British financial technology company Revolut is launching phone plans in the U.K., the company has told CNBC exclusively, making it the first financial services firm in the country to offer telecom plans — and among the first globally.

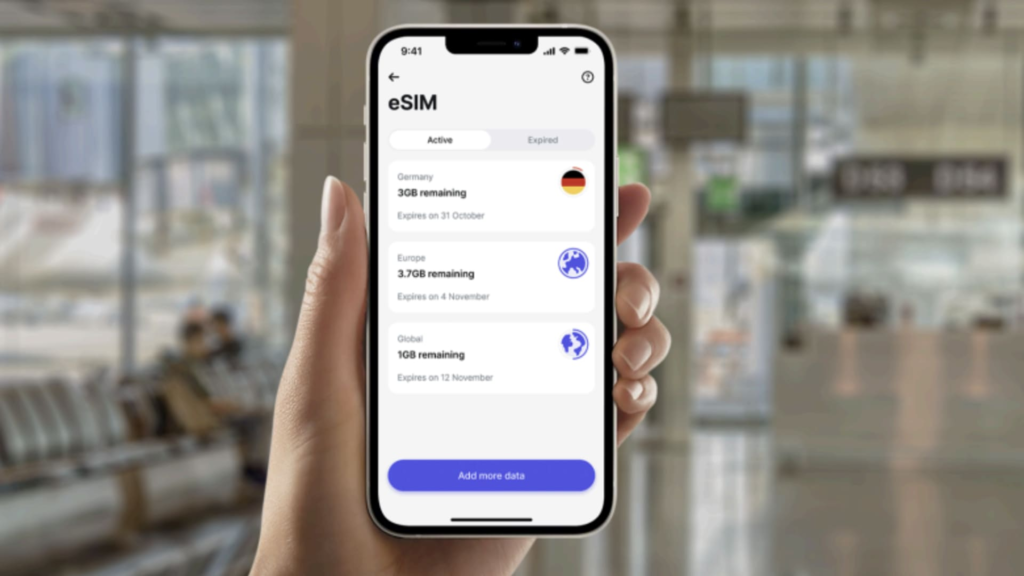

The digital banking and payments unicorn said it will start offering eSIMs — SIM cards that can be stored virtually rather than in physical form in the device — this week. The plans will begin rolling out for users in the coming days.

Customers on Revolut’s basic app experience without any subscription can get a standard eSIM plan that allows them to access their Revolut app so that they can top up their phone as and when needed. For instance, if a Revolut user arrives at an airport and runs out of data on their current SIM provider, they can still access features on their Revolut app free of charge and top up their data as usual.

Revolut customers on the company’s £55 ($69.47) a month, premium Ultra package will get 3GB of data to use globally, with a rolling refresh every month. That means that they will not have to worry about unexpected roaming charges when entering another country.

The cost of using mobile data overseas has increased for Brits in recent years. Several mobile carriers, including BT, Vodafone and Three, have reintroduced roaming charges since the U.K. left the European Union. Brits were previously able to travel across the EU without incurring roaming fees. Meanwhile, most mobile carriers don’t include free data in non-EU countries as part of their standard plans.

Revolut users without an Ultra subscription can get an introductory offer of 100MB of free data if they apply before May 1. The offer is valid for seven days, after which they’ll have to upgrade to Ultra if they want to keep using the eSIM.

Revolut has partnered with U.K. mobile network operator 1Global, formerly known as Truphone, to launch its eSIM.

Tara Massoudi, general manager of premium products at Revolut, said the decision for Revolut to launch eSIMs was to turn the company into more of an all-encompassing “super app” with services spanning bank accounts, currency exchange, insurance, travel bookings and airport lounge passes.

“Our ambition is very much to be the financial super app,” Massoudi told CNBC. “This is really in that direction.”

“Travel is a huge value prop that we’ve always had, and it’s still remained super important for our users,” Massoudi added. “So it’s important that we continue to innovate in that space.”

Launching phone plans is a rare step from a financial services firm. Plenty of challenger banks have bundled new services into their apps to give consumers more of a reason to use them over alternatives. The aim is to pull in a stickier customer base long term.

That’s pretty key in Revolut’s case. The company, which notched a $33 billion valuation in 2022, has been trying to get more of a loyal user base and grow its line of paid subscriptions to diversify revenue.

For that, it needs customers who use it as more of a permanent banking provider for all their financial needs, rather than just an optional low-fee travel account for when they go abroad.

David Zahn, CEO of tech startup Gigs, which helps businesses set up and sell their own branded eSIM phone and data plans, said Revolut’s move could prove lucrative for the firm in the long term.

“This move presents an easy avenue for Revolut to unlock a lucrative new revenue stream and could play a vital part in the company’s long-term profitability,” Zahn told CNBC via email.

“By enriching their offering with branded phone plans, neobanks like Revolut can fuse two essential services in one single app, easing the user experience and further compounding stickiness.”

Retail spending on travel connectivity services, including roaming packages and travel SIMs, is expected to rise to over $30 billion by 2028, according to roaming and connectivity market intelligence and consulting firm Kaleido Intelligence.

“We foresee many other banks launching phone plans and travel offers in the coming 18 months,” Zahn added.

Revolut isn’t the first fintech ever to launch an eSIM offering. Indian credit card startup Zolve, which helps immigrants set up banking before arriving in the U.S., started offering phone plans attached to physical SIMs and eSIMs in August.

Read the full article here