Investment action

I recommended a buy rating for Leslie’s (NASDAQ:LESL) stock when I wrote about it the last time, as I thought that FY24 was going to be a great year for the business as it benefits from the inventory normalization situation. As this happens, LESL should see positive earnings growth and valuations revising upward. Based on my current outlook and analysis of LESL, I recommend a hold rating. I believe LESL FY24 performance is full of uncertainty, which will cause the stock to be rangebound in the near term (for the next 3 fiscal quarters). The current valuation appears to be pricing in LESL meeting FY24 guidance, which is something with which I am not comfortable, as there is a good chance of missing guidance.

Review

LESL reported 4Q23 revenue of $432.4 million, a 9.1% y/y decline driven by a comparable sales decline of 11%. While this was better than the consensus expectation of a 13.6% decline, LESL profits did much worse. Adj EBIT margin was reported at 9.5%, missing consensus by 370 bps. This led to a very weak adj EPS performance of $0.14 vs. consensus $0.18. In my previous post, I was positive that FY24 was going to be the year for LESL as it benefited from the inventory normalization tailwind. With the 4Q23 results and management guidance, I am now downgrading my rating from buy to hold as I see visible headwinds in FY24, and there is no visible catalyst that could drive a valuation upgrade (valuation has already stepped up to historical average of 22x forward PE).

For headwinds, I expect the weakness in consumer spending to continue impacting demand for LESL products. At the top, discretionary SKUs are likely to see deferment in purchases as need-based consumers continue to tighten their budgets. Secondly, consumers who are price-sensitive are also likely to postpone equipment upgrades as they continue to shore up cash in their bank. Finally, in FY24, the chemical price reductions implemented in June 2023 will act as a drag for 1H24. Moreover, there does not appear to be any imminent catalyst that could enhance the near-term performance, as LESL is about to enter its weakest quarters from a seasonal demand standpoint. As such, the stock is likely to stay rangebound until LESL can convince the market that growth is going to turn positive. The timing of this is likely to be in the upcoming spring season (where the weather turns better), which is in 2Q24. Note that core seasonal demand will most likely remain unknown until 3CQ24 (June to early September). Effectively, demand will remain uncertain for three full fiscal quarters (1FQ24, 2FQ24, and FQ24). Management FY24 guidance is also definitely not painting a positive picture. FY24 comparable sales are guided to be down 1% to 3%, with 1H24 implied to see a strong decline as 2H24 is expected to be positive. The problem with such a guide is that it puts a lot of pressure on 2H performance, and the stock sentiment moves accordingly with 1H performance. In this case, 1H24 is expected to be really weak, and suppose it comes in really weak. Even if management reiterated the FY24 guide, the market is unlikely to give credit as it implies strong sequential acceleration in 2H24, which might not be possible. In this scenario, the stock price will likely drift further downward as investors cut positions as there is an increased risk of missing guidance. Additionally, keep in mind that the LESL expects a number of margin headwinds to persist throughout the first three quarters of FY24, so any improvement in margin is unlikely to occur until 4Q24.

Another thing to mention is that management noted two material weaknesses related to internal controls. The first one has to do with LESL’s internal database and its inadequate controls for calculating vendor rebates. The second one had to do with how well physical inventories were being calculated. It is particularly concerning that these weaknesses exist, which makes me wonder if there are other weaknesses that could possibly be distorting operating numbers. Considering that both weaknesses have strong implications for gross margin performance, I think many investors are going to stay even more conservative when modeling in the near term, which further reduces the stock’s likelihood of getting rerated upward.

Valuation

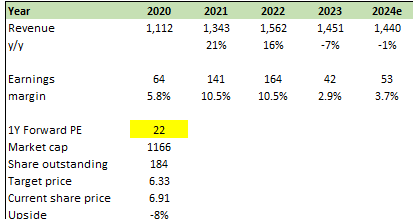

Author’s work

I have shifted my model focus to FY24 numbers as I believe the market is going to put extra focus on the near-term performance given the elevated uncertainty in the performance outlook. My review section has covered all my negative points regarding the business and stock. However, for my valuation section, I wanted to show readers that even if LESL meets management guidance, the stock still has no upsides. Using the midpoint of management FY24 guidance and attaching the current valuation that LESL is trading at (22x forward PE, which is also its historical average), the implied share price is $6.33. As I stated above, it is hard to say with confidence that LESL can hit FY24 guidance, and if it misses, I think the stock will see a sharp drop as consensus revised estimates and valuation drop to previous lows of ~11x.

Risk and final thoughts

However bearish I am in the near-term, I think there is still a possibility that LESL can outperform, which is my upside risk. Demand could come in stronger than expected, particularly if discretionary demand recovers. Also, if the US sees much more favorable weather, it could drive stronger seasonal demand. Both of which will reduce the uncertainty of meeting the FY24 guide.

In summary, I downgraded LESL from a buy to a hold rating, considering worse-than-expected headwinds for FY24. I expect consumer spending weaknesses affecting discretionary purchases and price-sensitive consumer behavior to persist, which paints a bad outlook for the near-term. The lack of a visible catalyst and upcoming weak seasonal demand should also put the stock in range-bound until signs of positive growth emerge. Moreover, management’s FY24 guidance hints at a challenging 1H24, placing a lot of pressure on a sequential turnaround in 2H24.

Read the full article here