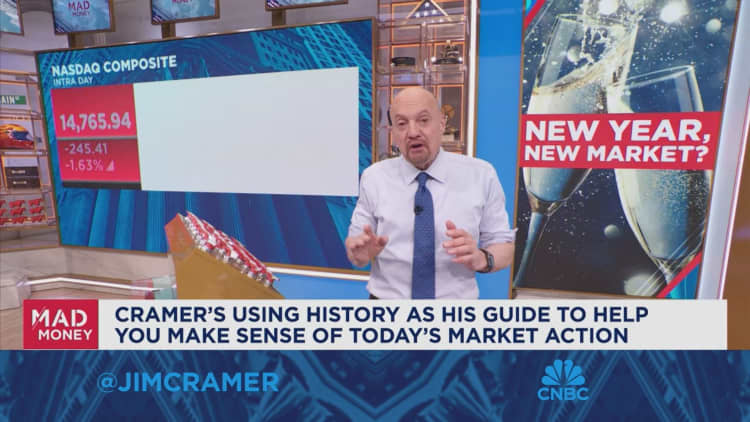

CNBC’s Jim Cramer on Tuesday shared his market predictions for 2024, but also warned that the first days of the new year often don’t say much about the future.

He suggested that Wall Street may now be seeing a “sector rotation“ as some investors doubt that the Magnificent Seven tech stocks will continue their runs, instead buying up stocks that have seen steep declines such as food or pharmaceutical names.

“According to my crystal ball, people will take profits in the best of the best, the ones that have defined this market, yes, the Magnificent Seven and friends, as well as the richly valued software enterprise names,” Cramer said. “I think investors will use that cash to invest in companies that haven’t gotten any respect for ages.”

Many years begin with a lot of this “repositioning,” Cramer said, but the moves may be temporary. Investors may start to buy back stocks that performed well in December, albeit at lower levels, once companies start to report earnings, he added.

To Cramer, a lot of Wall Street action will center around the Federal Reserve’s decisions, with many trying to predict and then scrutinize the organization’s moves, all the while fearing a recession. Rather than getting too caught up with Fed worries, he said investors would be wise to choose stocks of companies that they believe have solid leadership and are reasonably valued — not dramatically higher than the average stock in the S&P 500.

“So, wait patiently for the sell-off that I’m expecting and then do some buying,” Cramer said.

Read the full article here