Alto Ingredients (NASDAQ:ALTO) if facing some difficult headwinds at the moment, although its fortunes could improve later this year. However, I expect a lot of downside pressure when the company reports its Q3 results.

Company Profile

ALTO produces and distributes specialty alcohols, ethanol, and essential ingredients, such as dried yeast, corn protein meal, corn protein feed, corn germ. The company is focused on four primary markets. In the Renewable Fuels market, the company sells ethanol and distillers corn oil that is used as a feedstock for renewable diesel and biodiesel fuels. In the Essential Ingredients market, its products are used primarily in commercial animal feed and pet foods.

In the Food & Beverage market, the company produces grain neutral spirits that are used in alcoholic beverages and vinegar. It also produces corn germ used in corn oils. For the Health, Home & Beauty markets, it makes specialty alcohols that are used everyday items such as mouthwash, cosmetics, pharmaceuticals, hand sanitizers, and disinfectants.

The company has five alcohol production facilities, with three located in Illinois, one in Oregon, and another in Idaho. The company has capacity to produce 350 million gallons of alcohol, including 210 million gallons of fuel-grade ethanol and 140 million gallons of specialty alcohol, in addition to essential ingredients.

Opportunities & Risks

ALTO has a number of opportunities to grow its business. One of the more immediate it is pursuing is installing corn oil extraction and high protein technology at its facilities. Once this technology is installed, it will look to move up the value chain to the higher margin beverage grade market. Its Magic Valley facility in Idaho has been the first to have the technology installed, although it has run into some operation challenges that have delayed sustainable production. Ultimately, the company projects that the technology with add about $9 million in incremental EBITDA to Magic Valley, and a similar amount to three other facilities that could receive the technology upgrade.

Carbon Capture & Sequestration is another area that ALTO is pursuing. The company is currently working with a pipeline partner on a dedicated pipeline and sequestration system located near its main Pekin Campus. The company is currently negotiating contracts to first build a natural gas pipeline to its main facility to give its better access to natural gas. It expects the pipeline to be operation in 2025 and add an incremental $3 million in EBITDA.

Once the pipeline is built, ALTO plans to build a cogeneration system that will then replace its existing energy production and current obsolete equipment. This will lower costs by leveraging steam to generate power at the facility, as well as provide steam needed in the processing of its products. It is currently looking for this project to be operational in 2026 and to add about $15 million a year in incremental EBITDA.

Once both the natural gas pipeline and cogeneration system are built, the company can move to complete its Carbon Capture & Sequestration opportunity. With 45Q tax incentives, the company sees this as a $30 million a year EBITDA opportunity just from the tax credits. But it also thinks that it could help it get into other products, including blue ethanol, sustainable aviation fuel (“SAF”) and synthetic natural gas. The project is expected to be operational in 2027.

ALTO is also considering a project to expand into primary yeast production. However, the company noted that installation costs have risen over 70% since it first began exploring the project and increased the construction period from 18 months to 27 months. As such, it is still determining whether the returns on the project still justify going through with it. It did note primary yeast costs have also gone up, while expected operational costs are anticipated to come in lower. It had expected that the project could add $19 million in EBITDA in the first 12 months after completion and $25 million thereafter.

Overall, with if all its projects were to be complete, the company thinks they could add $125 million in EBITDA by 2027. However, it has not given estimates on the cost for of the larger projects it has discussed.

While $125 million in EBITDA projects on an under $150 million market cap company sounds enticing, history says small cap companies often run into issues with these types of projects. Plug Power (PLUG), which I wrote about here, and Vertex Energy (VTNR), which I wrote about here, are two recent examples of companies that have experienced a lot of issues when it comes to similar type of big growth projects. Meanwhile, years ago, fertilizer maker LSB Industries (LXU) nearly went bankrupt due to cost overruns on a fertilizer plant. Even Wolfspeed (WOLF) building out its new fab has come with many issues, so this can span into various industries. These projects always look good on paper, but the reality is generally much more difficult.

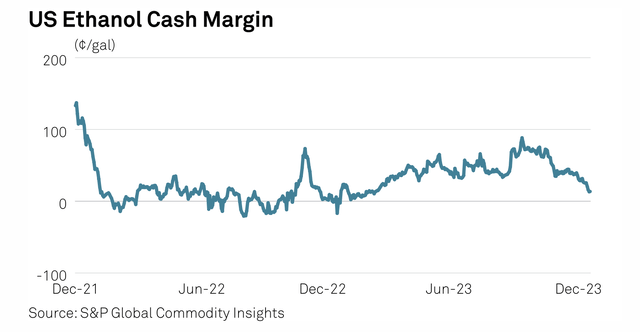

Outside of these projects, crush margins can play a big role in ALTO’s results given its ethanol production. Crush margins are simply the cost of corn per gallon of ethanol, and just like refining, this is a spread business. On that front, crush margins have fallen about -30% since late October.

On the specialty alcohol front, meanwhile, ALTO has been seeing lower consumer demand. As such, the company said it is working with its customers to roll a portion of its 2023 contracted volume commitments into 2024.

ALTO also has experienced operational issues across three of its plants in Q3. It also temporarily shut down its Magic Valley facility between January and April of 2023 due to extreme natural gas prices and other unfavorable market condition.

On its Q3 earnings call, CEO Bryon McGregor said:

“We normally scheduled [maintenance] in August because over the last couple of years that corn supply has dwindled and we’ve seen such high basis and overall corn prices in relation to ethanol prices that it makes sense to bring it down during that time to minimize losses and to take advantage of that opportunity. With margins where they were this year, particularly on crush and some additional supply of corn that was available in the local markets, we chose to instead postpone the wet mill into April of next year. That being said, there was still some work that needed to be done, and there was some capital expenditures for equipment and materials that needed to be spent prior to the shutdown that was incurred and expensed in Q3 that carry into the maybe next year that will be used during that shutdown. So you take that plus we ended up experiencing some water balance issues, some dryer issues. And the combination of those 3 things, we expect increased repair and maintenance, reduced production and reduced sales and then the quality of sales were significantly impacted, resulting in a significant impact to what would otherwise have been a much better quarter. ”

All of the above demonstrate the risks the company faces. This includes weaker crush margins, plant operational issues, demand for specialty alcohol, project inflation costs, cost overruns, and plant utilization with these new projects.

Valuation

ALTO currently trades around 5.3x the 2024 consensus EBITDA of $41.5 million and 3.4x the 2025 consensus of $64.1 million.

That said, hitting these estimates will still be very dependent on ethanol crush margins, which consequentially have been crushed, and ended 2023 at three-year lows.

Ethanol Margins (S&P Global)

However, the Environmental Protection Agency plans to issue a final ruling by March 28, 2024 to allow the sale of 15% ethanol gasoline blend all year around. The ruling is expected to positive for the ethanol industry, although anything can still happen, and as I noted, margins currently have been weak.

At this point, I think 2024 estimates are at risk given current crush margins, while 2025 is a bit more plausible if 15% ethanol gasoline blend can be sold year round. However, it still seems like it may be high.

Conclusion

I’d expect ALTO’s stock to trade poorly when it reports its Q4 results given the weakness in ethanol crush margins this winter. While the company continues to try to move to higher grade products, it is still pretty tied to ethanol crush margins at this point. Meanwhile, the company has been experiencing a lot of operational issues lately, as well, and there is a risk of projects being further delayed or cancelled.

Now while some investors may wonder or expect weak crush margins to already be priced into the stock, they likely aren’t. While working at a hedge fund, we tracked many data points, many often very public, that would seemingly telegraph a company’s quarter. However, assuming everyone knows this data or that it is priced into the stock is one of the worst mistakes an investor can make (both on the upside and downside) – as my experience says it rarely is.

Now with ALTO specifically, this is likely particularly true given that its small size, low trading volumes, and share price under $5, all of which precludes most large funds from taking any meaningful stake in the name. That means its investor base is largely made up of retail investors and index funds. At the same time, crush margins aren’t that well publicized (if you have a ~$28,000 a year Bloomberg terminal, yes they are easy to get). As such, most retail investors are not tracking it carefully, instead tempted by ALTO’s potential growth projects and cheap surface valuation.

At this point, I’d look at ALTO more as a trading stock, and given my expected poor Q4 results and Q1 outlook, I see a lot of potential downside ahead. If Q4 2023 resembles Q4 2022, when crush margins were weak, the company could see negative EBITDA of around -$40 million. As such, I’m going to start the stock with a near-term “Sell” rating. I’m expecting -20% -30% potential downside, as I anticipate the company to post negative EBITDA in Q4 and to burn through cash.

That said, after the quarter the stock could become more interesting if the EPA ruling goes as expected, lifting the fortunes of the ethanol industry. However, I am wary of its growth projects.

Read the full article here