High inflation continued to inflict financial pain on many Americans at the end of 2023, even as price pressures within the economy gradually cooled, according to Federal Reserve data published Tuesday.

Findings from the Fed’s Economic Well-Being of U.S. Households report for 2023 show that chronic inflation made financial lives “worse” for about 65% of U.S. adults. Among those respondents, 19% said their financial situation was “much worse” due to higher prices.

And while 34% of respondents said their family’s monthly income had climbed in the past year, 38% reported their spending had also increased.

INFLATION INCREASES 3.4% IN APRIL AS PRICES REMAIN ELEVATED

About three-fourths of adults – 72% – said they were doing “OK” financially as of October 2023 – down from 78% in 2021 and the lowest rate since 2016. That number is much lower among parents. The share of parents doing at least “OK” financially fell 5 percentage points to 64%, the lowest level since 2015 when the survey began.

While inflation has fallen considerably from a peak of 9.1% notched during June 2022, it remains well above the Federal Reserve’s 2% goal. On top of that, prices are up a stunning 19.4% since January 2021, before the inflation crisis began.

HIGH INFLATION IS CHANGING THE WAY AMERICANS RETIRE

High inflation has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food and rent. Grocery prices are up more than 21% from the start of 2021, while shelter costs are up 18.37%, according to FOX Business calculations. Energy prices, meanwhile, are up 38.4.%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

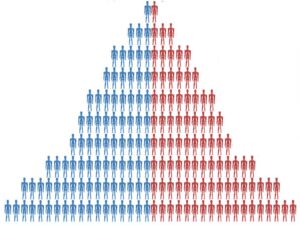

Price hikes are particularly devastating for lower-income Americans because they tend to spend more of their already-stretched paycheck on necessities and therefore have less flexibility to save money.

The typical U.S. household needed to pay $227 more a month in March to purchase the same goods and services it did one year ago because of still-high inflation. Americans are paying on average $784 more each month compared with the same time two years ago and $1,069 more compared with three years ago.

Read the full article here