© Reuters

Investing.com — Here is your Pro report of the upcoming major earnings releases next week: Apple, Microsoft, General Motors, Amazon, and Mastercard.

Apple

Apple (NASDAQ:) is expected to report earnings for Q1/24 on Feb 1, post-market close. Street estimates stand at $2.10 for earnings per share (EPS) and $118.3 billion for revenues.

Remarkably consistent, Apple has surpassed EPS forecasts in 7 of the last 8 quarters.

On the downside, however, Wall Street anticipates that the Cupertino-California based giant will report sales of $89.28 billion, a decrease of approximately 1% compared to the corresponding quarter in the previous year. This would mark the fourth consecutive quarterly sales decline for the company.

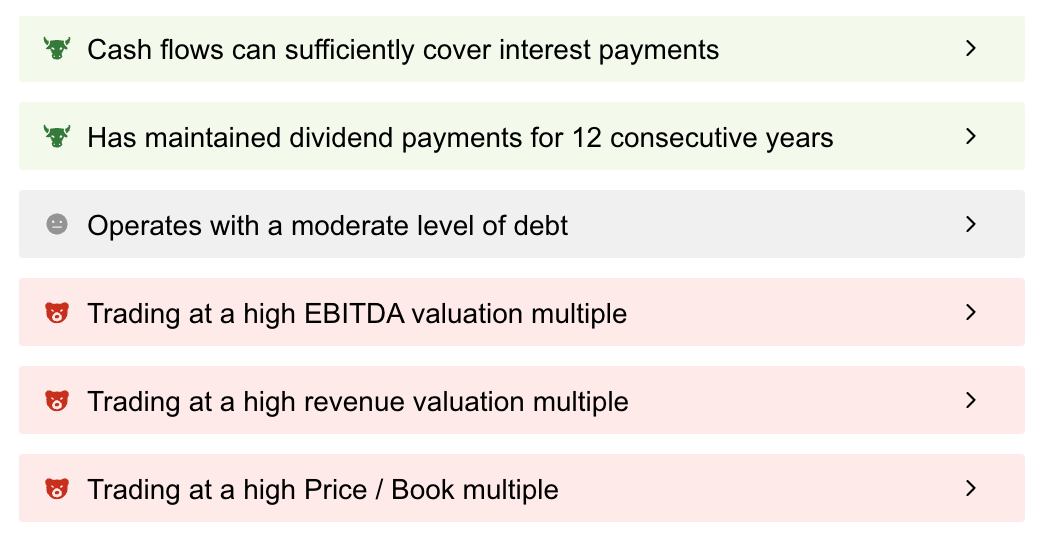

Going into earnings, our flagship ProTips tool warns of the company’s high multiples and weakening margins.

Source: InvestingPro

Apple has recently lost the title of the world’s largest company by market share to rival Microsoft (NASDAQ:), which reports on Tuesday prior. Insights from both companies’ earnings should set the tone for the tech space going forward.

Join ProTips now for up to 50% and get all the most important market insights at a glance!

Microsoft

After surpassing the $3 Trillion market-cap line last week, stakes are at a high for the Redmond, Washington-based behemoth when it reports quarterly earnings next Tuesday, the 30th.

Consensus is that the company will post net income of $20.6 billion, or $2.77 per share, compared with $17.4 billion and $2.20 from a year before, respectively.

Should the estimates prove correct, it would mark the highest revenue in seven quarters, coupled with a noteworthy uptick in EPS. Investors are confident that the company’s pushes in the AI and cloud spaces will help the giant maintain its momentum.

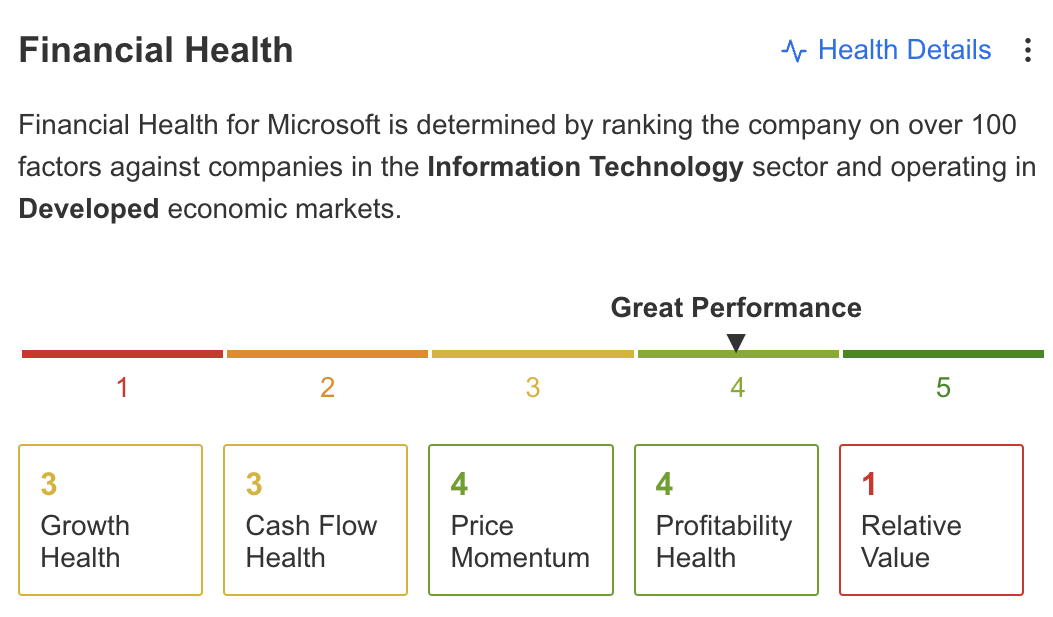

Going into earnings, Microsoft’s Financial Health on InvestingPro scores a ‘Great Performance,’ with a warning to the company’s relative value – suggesting a stretched valuation.

Source: InvestingPro

General Motors

General Motors (NYSE:) is expected to report earnings for Q4/23 on Jan 30, before the market opens. Street estimates stand at $1.14 for EPS and $39.5B for revenues.

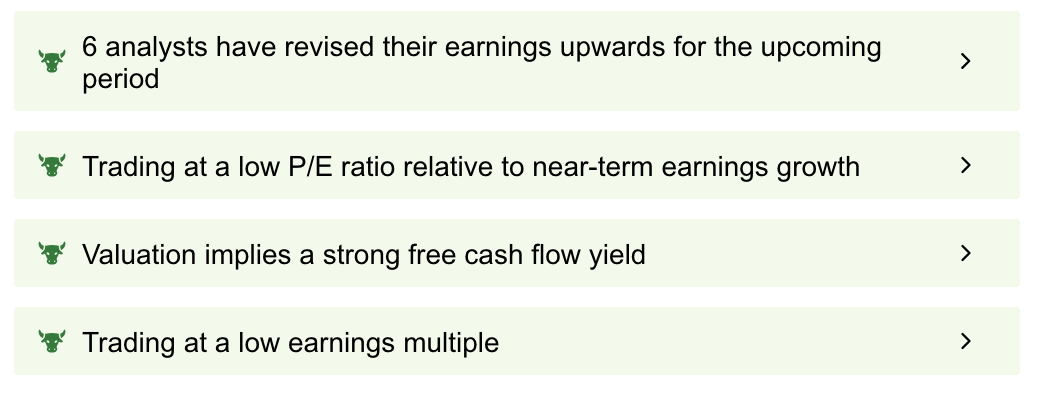

Our ProTips underline General Motors’ strengths, including upward revisions by 6 analysts, low P/E ratio relative to near-term earnings growth, strong free cash flow yield, and favorable earnings multiple.

Source: InvestingPro

Amazon

Amazon (NASDAQ:) is expected to report earnings for Q4/23 on Feb 1, after the market close. Wall Street analysts expect the company to post an EPS of $0.79 and revenues of $166.3B for the quarter.

According to ProTips, the company’s multiples appear somewhat stretched going into earnings. This suggests that any deviation from expectations could pose a considerable downside risk.

Source: InvestingPro

In January, BMO Capital initiated coverage on Amazon with an Outperform rating and a price target of $200.00. Meanwhile, DA Davidson Tesla initiated coverage on the company with a Buy rating and a price target of $195.00.

More recently, in other noteworthy news, MacKenzie Scott trimmed its Amazon Stake by $10 billion.

*InvestingPro users received these alerts in real time, gaining an edge over the market.

Mastercard

Mastercard (NYSE:) is set to report earnings for Q4/23 on Jan 31, pre-market open. Wall Street analysts expect the company to post an EPS of $3.08 and revenues of $6.48B for the quarter.

Most recently, in January, Oppenheimer upgraded Mastercard from Perform to Outperform with a price target of $510.00.

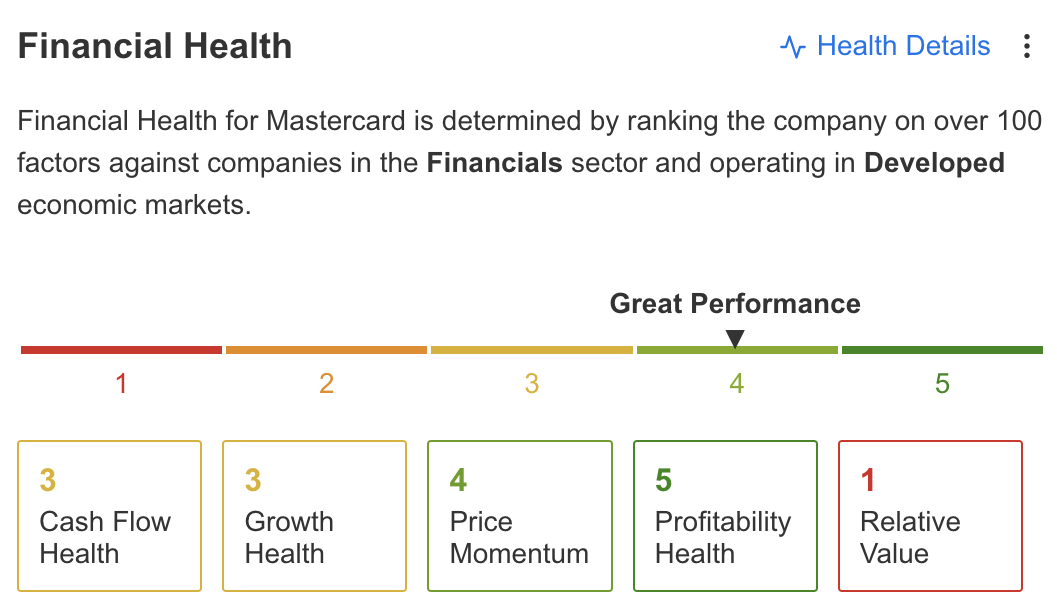

According to InvestingPro’s Financial Health section, which is determined by ranking the company on over 100 factors against companies in the Financials sector and operating in Developed economic markets, Mastercard is anticipated to exhibit ‘Great Performance’.

Source: InvestingPro

Source: InvestingPro

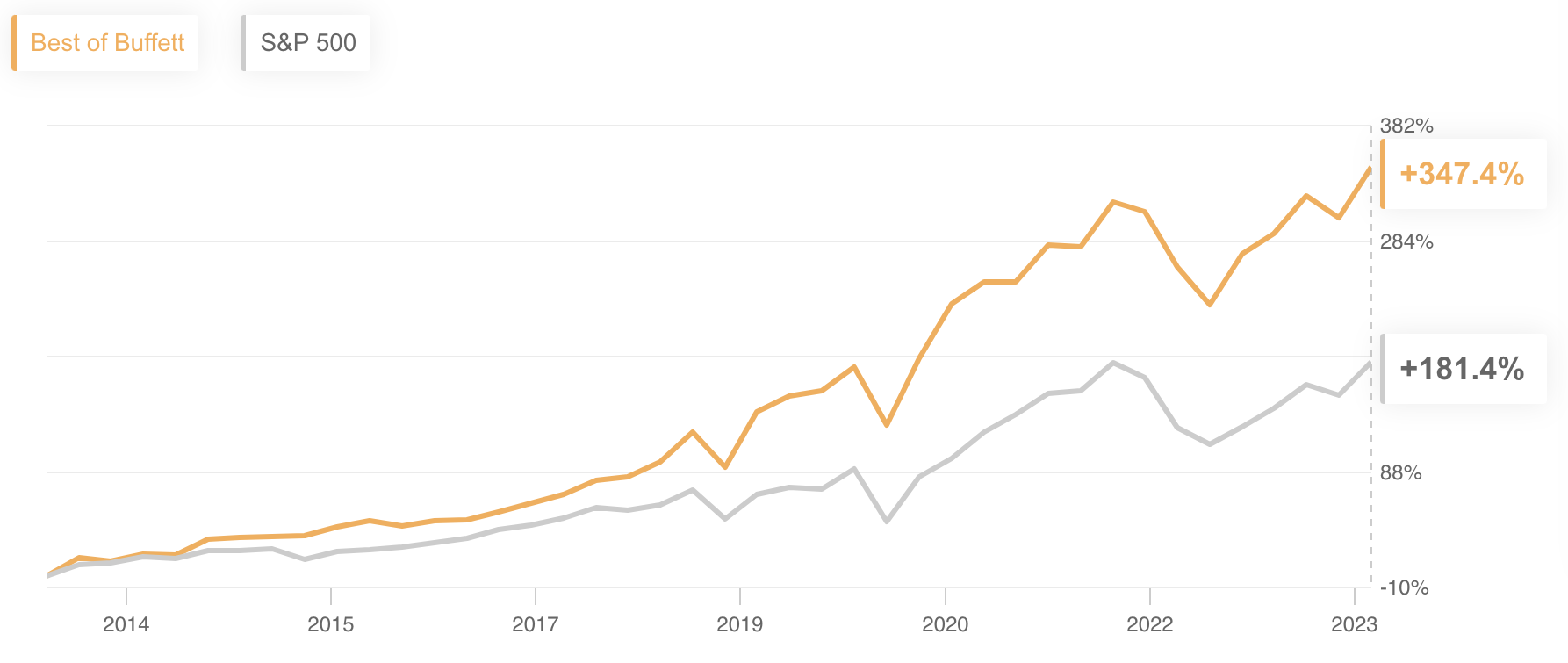

Mastercard has been an integral part of our ProPicks Best of Buffett strategy. This strategy, powered by advanced AI technology, analyzes every stock in Buffett’s portfolio and determines up to 15 stars from an already stellar group. These stocks are evaluated on a quarterly basis (every time Buffett’s quarterly 13F holdings are disclosed) to ensure up-to-date accuracy.

Best of Buffett strategy outperformed the market by a lofty 166.0% over the last decade.

Source: InvestingPro – ProPicks

For investors looking to capitalize on such market opportunities, InvestingPro’s AI-powered strategies offer a data-driven approach to stock selection. With these tools, investors can navigate the market with confidence, backed by the power of AI analysis.

With our six strategies, including the flagship Best of Buffett, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Read the full article here