In my initial write-up on ServiceNow (NYSE:NOW) in March 2023, I wrote that it was one of the best-run SaaS companies out there. However, I thought the stock was appropriately valued at the time, even though it had traded at higher multiples in the past when its growth was higher. Clearly, I underestimated the stock, as it is up nearly 80% versus a 24% gain in the S&P over the same period. More recently, in September, I maintained my “Hold” rating, also due to valuation. Let’s catch up on the company after its recent earnings report late last month.

Q4 Results and AI Push

For Q4, NOW grew revenue 26% (or 24% in constant currencies) to $2.44 billion. That edged past the consensus of $2.40 billion. Subscription revenue jumped 27%, or 25.5% in constant currencies, to $2.365 billion. Professional service revenue fell -10%, or -1% in constant currencies, to $72 million.

Adjusted EPS of $3.11, meanwhile, easily topped analyst estimates of $2.78.

The company had 168 transactions over $1 million in new net annual contract value (“ACV”) in the quarter, representing 33% growth. Overall, the company ended 2023 with 1,897 customers with more than $1 million in ACV, a 15% increase.

In the past, one area I’ve said investors should pay attention to is RPO (deferred revenue + backlog) growth. On that front, NOW saw RPO grow 29%, or 27.5% on constant currencies, to $18.0 billion, and current RPO (cRPO) jumped 24%, or 23% in constant currencies, to $8.6 billion.

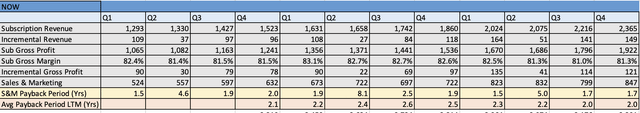

One thing I also really like to look for with SaaS companies is their sales and marketing efficiency and the payback on that spending. On that front, NOW has been doing a great job over the past year. While many SaaS companies have seen this metric worsen, NOW has actually seen it improve over. That’s impressive.

Self and Company Filings

Turning to the balance sheet, NOW ended the year with $8.1 billion in cash and investments. It has $1.5 billion in debt.

Looking ahead, the company projected Q1 subscription revenue to grow 24.0%-24.5% to $2.510-2.515 billion. On a constant currency basis, it was looking at growth of 23.5%-24.0%

It also projected cRPO to grow 20%, and 20% on a constant currency basis as well. That would continue a trend of modest cRPO growth deceleration on a constant currency basis. The company did note that the strength in its Federal business will create a -150 basis headwinds to cRPO growth in the quarter.

With the year already less than a month in at the time it reported its results, NOW raised its full-year guidance from its earlier projections.

For the full year, the company forecast subscription revenue of $10.555-10.575 billion, representing growth of 21.5-22.0%. It is projecting revenue growth to be 21.5% in constant currencies. It is expecting its operating margin to be 29%.

The new guidance represents a $165 million increase in subscription revenue at the midpoint. It also upped its operating margin forecast up from 28%, citing OpEx efficiencies.

NOW credited the increased guidance to the success it has been seeing in generative AI products. It said its investments in this area was helping accelerating its pipeline of companies that were looking to be early AI adopters.

AI was once again a bit topic of conversation on NOW’s earnings call, with CEO William McDermott saying:

“We are, in fact, in a new era of business transformation powered by AI. This is unlocking massive opportunity in the enterprise software industry. And ServiceNow is extremely well positioned, not only to lead this movement, but to define it. … Gartner estimates $5 trillion in tech spending in 2024, growing to $6.5 trillion by 2027. That means that spending will grow another $1 trillion in only 2 years, accelerating from the decade plus it took for us to get to $5 trillion. … And when you drill deeper into the Gartner forecast between 2023 and 2027, $3 trillion will be spent on AI. What we have here is a strong, durable market being supercharged by a once-in-a-generation secular trend. ServiceNow has been investing, innovating and preparing for this wave for years, which is why we’re catching it so early. We have a long track record of commercializing breakthrough technologies. When our Pro SKUs were introduced, we saw very exciting traction and customer adoption. Our Pro Plus offerings, which we launched just 4 months ago with our Vancouver release, are outperforming the pace of the Pro upgrade cycle. Exciting.”

NOW once again turned in a strong quarter. It’s winning large new customers, and in fact had its largest new customer win ever in the quarter. It’s winning across industries, as well as in both the public and private sectors. And it’s doing this while improving its sales & marketing efficiency as well.

Meanwhile, NOW is one of the companies at the forefront of AI. This is both driving adoption as well as seeing the company get a nice price lift for its offerings as well. That’s a nice combination.

If there was one thing to nitpick about the results is that cRPO growth continues to decelerate the past few quarters. In constant currencies, it’s gone from 25.5% in Q4 of 2022, to 24% in Q3 of 2023, to 23% in Q4, to a projected 21.5% in Q1 2024 (excluding the Federal headwind, or 20% including it). cRPO plays a role in forecasting future revenue growth, so it is an indication that NOW’s revenue growth is decelerating, which you also see in its full year 2024 guidance.

Valuation

SaaS companies are generally valued based on a sales multiple, given their high gross margins and the companies wanting to pump money back into sales and marketing to grow.

In this regard, NOW is valued at a EV/S ratio of about 13.9x based on the 2024 consensus for revenue of $10.9 billion. Based on the 2025 revenue consensus of $13.14 billion, it trades at an EV/S multiple of 11.5x.

In the past, the company has often traded at over 13x LTM sales, sometimes over 20x. However, it was growing over 30% during these periods. Revenue growth is projected to be 21.3% this year and 20.5% next year.

I’d value a SaaS company growing low 20% with no net debt and solid cash flows at between 10-12x revenue. Based on 2025 revenue estimates, that would be between $670-$800.

NOW will most likely grow its revenue more than it has forecast, but it is notable that the 2024 consensus is already well ahead of its forecast. While I think NOW will likely surpass analyst estimates given its AI push, the combination of the consensus already being well above the company’s forecast ($10.9 billion versus $10.575 billion) with slowing cRPO growth doesn’t indicate it will blow estimates out of the water at this time, and that its revenue beats should be fairly modest.

Conclusion

I clearly missed the boat with NOW, even though I thought it was a great company. However, when you stick to your valuation parameters, sometimes that is going to happen.

While I think the NOW service story has become even more attractive since I first looked at, given its AI push, I still can’t get myself to jump on board at these levels with the decelerating cRPO. As such, I will maintain my “Hold” rating and see if a better entry point arises in the future.

Read the full article here