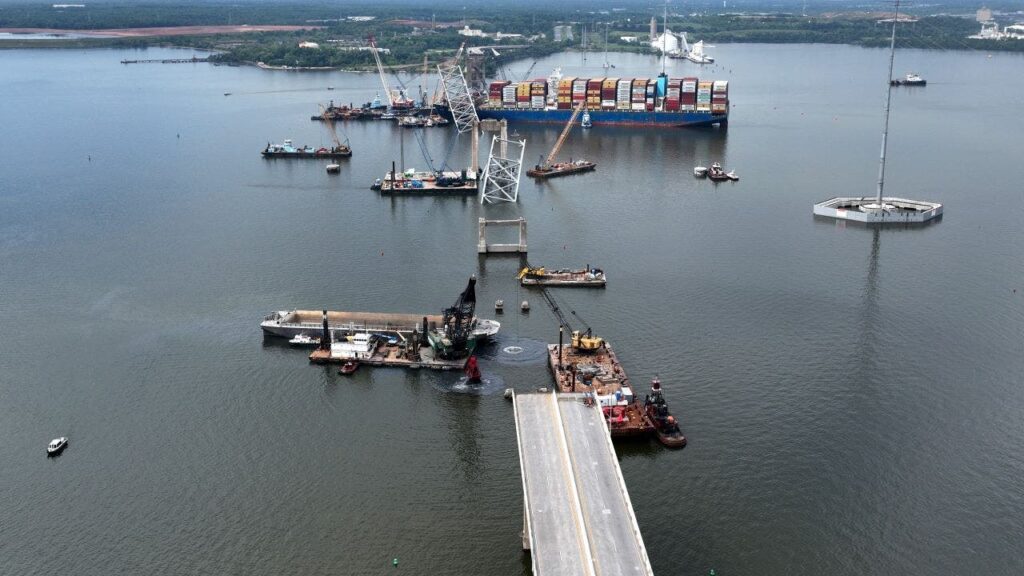

Baltimore-headquartered CFG Bank is rolling out a special money market account that allows depositors to contribute a portion of the interest they accrue to benefit relief and recovery efforts in the city after the Francis Scott Key Bridge collapsed in late March when it was struck by a container ship that lost power.

CFG’s Maryland Tough Baltimore Strong high-yield money market account allows commercial and retail customers to donate 0.05% of their accrued interest through the end of the year to the Maryland Tough Baltimore Strong Key Bridge Fund. Existing depositors can easily transfer funds from an existing CFG Bank account, while new customers who are interested can create an account online or in-person.

The fund was created by the Baltimore Community Foundation and provides funds for the families of the six people who died in the tragedy and first responders and their families, as well as port workers who’ve been displaced and small businesses that have faced disruption. Dwyer said interest donated through the accounts will be matched up to $500,000 by the bank.

“In light of the horrible tragedy, I was really trying to think some things through that I could really do to help,” CFG CEO Jack Dwyer told FOX Business in an interview. He said the money market fund providing interest to the Baltimore relief fund makes it “one of a kind product” and added that “As far as I know, no one’s ever tried to do anything like this before.”

BODY OF 6TH VICTIM IN BALTIMORE BRIDGE COLLAPSE PULLED FROM WATER

“The way I look at this is we want to try to get as many people as we can to contribute to Maryland Tough Baltimore Strong,” Dwyer said. “And I figured the way to do that would be to basically offer this product to our existing depositors and then solicit other depositors.”

“To me, it’s a much simpler way if you have money in a bank and rather than writing a check, you could just basically say, ‘OK, well I’ll contribute 5 basis points of the interest to this account, Maryland Tough Baltimore Strong,'” he added.

BALTIMORE BRIDGE COLLAPSE POSES ‘TEMPORARY RISK’ TO LOCAL, STATE ECONOMIES: MOODY’S

“My goal was to try to raise at least $1 million to really help the families of the people who’ve lost their lives, the port workers and their families who have been totally disrupted, the small businesses in nearby communities. … To just try to do something for them because of this horrible tragedy; I mean there’s a lot of people suffering as a result of that,” Dwyer said.

“It’s not a good situation. And you know, the federal government and the state government, they’re doing everything they can to help,” he added. “But in my opinion, in situations like this, it takes the private sector to step to the plate, and that’s what they really have to do, and that’s what I’m going to do.”

MARYLAND OFFICIALS SAY BALTIMORE KEY BRIDGE REBUILD COULD COST $1.9B

He added that he “absolutely” hopes the charitable giving of interest through dedicated bank accounts is replicated by other financial institutions around the country when disasters and tragedies occur.

“They absolutely should do that,” Dwyer said. “And you know, I try to be innovative, but I want to be copied by others because it’s all going to help good causes and that’s the key.”

“The government can’t do everything, you have to have the private sector stepping to the plate and individuals and companies step up to the plate, and I think it’s a great compliment if I can get other people to follow my lead,” he added.

Read the full article here