Introduction

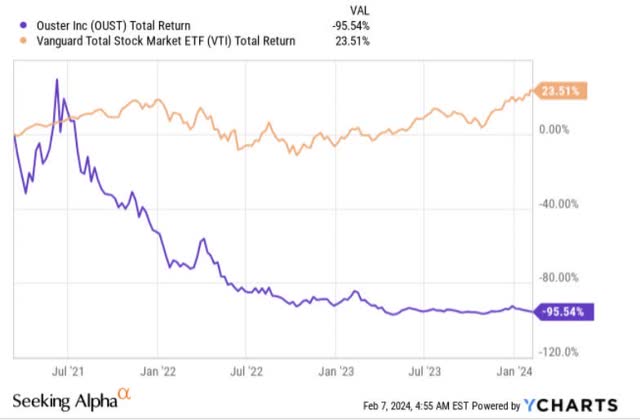

The micro-cap stock Ouster, Inc. (NYSE:OUST), a specialist in the field of LIDAR sensors, which are used in terrains such as automotive, industrial, robotics, and smart infrastructure, has been a source of great wealth destruction for its investors. Incorporated in 2015, OUST came to the bourses around six years later, and since then it has lost a massive 95% of its value, even as the broader markets (as represented by the VTI ETF) have delivered over 23% returns during the same period.

YCharts

OUST’s performance so far may have left scars on a lot of its early investors, but we think at these levels, it wouldn’t necessarily be a disastrous proposition. Here are a few reasons why we think OUST may be worth considering.

Quite A Few Silver Linings

One of the reasons why OUST has a bad rap is because it hasn’t been able to generate profits for eight straight years since its inception, and this trend looks likely to continue through FY26! Nonetheless, we’re not looking to condone this feature of OUST, but we also think that investors should not get overly fixated on the lack of bottom line.

OUST, we feel, still deserves some credit for how effectively it is executing on the topline (more on that later), and with plans now to ramp up its manufacturing efforts for Velodyne products with its partners in Thailand (one of the major barriers to widespread adoption of LIDAR sensors is high production costs, and shifting the onus to Southeast Asia should help the business develop a more competitive position), and reduce duplicity of its enterprise system, we think the company could be better positioned to facilitate some operating leverage over the next two years. Even otherwise, do note that it has already brought through over $120m of annualized cost savings this year, well ahead of schedule and well ahead of target (previously they had only targeted $110m of cost savings by December 2023).

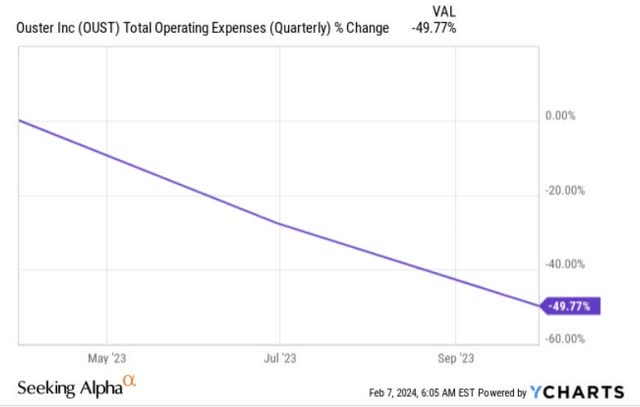

YCharts

All in all, note that over the past year, OUST’s opex cost base has already dropped off by 50%, and the goal now is to cap it or keep it below the $39m levels seen in Q3, at least through the next 18 months or so.

Now coming back to the top line, it’s worth bearing in mind that OUST still belongs to one of the most exciting and fastest-growing markets around. LIDAR tech is being adopted in a whole host of sub-terrains now, but arguably, it’s the automotive market where its utility may most keenly be felt (OUST management highlighted how key customers within their automotive accounts have signed binding agreements to increase their purchases by 3x).

Previously, there was a flawed narrative doing the rounds that LIDAR may only gather scale if self-driving cars or autonomous vehicles gain traction, but do consider that even in 2023, we’ve already seen around 66 LIDAR-equipped passenger car models make it to the market; crucially, this is double the number seen in the previous year. And note that it isn’t only just the premium vehicles that have incorporated the tech, even vehicles with a price point of only $20,000 have taken to LIDAR tech.

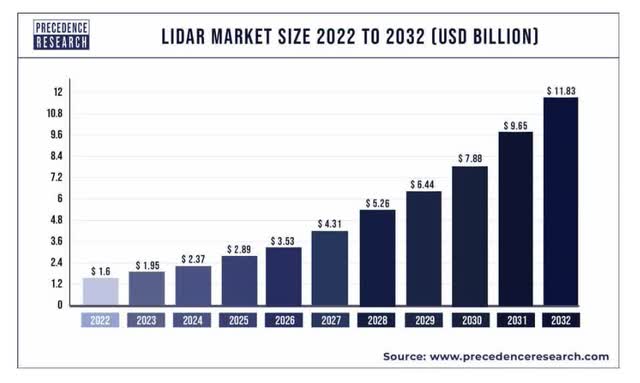

All in all, do consider that this is a market that is poised to expand by 6x over the next decade, and over the next two years alone, you’re looking at annual growth rates of 22%.

Precedence Research

That number, in itself, is quite impressive, but note that OUST looks well-placed to take market share within this growing market, as its book-to-bill ratio averaged an impressive 2x (through 9M-23) and that should translate to quite sturdy levels of topline growth going forward.

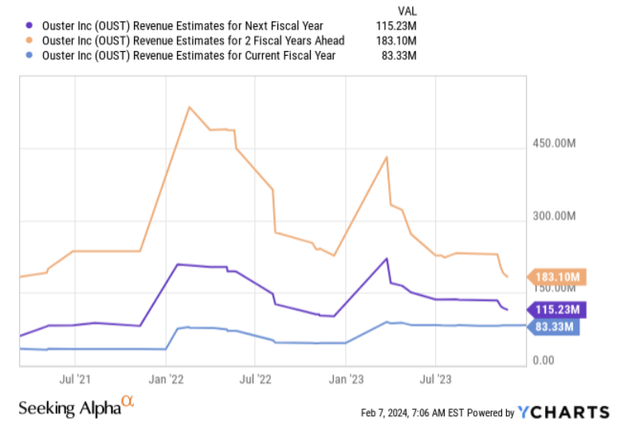

Indeed, YCharts consensus points to a much superior topline pace of 38% in FY24. Ordinarily in light of a high base, one could have expected some slowdown in the following year, but even in FY25, the topline growth is expected to be even more resilient, with an expected rate of nearly 60%! For context, OUST’s long-term annual topline growth forecasts are within the 30-50% range.

YCharts

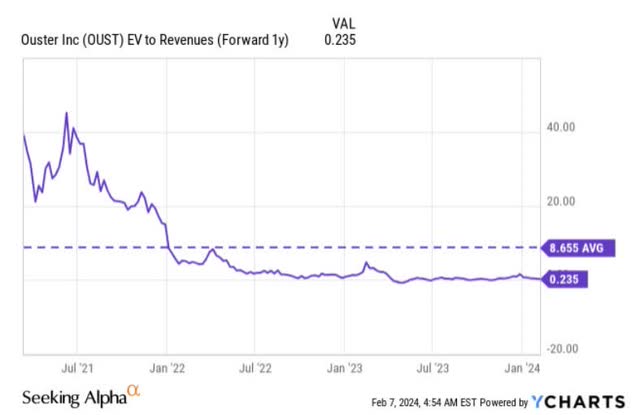

Given such sturdy levels of topline growth, one could have been forgiven for expecting some pricey EV/sales multiples around the double-digit threshold, but conversely, OUST stock is priced at just a lowly multiple of just 0.24x (based on the FY24 forecasts), which is just a dot when compared to its trading average multiple of 8.6x

YCharts

It isn’t just the cadence of high growth that’s worth getting behind, even the texture of OUST’s revenue base is changing for the better. Around a year ago, OUST introduced its Ouster Gemini platform designed to cater to the smart infrastructure space, and this seems to have gained tremendous traction since its launch. Unlike some of OUST’s traditional product offerings, Ouster Gemini’s growing penetration within the sales mix will also help bring some useful recurring revenue to the business.

Closing Thoughts – Technical Considerations

Finally, when looking at the standalone and relative strength charts as well, we feel rather enthused by the current reward-to-risk on offer.

The SPDR S&P Kensho Smart Mobility ETF (HAIL) covers a universe of around 80 stocks that are likely to benefit from progression in the manner of how people and goods will be transported over time. Put another way, it encompasses businesses that typically churn out innovative products and services linked to smart transportation. Now OUST is one of the names that it covers, and the relative strength chart of OUST and HAIL suggests how beaten down OUST looks in relation to other alternatives in this space. If anyone was interested in bargain opportunities within this universe, we reckon OUST would represent a good shot, as its current relative strength ratio is around 89% off the mid-point of its long-term range.

StockCharts

We think this ratio has the potential to mean-revert, also on account of the favorable reward to risk seen on OUST’s standalone weekly chart.

Investing

Note that for close to a year now, the OUST stock has been chopping along within a certain ascending channel. As things stand, you have some support at the $4 level and resistance around the $8 level. If one were to contemplate a long position here, using the channel boundaries as barriers, you’re looking at a rather appealing reward-to-risk equation of roughly 3x.

Read the full article here