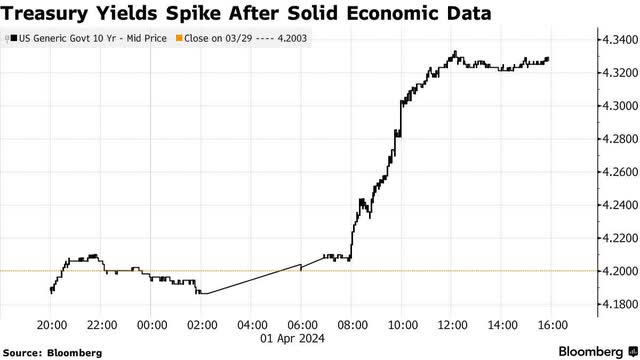

Stocks took a breather to start the second quarter, which should come as no surprise given the blistering first quarter performance for the major market averages. The blame for yesterday’s slide, which was relatively modest, was a sharp spike in long-term interest rates. The yield on the 10-year Treasury rose 14 basis points to 4.33%, making for the largest one-day increase in two months, and when long-term interest rates increase, it pressures the value of long-duration assets like common stocks. Investors appeared to be reacting to a combination of Friday’s inflation report and a stronger-than-expected number from the manufacturing sector.

Finviz

The core Personal Consumption Expenditures price index, which is the Fed’s preferred measure of inflation, continued its gradual decline in February, falling to 2.8% in February from 2.9% in January. The monthly increase of 0.3% increased the probability that the January spike was an anomaly due to seasonality. Still, investors are concerned that the slow progress in declining a final 100 basis points to the magical number of 2% will dash hopes of short-term rates falling sooner than later. Yet so long as the economy stays resilient, it really doesn’t matter if there is a delay.

Bloomberg

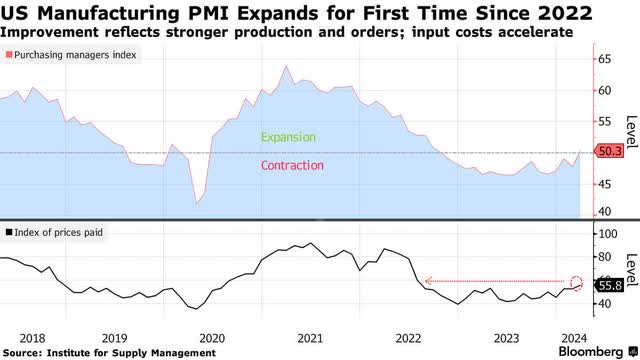

More resilience came in the form of the Institute for Supply Management’s (ISM) Purchasing Manager’s Index for the manufacturing sector. The US Manufacturing PMI rose above the 50 level that marks expansion for the first time in 17 months. This should come as no surprise, considering a similar survey for the sector from S&P Global, which tends to lead the ISM, has been in expansion territory for the past three months.

Bloomberg

Last year, I suggested that we would see a much-needed recovery in manufacturing to help offset slower rates of growth in the much larger services sector. Thankfully, that appears to be happening, but I would hardly call it a depiction of strength. The pessimists sounded the alarm on the increase in prices paid by manufacturers as another canary in the inflationary coal mine, but at 55.8 we are simply consistent with pre-pandemic levels. There is no reason to sound an alarm. Soft landings are balancing acts between strength and weakness, and that is what we are seeing today.

I think investors should avoid overcomplicating things when assessing the high-frequency economic data. Most pundits continue to dig through every detail of every report in a seeming effort to find some reason for concern. There are constant warnings about an uptick in inflation, labor market weakness, and the timing of rates cuts, to name a few, but the underlying trends and rates of change in the data continue to be favorable to a risk-on approach, which is why the major market averages maintain their uptrends. The sole reason we analyze the data as investors is to determine the underlying trend in the markets and stay on the right side of it with our money.

Keeping it simple has been the best strategy since the bear market low of October 2022, but fear sells and warnings are more popular than a steady stream of good news. I intend to continue following the underlying trend in markets and keep an eye on the rates of change in the economic data to capture as much of the upside in this bull market as possible. There will be a time when it makes sense to become more defensive, if not bearish, but that time is not today. Still, I appreciate a lot of pessimistic commentary, as that is the glue that keeps the uptrend intact.

Read the full article here