VICI Properties Inc. (NYSE:VICI) is a well-managed real estate investment trust, or REIT, with a portfolio concentrated in casino properties. The trust’s leases contain rent escalation clauses which point to organic rental growth for VICI Properties and its shareholders moving forward.

VICI Properties continues to profit from a strong U.S. economy, and the dividend could easily grow at double-digits in 2024 as the trust grows its cash flow.

With a strong real estate portfolio in place, a well-covered dividend, and possibly substantial dividend growth awaiting passive income investors in 2024, I think that VICI Properties is a core holdings in a more capital growth-focused income portfolio.

My Rating History

My previous investment recommendation of VICI Properties was driven by the trust owning a diversified real estate portfolio which, due to inclusion of rent escalators, provided a hedge against inflation.

Secondly, the trust owned a large portfolio of trophy assets located on the Las Vegas Strip that profit from Las Vegas being a highly-rated tourist destination.

Lastly, I think that VICI Properties’ low pay-out ratio based on adjusted funds from operations, or AFFO, makes VICI appealing as a dividend income investment.

VICI Properties’ Portfolio And AFFO Trajectory

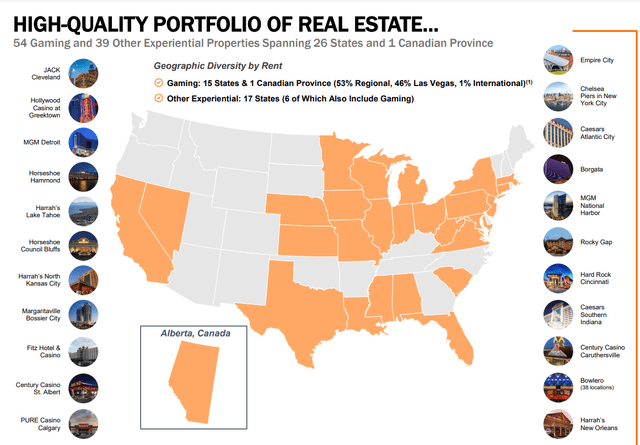

VICI Properties owns a gaming-focused real estate investment portfolio that spans 26 states and Canada. The trust owned 54 gaming properties at the end of 2023 which were complemented by 39 experiential properties that include convention space, retail outlets and entertainment venues.

VICI Properties also owned 4 golf courses to complement its portfolio mix and owned 10 properties that are located right on the Las Vegas strip. The trust’s real estate investments, as of December 31, 2023, were valued at $42.5 billion.

Real Estate Portfolio (VICI Properties)

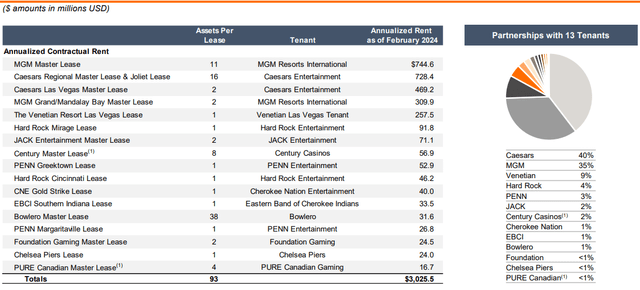

VICI Properties has a strong tenant base with the industry’s biggest casino operators paying rent to the trust. Approximately 80% of the trust’s rent comes from its 13 largest tenants, which are publicly-traded and VICI Properties had 100% occupancy as of December 31, 2023.

Among the REIT’s top tenants are MGM Resorts International, Caesars Entertainment and the Venetian Casino. The two largest operators are MGM and Caesars, which together account for 75% of annualized base rent.

Tenant Base (VICI Properties)

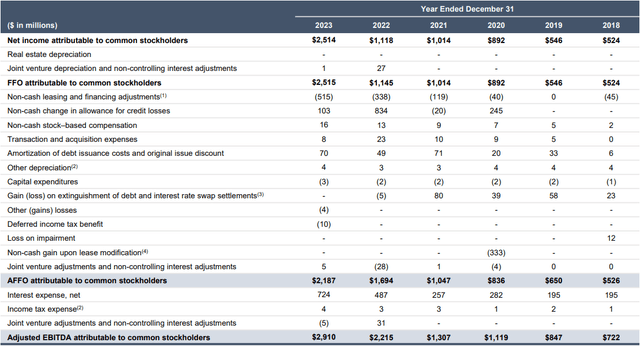

As far as VICI Properties’ AFFO trend is concerned, the real estate investment trust has seen significant AFFO growth in the last 5 years due to strategic additions to its commercial real estate portfolio and organic cash flow growth.

In 2023, VICI Properties produced $2.2 billion in AFFO, which compares against an AFFO of only $526 million five year earlier. Put simply, the trust’s main cash flow metric, AFFO, increased 316% since 2018.

AFFO (VICI Properties)

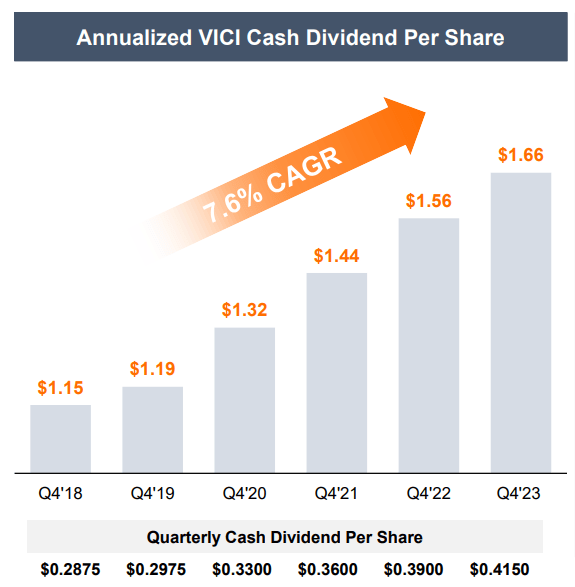

It is this growth in AFFO that is backing up the trust’s commitment to growing its dividend. Since the end of 2018, VICI Properties’ dividend has risen 44% in total, which breaks down to an annual growth rate of 7.6%.

Dividend Growth (VICI Properties)

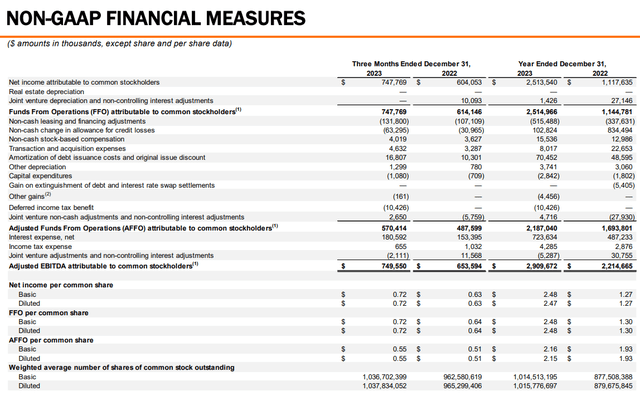

VICI Properties produced $2.15 per share in diluted AFFO in 2023 which compared to a cumulative dividend payout of $1.61 per share. This implies a 2023 dividend payout ratio of 75% (2022: 78%).

Even though the trust has raised its dividend twice since 2022, the payout ratio declined 3 percentage points YoY in 2023. The dividend, thus, has a very high margin of dividend safety, leaving room for new investments or property improvements, and passive income investors could see another dividend hike in the latter half of the year.

Non-GAAP Financial Measures (VICI Properties)

Reasonable AFFO Multiple

VICI Properties sees between $2.22 and $2.25 per diluted share in AFFO in 2024. Since the trust’s stock is selling for $29.79 at the time I am writing this piece, the valuation reflects a 13.3x AFFO multiple.

In the last year, VICI sold for between 12-15x AFFO, so the valuation multiple is right in the middle of this range, suggesting that passive income investors are presently getting an “average” deal.

With that said, even the “average” value proposition is quite good when taking into account that VICI Properties has consistently grown its dividend pay-out in the last five years.

I often compare my REIT investments to Realty Income Corp. (O), simply because that commercial real estate investment trust sets a high bar for other real estate investment trusts in terms of financial consistency and dividend growth.

Realty Income is the epitome of quality in the REIT market and has garnered a large following primarily because of its ability to grow its dividend for a very long stretch of time.

Realty Income sees $4.13 to $4.21 in AFFO per share, implying an AFFO multiple of 13.0x. Thus, VICI Properties is only slightly more expensive than Realty Income while offering a comparable 6% yield.

Volatile Tourism May Be A Risk For VICI Properties

VICI Properties’ casino assets are mainly located on the Las Vegas strip which could insert a degree of volatility into the trust’s cash flow picture moving forward, particularly if the Las Vegas economy would have to deal with a recession.

Las Vegas is a tourist destination and gambling is dependent on the trajectory of the economy, meaning a recession typically leads to a headwinds for casino operators.

With that said, VICI Properties has long-term leases in place with strong tenants like MGM Resorts International and Caesars Entertainment, and the trust has a consistent history of AFFO growth, even during the pandemic.

My Conclusion

VICI Properties is a well-managed REIT that makes a strong value proposition for passive income investors: The trust has grown its adjusted funds from operations consistently for years, is paying a higher dividend each year and the dividend pay-out ratio implies that the dividend has a high margin of safety as well.

The fact that VICI Properties has been able to grow its AFFO consistently over time, including during the pandemic period, attests to the strength of the underlying real estate assets. Presently, VICI Properties’ stock pays a 6% dividend yield and the dividend is set to grow in 2024.

Read the full article here