Many investors and analysts assume that all term CEFs are going to terminate because, well, it’s in the name. The reality, as many experienced investors know, is very different. A number of funds have avoided a termination by simply asking their shareholders to approve an amendment turning it into a plain old perpetual one. On the other hand, as we have discussed previously, Nuveen is the only manager that has consistently delivered on the premise of term CEFs and it is doing it again with its Preferred and Income Term Fund (NYSE:JPI).

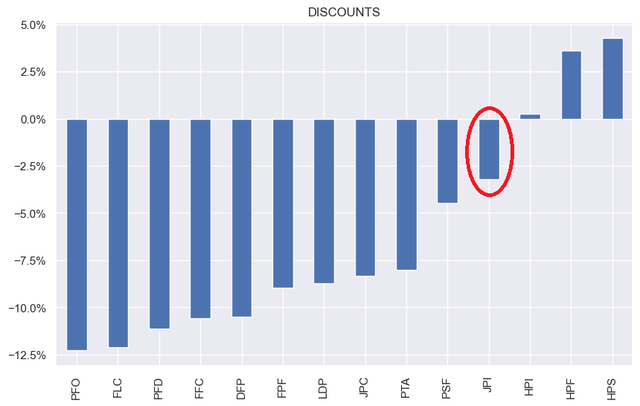

We have held JPI in our Income Portfolios on and off over the last couple of years. At its discount of 3.9% at the time of this writing, it remains attractive.

Why Term CEFs?

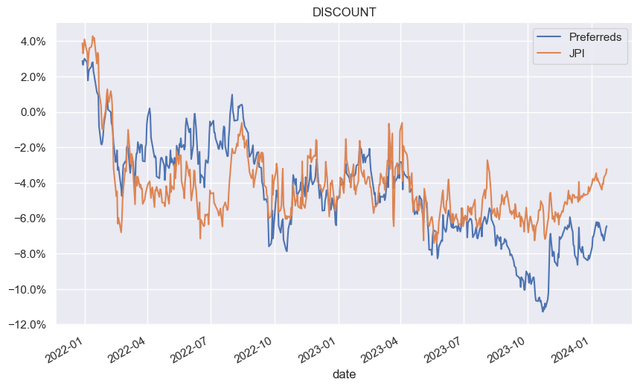

For investors unfamiliar with term CEFs – they can offer two key advantages. First, their discounts are typically less volatile than those of perpetual CEFs, allowing them to hold their value better through drawdowns. We can see this in the chart below which compares the JPI discount to that of the broader Preferreds CEF sector.

Systematic Income

And two, term CEFs can provide a significant alpha tailwind in case of either termination or tender offer at NAV. Our base case for JPI has been the same process it ran a number of times which we discuss below. This process allows investors to monetize the full discount by receiving NAV for their shares.

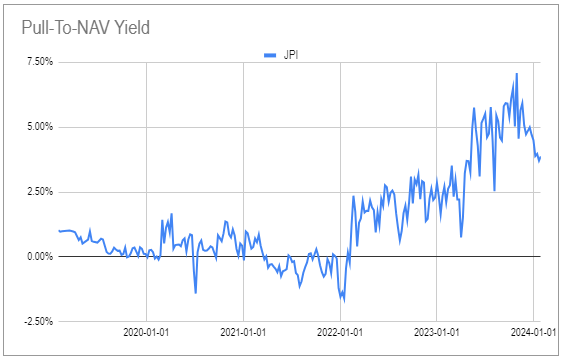

This additional performance tailwind we call the pull-to-NAV yield, measured as the annualized yield (i.e. a 6% discount over 2 years has a pull-to-NAV of 3%; under a year, the measure is not annualized).

It changes over time based on the discount and the time to expected maturity. We have highlighted the fund a number of times when its pull-to-NAV yield was trading north of 5%. It has now fallen from its peak as both the discount has tightened and the time to maturity has decreased.

Systematic Income CEF Tool

We have held JPI in our High Income Portfolio across two different periods and the fund has outperformed the sector in both as a result of these dynamics.

What Happened?

The other day Nuveen issued a press release which described the now familiar process it is undertaking with JPI in light of its upcoming scheduled termination. As we touched on above, investors without much experience with term CEFs may simply assume that the fund will do what it says on the tin. If JPI has a scheduled termination in August of this year then it will simply terminate. This actually rarely happens. Some funds do terminate (e.g. JHAA, IHIT recently) while others ask shareholders to approve a conversion to a perpetual fund (e.g. XFLT, BSL, DMO, etc.).

Nuveen is doing something different – specifically it is following a template that it has executed a number of times for its non-target term CEFs like JLS, JMT, JPT and others. The fund is asking shareholders to approve a conversion to a perpetual CEF by eliminating the term date. The process is fully spelled out here.

If the amendment is approved by shareholders, the fund will conduct a tender offer for 100% of its outstanding shares at net asset value. If the fund’s common assets taking into account common shares properly tendered in the tender offer would be $70 million or greater, the tender offer will be completed and the fund’s term will be eliminated. If the fund’s common assets after the tender offer would be less than $70 million, the tender offer will be cancelled with no common shares repurchased, and instead, the fund will proceed to terminate as scheduled.

The press release does not mention it explicitly but if the proposal is not approved, then the fund will simply terminate as well. In other words, the fund will terminate if either the proposal is not approved or if less than $70m of shares remain after the tender offer (after the proposal is approved).

What does this mean in practice? What it means is that the fund will return the NAV to shareholders whatever happens – whether by buying back shares at the NAV in the tender offer or by terminating.

Even though investors get the NAV back in both scenarios, there are two key differences between them. The first difference is the timing – a tender offer outcome will complete earlier, resulting in a slightly higher total return as investors get the same discount amortization quicker. And two, the tender offer will put less pressure on the fund’s NAV from trading slippage. A full termination may require the fund to pay bid/offer on all of its holdings, creating a larger drag on the NAV than a tender offer where only some of its assets will need to be liquidated.

One concern we often hear is that – getting the NAV back is all well and good but I want to remain invested in preferreds as I think there are capital gains ahead. Nothing stops investors from taking their capital and allocating it straight back into the preferreds market. Sure, if the discount tightens to zero or near zero prior to the tender offer it can make sense to sell the fund and rotate into another preferred CEF however passing up on the additional alpha by selling the fund now when its discount is around 4% doesn’t make much sense.

What is the right gameplan for investors? Just as with JPT, what most makes sense is to approve the amendment (to turn the fund into a perpetual CEF) and to tender all shares. This maximizes the likelihood of the fund remaining in existence but ensures that investors enjoy the discount amortization. Not tendering the shares could mean a capital loss for investors as the discount is likely to widen if JPI converts successfully to a perpetual fund.

What Can Go Wrong?

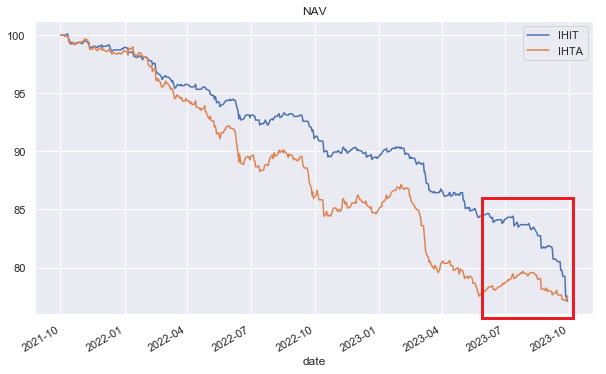

As many investors know the Invesco High Income 2023 Target Term Fund (IHIT) terminated recently, burning a big chunk of its NAV in the process. It is not entirely clear what drove this NAV collapse but it’s likely linked to having to exit its fairly illiquid and stressed CMBS portfolio. The chart below shows that the IHIT NAV fell sharply into its termination while that of its sister fund held in OK.

Systematic Income

We don’t expect the same thing to happen with JPI for several reasons. One, Nuveen has gone through a number of CEF terminations – the largest of any other fund manager. Two, the preferreds sector is far from stressed – credit spreads are near 5-year tights.

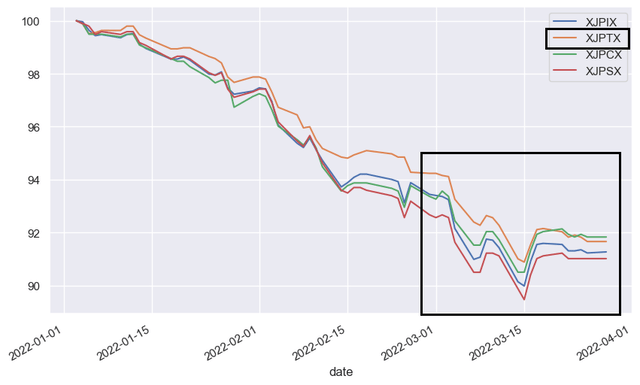

Three, previous termination processes have not had any negative impact on the NAV. The chart below shows the behavior of the preferred CEF JPT NAV relative to its sister funds. JPT commenced a tender offer on 20-Jan-22 and completed it on 24-Feb. We don’t see any significant relative underperformance of the fund’s NAV a month from the end of the tender offer. The absolute drop in the NAV across all funds was due to the increase in interest rates over that period.

Systematic Income

Four, the fund is unlikely to have to exit all of its holdings as we expect the amendment proposal to be successful just as it was with JPT. Only 36% of JPT shares were tendered, meaning the fund kept most of its positions.

Something else to watch out for is that once JPI becomes a perpetual fund, investors shouldn’t buy it unless it trades at a much wider discount – closer to where the rest of the sector is. We expect it to trade at a similar discount as its sister fund JPC.

Systematic Income

Finally, as we highlighted above, not tendering shares could result in a significant capital loss as the fund’s discount is likely to widen closer to that of JPC on its successful conversion.

Takeaways

As we anticipated, Nuveen has delivered once again for CEF investors by offering an exit at the NAV for its term CEF JPI. At its current valuation, we expect this to deliver an additional near-4% tailwind for shareholders. And while there are always risks during a termination process, these are mitigated by a number of factors which should minimize the associated costs. This makes JPI a very attractive tactical holding over the near term.

Read the full article here