN preferreds, selling them would seem to be a good course of action.

Taxation

As a REIT preferred stock, 20% of RLJ-A’s dividends are tax-free for American investors.

Summary/Conclusion

We have had a huge rally in treasuries bonds over the last 2 months so interest rates on the long end have dropped significantly. This has led to a strong rally in many preferred stocks and bonds. But RLJ-A has significantly lagged the rally for no apparent reason. While the preferred stocks of RLJ’s closest peer, PEB, have rallied around 23% from 2 months ago, RLJ-A has only rallied 5.5%. That almost certainly provides an investment opportunity somewhere.

Not only does RLJ-A offer up a higher yield than PEB preferreds, and unlimited price upside, but RLJ-A looks to be a much safer preferred stock than PEB preferred stocks. Not only is RLJ’s leverage much lower than PEB but RLJ has a mountain of cash versus PEB which has a puny amount of cash and is using its cash and leveraging up its balance sheet to make common stock buybacks.

To confirm that RLJ-A is very undervalued, we also looked at the yield and leverage of RLJ versus another hotel REIT symbol INN. In that comparison, RLJ-A is even more undervalued than its closer peer PEB preferreds.

In comparison to PEB, RLJ-A looks to be $2.75 undervalued which shouldn’t be a surprise since the price of RLJ-A has lagged PEB preferreds by 17% over the last 2 months. And versus INN preferreds, RLJ-A is even more undervalued. Thus, RLJ-A clearly has a much better total return potential; capital gains plus dividend yield. Thus, the recommendation is that RLJ-A be purchased and PEB and INN preferred stocks be sold or avoided.

Read the full article here