Home, energy, car and childcare costs have all increased since President Biden took office and there is no end in sight as inflation remains stubbornly high.

The latest consumer price index (CPI) report showed inflation eased slightly in April, rising only 0.3% when economists had expected a 0.4% increase. President Biden welcomed news that core inflation “fell to its lowest level in three years,” but acknowledged “we have a lot more to do.”

“Prices are still too high — so my agenda will give families breathing room by building two million new homes to lower housing costs, taking on Big Pharma to lower prescription drug prices, and calling on grocery chains making record profits to lower grocery prices for consumers,” Biden said in a statement.

He also criticized Republicans, claiming that GOP-supported tax cuts and spending reductions for Social Security and Medicare “would send inflation skyrocketing” — although Republicans have put forward no serious proposal to limit entitlement spending.

INFLATION INCREASES 3.4% IN APRIL AS PRICES REMAIN ELEVATED

CPI is a broad measure of how much everyday goods like gasoline, groceries and rent cost. Contained in the Labor Department’s report are figures for so-called core prices, which exclude the more volatile measurements of gasoline and food in order to better assess price growth trends. Biden celebrated that core prices only rose 0.3% in April and 3.6% from the same time last year — the lowest reading since 2021.

However, price increases at slower rates are still price increases, and Americans face far higher costs today than when Biden assumed office in January 2021.

Data from the Bureau of Labor Statistics shows shelter costs, that is, rent, mortgage payments, real property taxes and other costs associated with housing have increased 20.9% from Jan. 2021 to April 2024.

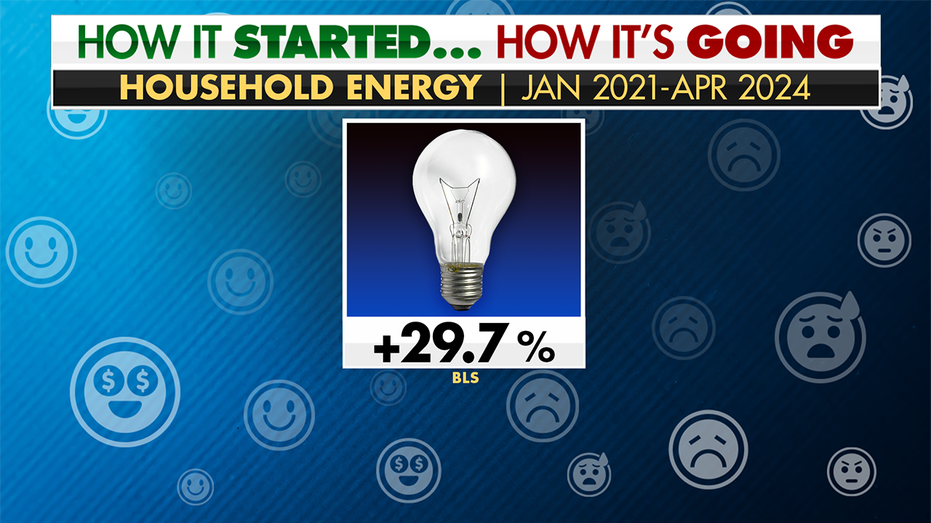

Household energy costs were up 29.7% in the same period.

WHY ARE GROCERIES STILL SO EXPENSIVE?

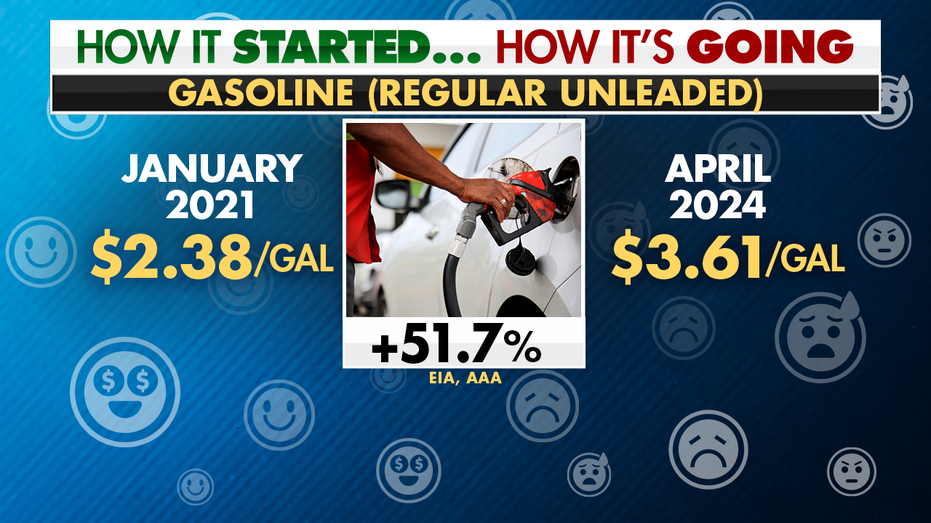

For those leaving home, the price of gasoline has risen from an average $2.38 per gallon in Jan. 2021 to $3.61 per gallon, according to the Energy Information Administration (EIA) and AAA. That’s an increase of more than 50%. Gasoline and shelter prices accounted for over 70% of the monthly CPI increase in April.

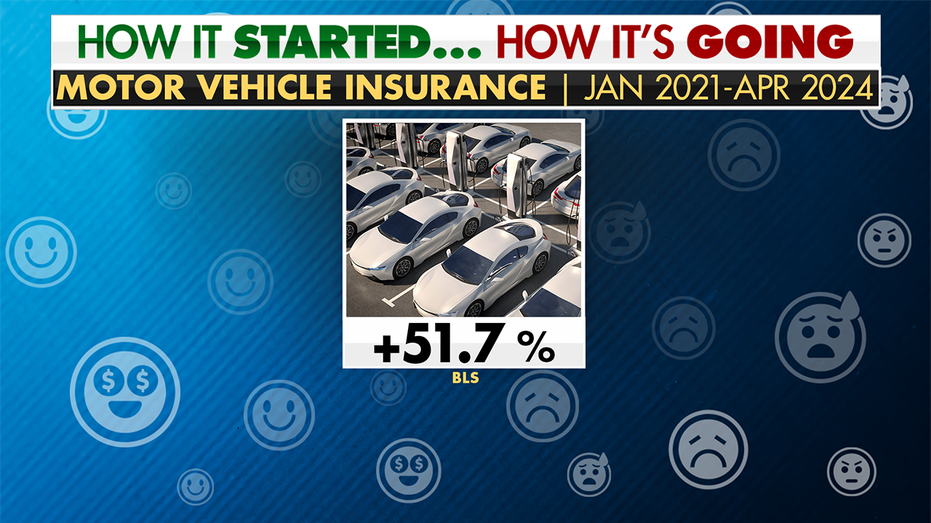

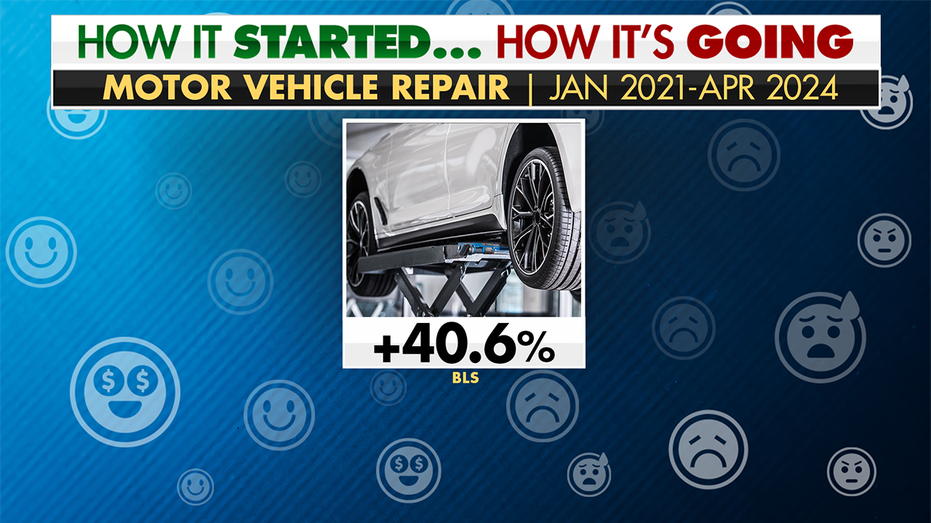

It costs more for Americans to insure their cars as well, with vehicle insurance costs up 51.7% since Biden took office. Car repairs cost 40.6% more too, Bureau of Labor Statistics data shows.

Going out to eat? Food away from home prices have jumped 21.8% in the last three years. Sending kids to college? Tuition and fees are 6.1% more expensive. Children too young for school? Daycare and preschool costs are 9.3% more expensive since Jan. 2021.

To deal with inflation, Federal Reserve policymakers are considering whether to slash interest rates. Fed Chair Jerome Powell said Tuesday the central bank will need to be patient and wait for evidence that inflation is slowing before it cuts rates.

AMERICANS ARE CARRYING A RECORD AMOUNT OF HOUSEHOLD DEBT

“We did not expect this to be a smooth road, but these were higher than I think anybody expected,” he said. “What that has told us is that we will need to be patient and let restrictive policy do its work.”

Republicans blamed Biden’s policies for persistent inflation after the CPI report came out Wednesday and claimed prices will only get worse if he remains in office.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Life is less affordable under President Biden, and hardworking Americans are being forced to drain their pocketbooks just to keep up. Unfortunately, the policies proposed in the President’s budget would only exacerbate inflation and saddle future generations with trillions more in debt,” said Rep. David Schweikert, R-Ariz., the vice chairman of the Joint Economic Committee.

“We must stop adding fuel to the fire and return to the pro-growth policies that brought prosperity to so many American families,” he added.

Fox Business’ Megan Henney contributed to this report.

Read the full article here